Australian superannuation funds produced negative returns in February 2025 as markets reacted to the risks of a trade war, according to SuperRatings.

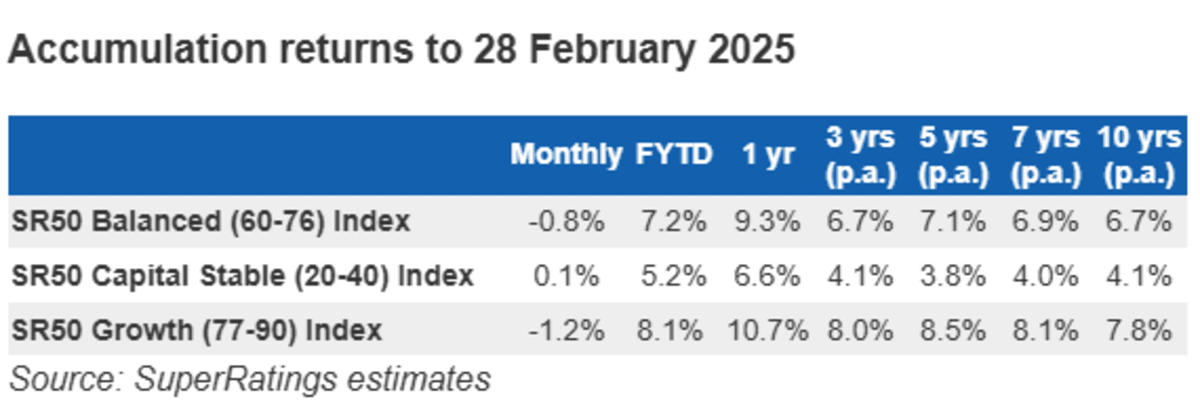

The superannuation research house estimated the median balanced option of an accumulation fund returned -0.8% in February and 7.2% in the financial year to date.

The median growth option return was estimated to be -1.2% over February to make 8.1% since 1 July while the median capital stable option was estimated to have delivered a 0.1% return last month and 5.2% for the financial year so far.

“Despite an uncertain environment, it was only the second negative monthly return for the financial year; however, it was clear that signs of discomfort were emerging as markets digested the looming risks of tariffs and the effects that may result in the global economy,” SuperRatings said in a media release.

Although the Reserve Bank of Australia lowered interest rates in February, Australian and international share markets declined as they focussed on the agenda of new U.S. President Donald Trump.

“The impact of tariffs on China and potential flow on effects to the Australian economy in particular influenced Australian share expectations, offsetting any potential benefit from the reduction in interest rates,” the firm said.

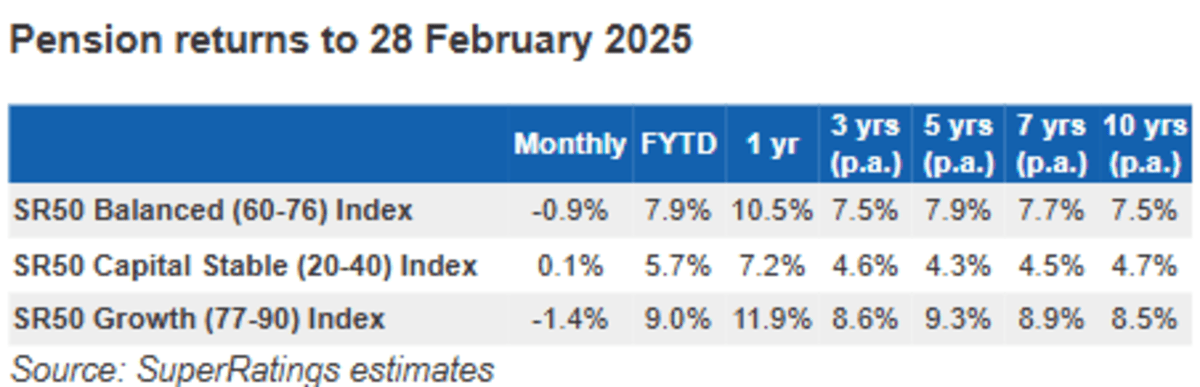

Pension returns were estimated to have followed accumulation return trends, with the median balanced pension option falling by an estimated -0.9% in February, the median capital stable pension option remaining in the black with 0.1% and the median growth pension option falling by -1.4% for the same period.

“Provided funds can navigate the next few months well, members are currently on track for a positive return for FY2025,” SuperRatings,” SuperRatings Executive Director Kirby Rappell said.

“When markets are more turbulent, it is important to remember that for most of us superannuation is about long-term outcomes and to focus on maintaining a long-term strategy.”