Global wealth increased by 4.6% in 2024 with the Americas accounting for most of the increase, according to UBS.

Publishing the 16th edition of its UBS Global Wealth Report, the Swiss investment bank and financial services company said this was second successive year of growth after a 4.2% rise in 2023.

“Despite the overall positive trend, the gains were unevenly distributed, with North America and the broader Americas region accounting for the bulk of the increase – more than 11% – buoyed by a stable US dollar and strong financial market performance,” UBS said in a statement.

The Asia-Pacific (APAC) and the Europe, Middle East and Africa (EMEA) regions showed gains of less than 3% and less than 0.5% respectively.

Published annually by UBS Global Wealth Management, the Global Wealth Report is a comprehensive study of wealth trends and distribution across more than 50 countries.

UBS Global Wealth Management Chief Economist Paul Donovan said the way wealth was distributed and transferred would shape opportunity, policy and progress as the world navigated the fourth industrial revolution and rising public debt.

“This year’s report underscores the evolutionary shifts in wealth ownership, especially the growing influence of women and the enduring importance of property and long-term asset trends,” Donovan said.

The report found:

- North America was the wealthiest region with an average of US$593,347, followed by Oceania (US$496,696) and Western Europe (US$287,688).

- Average wealth per adult fell in more than half of the 56 markets analysed.

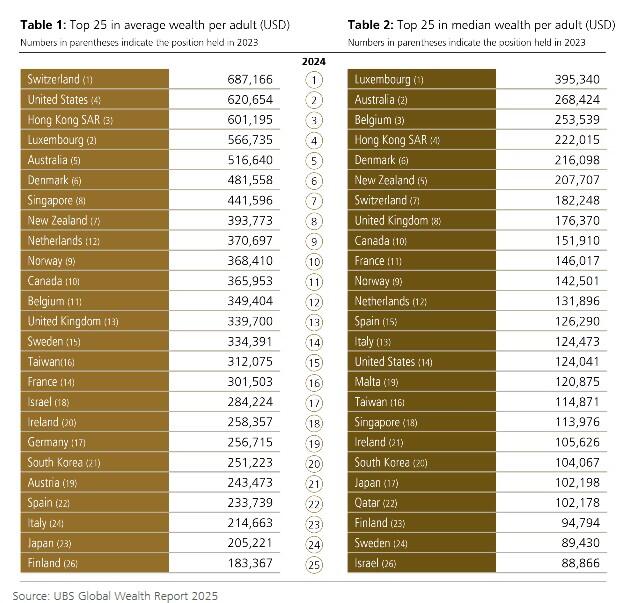

- Switzerland remained the wealthiest country per adult, followed by the United States, Hong Kong SAR, and Luxembourg.

- Denmark, South Korea, Sweden, Ireland, Poland and Croatia posted double-digit gains in average wealth in local currency terms.

- The number of U.S. dollar millionaires increased by 1.2% or 684,000, with the U.S. alone contributing more than 379,000, and giving it nearly 40% of the global total.

UBS also noted the rise of “everyday millionaires" (EMILLI), people with US$1–5 million in investable assets, who have quadrupled since 2000 to 52 million globally and represent US$107 trillion in combined wealth.