Perhaps a little late to the critical minerals party, the European Union has earmarked 47 strategic projects worth €22.5 billion (A$38.4 billion) and set a somewhat lofty target for its domestic supply chain goals, of which it says are a key step in implementing its Critical Raw Materials Act (CRMA) and decarbonisation mandates for carmakers.

That's because it wants to primarily rejuvenate its waning automotive sector that's being priced out of the market by China and East Asia, which have not just competitive labour costs, but cheaper production all the way to manufacturing costs too.

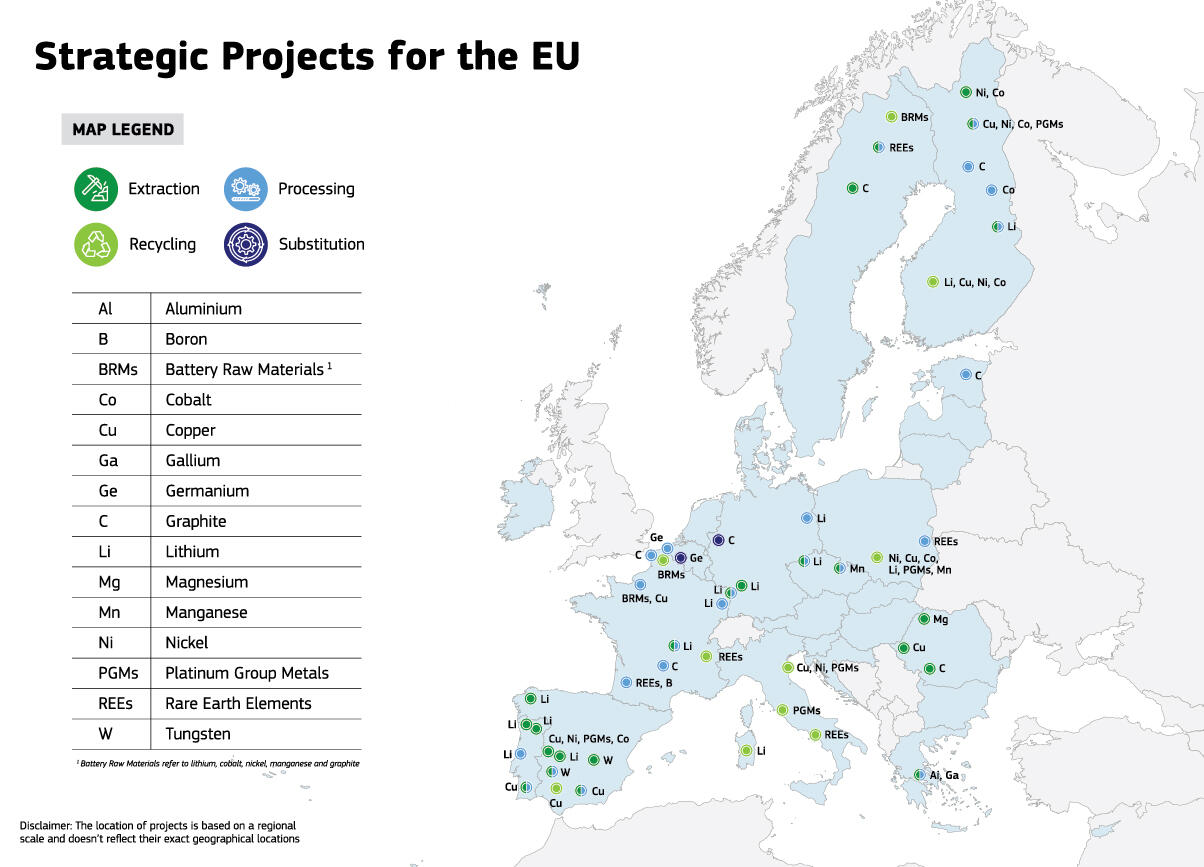

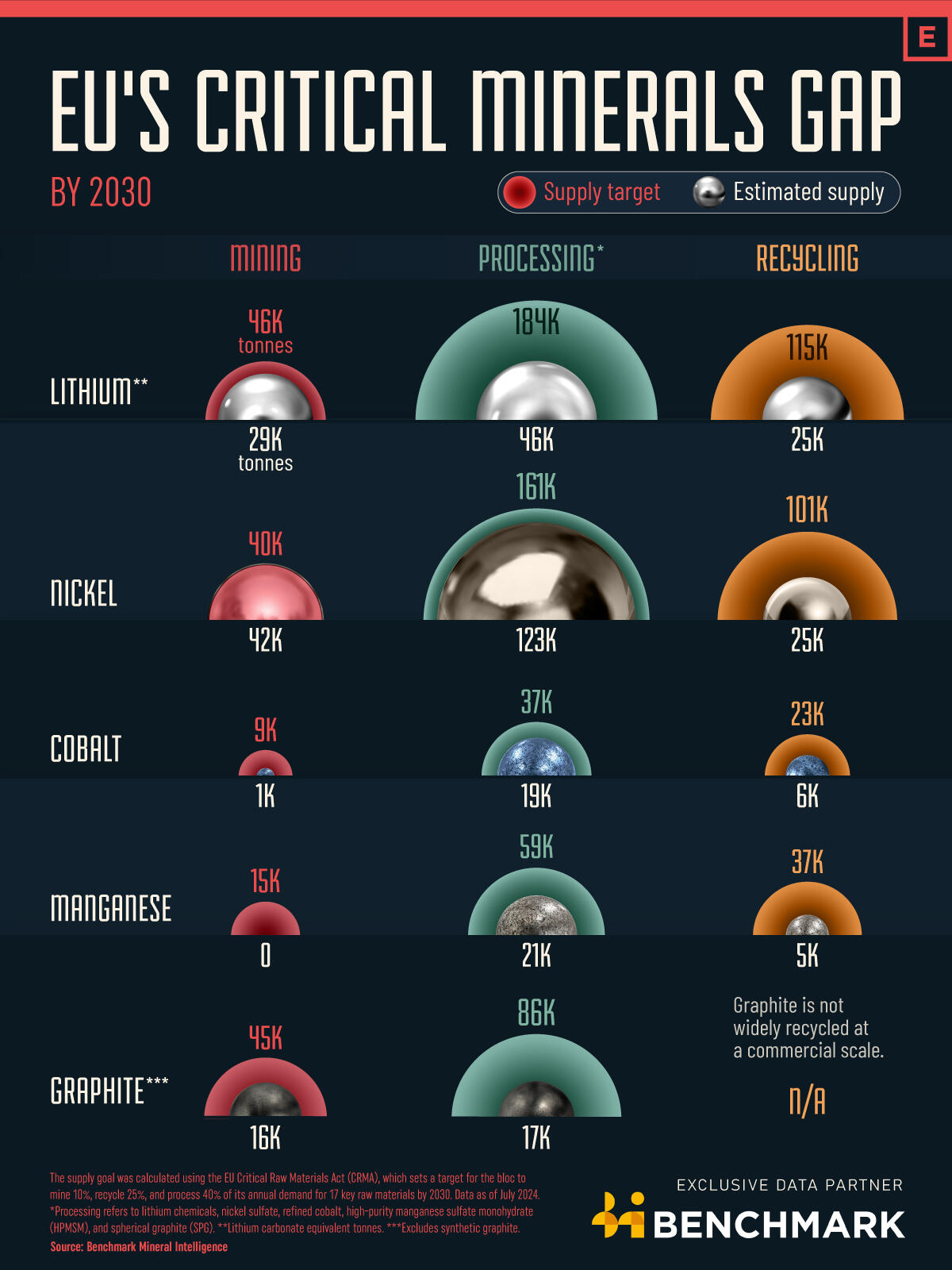

The collective aims to extract 10%, process 40%, and recycle 25% of these essential materials by 2030 from across 13 EU member states: Belgium, France, Italy, Germany, Spain, Estonia, Czechia, Greece, Sweden, Finland, Portugal, Poland and Romania.

The breakdown

Covering one or more segments of the raw material value chain, 25 projects will produce, 24 process, 10 will be for recycling and two for substitution of certain critical minerals.

They'll be notably made up of lithium (22), nickel (12), cobalt (10 ), manganese (7) and graphite (11) projects aimed to strengthen region's battery raw material value chain, with elements such as gallium and boron for renewable energies; and titanium and tungsten for its space and defence sectors.

To incentivise the private sector for these projects, the EU has made available €1.8 billion (A$3 billion) for battery raw materials alone, with an end goal of lifting the growth of the European automotive industry.

European Commission president Ursula von der Leyen says she wants to see Europe's automotive industry take the lead, yet as far as Azzet's reporting shows, they're champing at the bit to make supply chain deals within its biggest market, the U.S., on the back of Trump's looming tariffs against materials and goods related to foreign carmakers which are expected to start on April 2.

“We will promote domestic production to avoid strategic dependencies, especially for batteries production,” von der Leten said.

“We will stick to our agreed emissions targets, but with a pragmatic and flexible approach.”

Yet they haven't stuck to agreed emissions targets - just moved the goalposts. The carmakers fell embarrassingly short of their emissions targets and were supposed to be hit with penalties of ~€16 billion.

Inherently, that's down to sluggish demand for zero-emission cars in the EU due to costs and competition from Chinese and US automakers.

And so the EU revised its plan so that industry can “meet 2025 targets” across the next three years until the end of 2027 - as long as they promise to ramp up their decarbonisation efforts.

Achievable?

Azzet's question to the EU is, how does it think it can ramp all these projects from an identified resource, through development and into production in just five years?

Its bold plan reckons that mining companies will be incentivised to pour in €22.5 billion into almost 50 different projects, through coordinated support by the EU countries and better accessibility to finance and offtake partners.

Benchmark Intelligence is not so sure the goal is achievable either, estimating EU domestically produced battery-grade materials will only meet half of cobalt, a third of manganese and just a quarter of its lithium and graphite processing targets, while falling short for all commodities for its recycling targets.

To be fair and in line with the CRMA the commission does have the governing rights to streamline permitting provisions by cutting through red and green tape without blowback, yet for its five-year goal the Act allows 27 months just for the permit-granting process - leaving two years to develop a mine into operation.

Lofty goals indeed - as current permitting process times alone for mining projects across the EU take 5-10 years.