Retail investors now command 45% of U.S. equity option volume, a shift that has moved derivative markets from institutional territory into individual hands and fundamentally changed the way markets fluctuate.

Derivatives activity hit a record 1.2 billion contracts in January 2025, with average daily volumes surpassing 70 million contracts - levels that exceed the 2020-2021 peaks.

This retail influx represents more than speculative appetite.

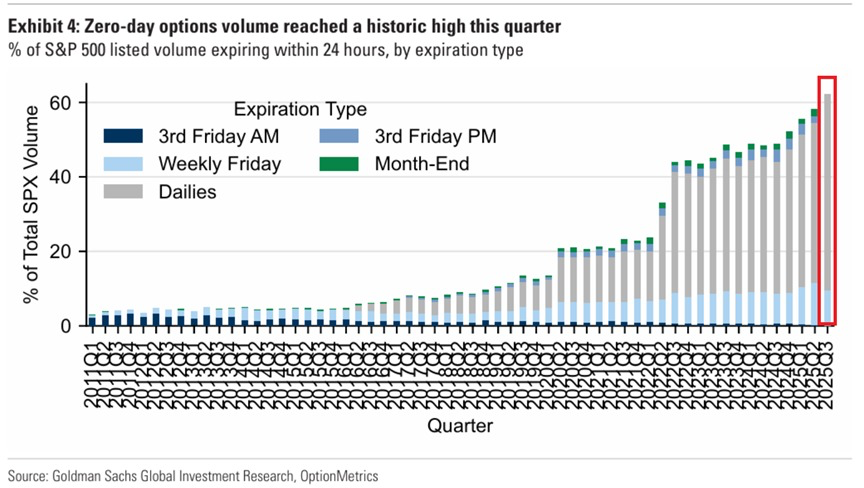

It reflects the democratisation of complex financial instruments, driven by commission-free platforms such as the aptly named Robinhood, enhanced market access, and zero-days-to-expiration (0DTE) derivatives that constituted over half of total S&P 500 volume in Q4 2024.

TLDR;

OPTIONS TRADING SURGE: KEY METRICS

- Retail market share: 45% (2025) vs. 25% (2020)

- Tracked retail transactions: $15 billion in trades analysed

- Daily 0DTE volume: 1.5 million contracts (Q4 2024)

- Call option dominance: 68% of volumes - highest since 2021

- Revenue winner: Derivatives contributed $265M to Robinhood's Q2 2025 results

0-day contracts fuel growth explosion

Lucrative 0DTE instruments averaged over 1.5 million trades daily in Q4 2024 - double the volume from just three years ago.

These same-day expiring contracts have become the market's preferred adrenaline vehicle, offering lottery-style payoffs on intraday movements while requiring minimal capital commitment.

The acceleration reflects both institutional adoption for hedging and retail enthusiasm for quick-turnaround speculation.

The mechanics are straightforward, yet powerful.

Derivatives contracts grant holders the right - not an obligation - to buy or sell underlying assets at predetermined strike prices within specified timeframes.

Unlike futures, which impose transaction obligations, these instruments offer flexibility while amplifying potential returns through leverage.

Fintech platforms accelerate participation

Commission-free platforms led by companies such as Robinhood have removed traditional barriers to this, moving derivatives from institutional domains into accessible instruments for novice investors.

11% of Robinhood's monthly active users made derivatives trades in the first three quarters of 2021, while fewer than 1% executed multi-leg strategies.

Individual investors still predominantly buy basic call and put contracts - which have a much lower probability of profit compared with advanced strategies like spreads.

Individual traders gained access to the instruments, but not the sophisticated strategies that institutional players employed.

That's now changed. AI-driven analysis and social trading platforms have made options trading more accessible and just as data-driven as the best that institutional investors can deploy.

It's weaponised to enable retail traders to access institutional-grade analytics - while maintaining the speed required for short-duration strategies.

However, this technological empowerment comes with implementation challenges - retail traders must navigate complex Greeks, time decay, and assignment risks without institutional support structures.

Social media platforms amplify both opportunities and risks, disseminating strategies while fostering communities that normalise high-risk behaviours.

The whole ‘meme stock’ phenomenon and AI hype create feedback loops where retail crowds amplify volatility and liquidity.

Retail revolution

Robinhood generated $2.95 billion revenue in 2024, with derivatives activity contributing $265 million in Q2 2025 alone - beating analyst estimates of $250 million.

Find out more: Robinhood more than doubles net income in Q2

The platform's derivatives-heavy user base drives higher-margin revenue streams compared to basic stock activity.

Charles Schwab, meanwhile, maintains its 9.74 trillion in assets under management, but faces margin pressure from zero-commission competition.

Schwab still charges $0.65 per contract, while Robinhood offers commission-free access, creating a structural revenue disadvantage that traditional brokers struggle to address.

Institutions catch up

The competitive dynamics have forced established players to adapt their business models to compete on tech and user experience, rather than exclusive access to sophisticated instruments.

Morgan Stanley's recent integration of E*Trade reflects this shift toward individual-focused platforms, while Goldman Sachs processes $837 billion in equity volume quarterly but sees individual encroachment on institutional flow.

JPMorgan's derivatives desk processes 2.3 million contracts daily, setting benchmark prices that retail traders now influence through concentrated 0DTE activity.

Goldman Sachs has enhanced its e-trading platform to handle retail flow, while Morgan Stanley has invested heavily in AI-powered trading tools to maintain competitive advantages.

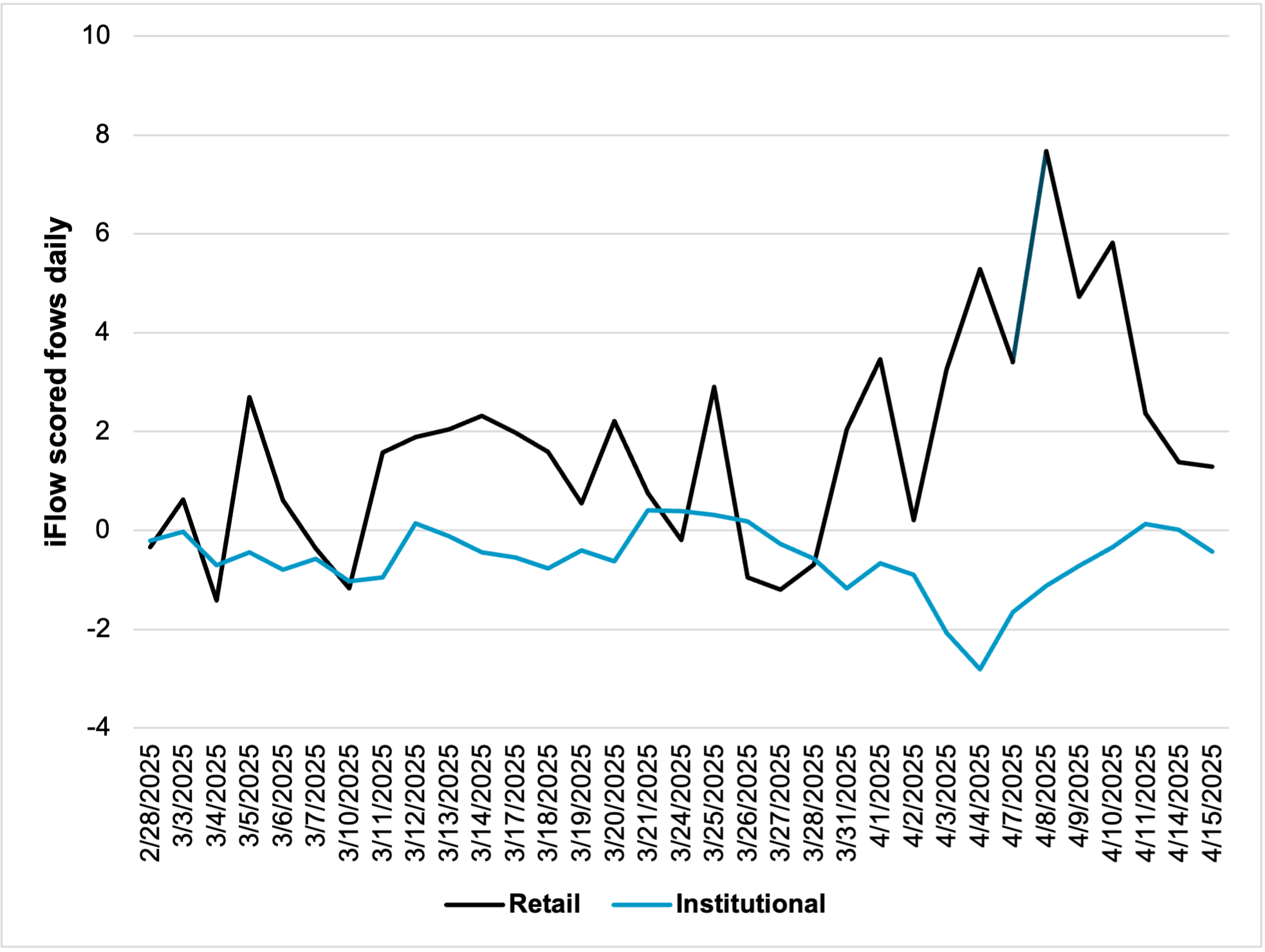

However, the democratisation of options access means institutional players must now account for retail positioning in their risk management strategies.

When retail traders focus on a limited number of underlyings - particularly S&P 500 index options - they can move markets in ways that institutional players must navigate.

This has led to increased volatility around key expiration times and forced traditional market makers to adjust their hedging strategies.

Market makers must hedge these positions by buying or selling the underlying stocks, amplifying price movements that may have little connection to corporate fundamentals.

Daily expiration cycles now extend beyond indices to individual stocks, with index options such as SPX and XSP, and ETFs like SPY and QQQ available to trade five days a week.

Exchanges have also adjusted their fee structures and market-making incentives to attract retail order flow, recognising that high-frequency retail options trading generates substantial transaction fees despite lower individual trade sizes.

The options trading surge reflects a broader financial market evolution that traditional Wall Street would prefer to ignore - retail investors have crashed the institutional party and they're not leaving.

And momentum will continue whether regulators like it or not, with 0DTE options expected to maintain their upward trajectory into 2025 despite hand-wringing from establishment players.