The value of assets managed by Australian superannuation funds reached A$4.167 trillion (US$2.625 trillion) at 31 December 2024, according to data from the Australian Prudential Regulation Authority (APRA).

APRA was releasing its Quarterly Superannuation Performance publication and the Quarterly MySuper Statistics report for the December 2024 quarter, which had put the value of the sector at $4.083 trillion at 30 September 2024.

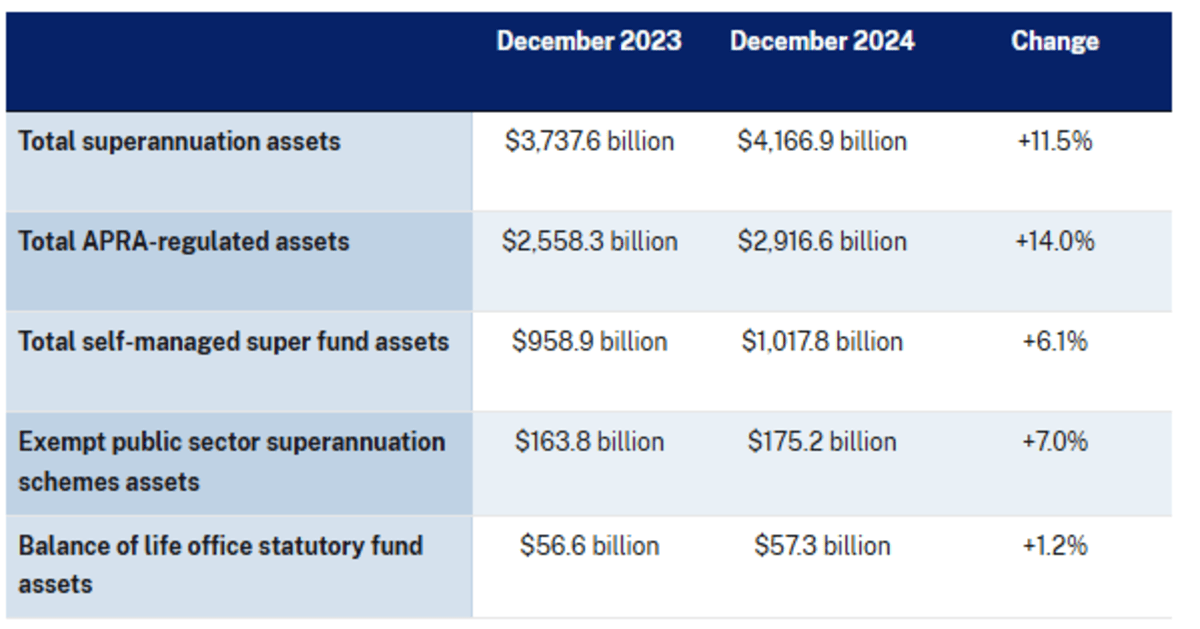

The regulator said in a statement that Australian super assets grew 11.5% in 2024, powered by a 14% increase in APRA-regulated assets to $2.917 trillion, with self-managed superannuation fund (SMSF) assets rising 6.1% to $1.018 trillion.

Total contributions increased by 14.8% to $198.1 billion in the year ending 31 December, of which employer contributions rose 10.8% to $144.0 billion and member contributions jumped 26.7% to $54.1 billion.

Benefit payments increased by 12.0 per cent to $124.4 billion, as lump sum payments rose 7.8% to $68.2 billion and pension payments soared 17.5% to $56.2 billion.

Australia has the world’s fourth-largest pension pool because employers have been required since 1992 to put aside a percentage (3% then, 11.5% now) of an employee’s salary to be invested for their retirement.

Peak body the Super Members Council last week forecast Australia’s retirement savings would surpass the British and Canadian systems to become the world’s second largest pool within the next decade, behind only the U.S.