By all accounts Millennials (born 1980-1994) should be next in line for the greatest intergenerational transfer of wealth ever witnessed in Australia. However, recently released data by KPMG suggests they’ve been left behind by their younger Gen X (1995-2012) counterparts.

Over the next twenty years, the ‘richest generation’ moniker is set to transfer Generation X as Baby Boomers offload an estimated $3.5 trillion dollars in assets.

Based on his analysis of ABS (bureau of stats) data, KPMG urban economist Terry Rawnsley attributes much of Australia’s pending tectonic wealth transfer to surging property prices, and massive share market gains.

Student debt and house prices

However, despite the gains of unprecedented growth in property prices, KPMG data suggests student debt places a huge drogue on Millennials — with many now feeling priced out of the [property] market.

Having analysed asset distribution across four generations, Rawnsley’s analysis puts the average 51-year old Gen-Xer holding $1.31 million in housing value, narrowly beating the average 69 year-old Boomer who holds $1.30 million.

With Millennials and Gen Z struggling to break into the market as prices soared across Australian capital cities, both cohort lags behind with $750,000 and $69,000 in property respectively.

Historical trends suggest each generation is generally wealthier than the last - as assets build up over multiple lifetimes – but Rawnsley suspects Millennials failure to break into the housing market may compromise their future net wealth increases.

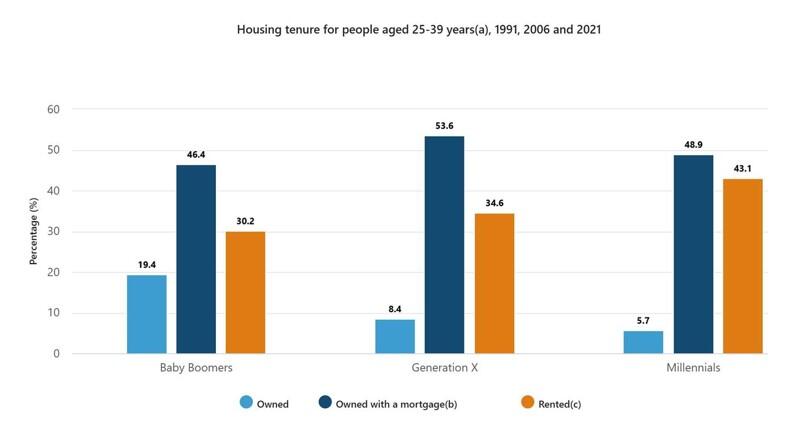

While home ownership levels are about 10% lower for Millennials than that of older generations, KPMG analysis suggests debt levels are just 8.5% below the average Gen Xer.

What the data points to, adds Rawnsley, is the growing reliance Millennials have on future inheritance to build housing portfolios.

“While the starter’s gun has been fired on the great wealth transfer, our findings still demonstrate a clear disparity in housing wealth between older and younger generations.” Rawnsley said.

Share ownership

Gen Xers also take line honours in the share ownership stakes and with an average portfolio of $256,000 outperforming Baby Boomers who favour less risky investments and on average hold $206,000 in shares.

By comparison, Millennials and Gen Z have significantly lower amounts, $51,000 and $7,0000 respectively.

Unsurprisingly, Boomers outstrip their Gen X counterparts $242,000 to $176,000 when it comes to holding cash and deposits.

“Baby Boomers are gravitating towards liquidity and higher cash holdings which reflect their inclination towards safer investments,” Rawnsley said.

Super source of future wealth

While intergenerational wealth transfer also includes super – with most retirees dying with significant unused super intact – younger generations will share these future spoils with the government which will take 32% off adult children.

Overall, when it comes to super, Boomers and Gen X are fairly comparable, while the balances of younger generations tail off, reflecting their limited time in the workforce.

However, Rawnsley highlighted the increases to the super guarantee rate over the years as a potential source of wealth for younger generations.

“There is some good news for younger generations in the superannuation asset class as they are coming off a far higher base than their parents,” he said.

“This means the wealth they will eventually accumulate from super will be far higher than older generations.”