The global transition to a green economy hinges on a single, silvery-blue metal: cobalt (Co). Yet, beneath the gleaming promise of EVs and renewables lies a precarious supply chain, dominated by geopolitical machinations and ethical practices that threaten to derail our clean energy goals.

An eye-whopping 70% of cobalt is forged in the Democratic Republic of Congo (DRC) - a nation with a long history of inherent instability, trade disputes and acts of resource nationalism - followed by 11% from Indonesia.

Back in February, that reliance on DRC's cobalt production exposed the entire industry's vulnerability.

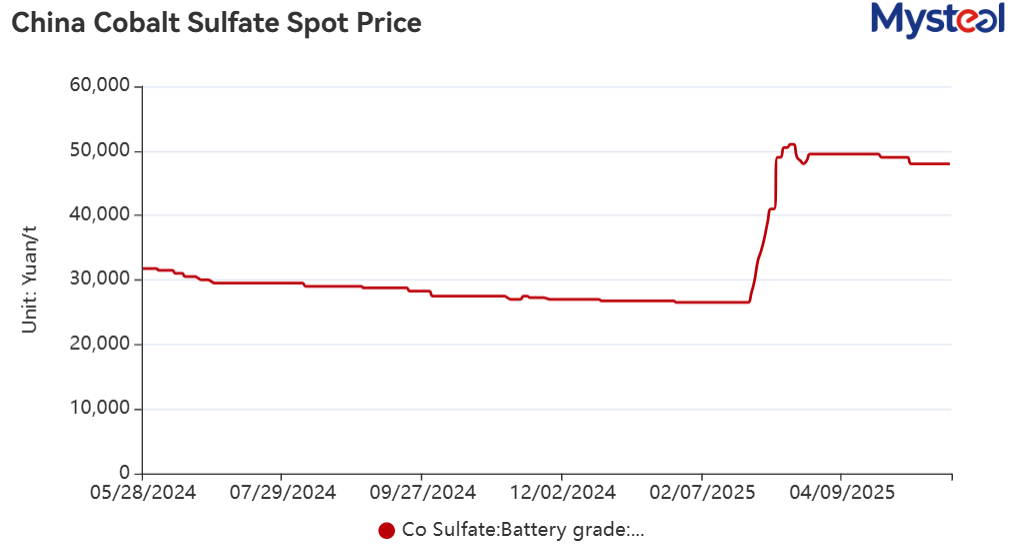

It played out in a surprise four-month cobalt export ban imposed by the DRC that was intended to alleviate oversupply and bolster prices - yet it immediately sent shockwaves through the market causing price spikes - highlighting the extreme fragility of a supply chain concentrated in a politically volatile region.

Such unpredictable policy interventions create a high-risk environment for international investors, and reinforce the need for supply chain diversification.

“The DRC's export restrictions have exacerbated shortages of cobalt intermediates, while high raw material costs coupled with weak downstream demand may continue to squeeze smelters' profit margins,” Mysteel said in a June 5 note.

"The persistent sluggish demand may further soften cobalt intermediates price, intensifying competition across the supply chain.

“In addition, small and medium-sized enterprises (SMEs) are focusing on destocking, with technologically backward or financially vulnerable players gradually exiting the market amid prolonged losses. While the top-tier ones are likely to consolidate resources and improve smelting efficiency to solidify their market positions.”

Foreign governments and mining companies are now facing increased scrutiny over who, where and how it's produced - demanding a re-evaluation of global strategies towards mining in its backyard.

Historical data saw cobalt fluctuate between US$21,500 and 2025, peaking at around US$81,790/t in April 2022 and hitting a multi-year bottom early last year.

Spot prices have since rebounded.

Current landscape

Adding another layer of complexity is China's strategic, long-term play in the cobalt sector.

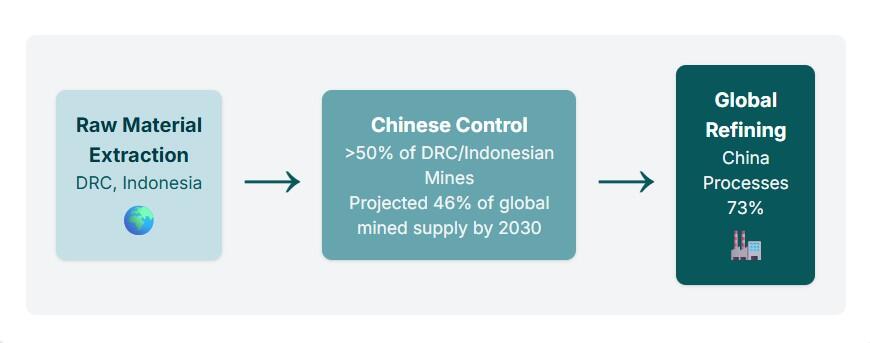

Chinese companies have achieved deep entrenchment in DRC mining operations, controlling over half of the cobalt production there and in Indonesia. In addition, they control 85% of Papua New Guinea's output.

By 2030, China will have have unearthed 46% of all mined cobalt. It has a near-monopoly on cobalt refining - processing an astonishing 73% of the world's supply.

Australia, despite possessing significant cobalt reserves (15% of the global total), contributed only 2% of global production in 2023, with Canada accounting for a similar 2.2%.

This transforms Beijing into the de facto gatekeeper of global cobalt flows. Key acquisitions - such as CMOC's purchase of the Tenke Fungurume and Kisanfu mines from Freeport-McMoRan - have solidified its control over major DRC cobalt assets.

This extensive control across the cobalt value chain, from mining to refining, transforms a raw material into a significant geopolitical leverage point.

It's going to force the West to invest in costly, long-term diversification strategies - driven not just by economic stability but by critical national security concerns, echoing broader global trade tensions.

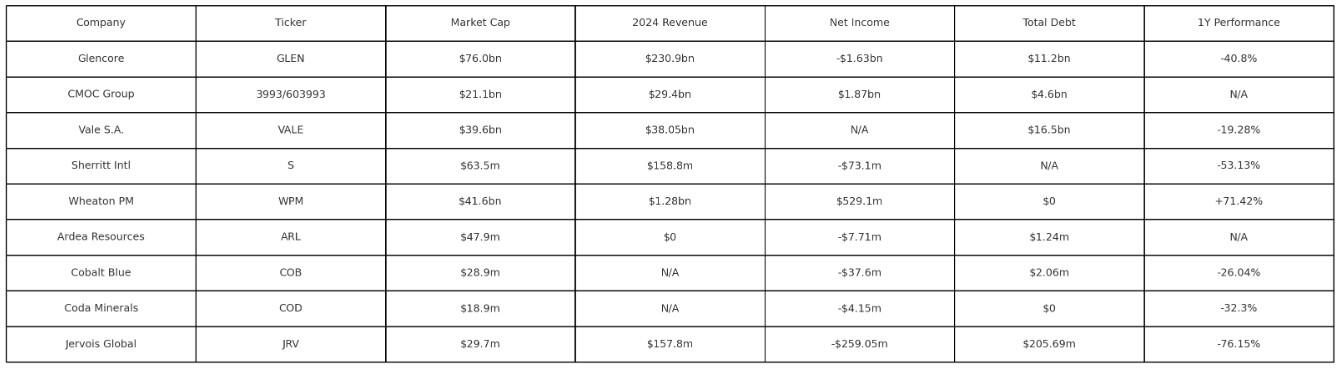

Companies in cobalt

(Data accurate to Q1 2025)