Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals prices and supply chains - from production, refinement, mergers & acquisitions, to manufacturing and consumer products.

Signs of tightness around industrial metals are emerging, amid the chaos caused by President Donald Trump’s move to decouple the United States (of which I don't recall there being much around) from the world in his grand re-entrance to capitalism's throne with tariffs 2.0.

And so the resilience of the global economy is again being tested - much like people’s resolve - as a man often with an orange tan plays a real life version of the board game RISK, setting his sights on the pain points of global trade and particularly battery metals as part of the US-China trade war.

Read the latest: Cheers: Canada, EU impose reciprocal tariffs on US goods

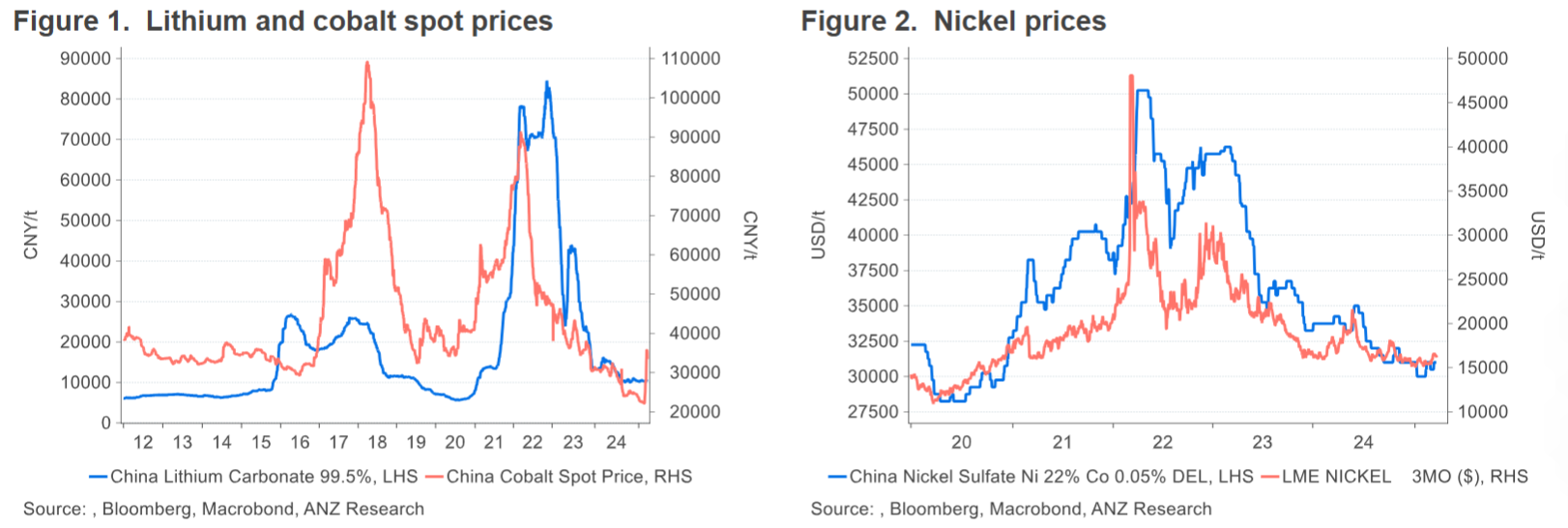

The raw materials that go into batteries as part of our push for clean energy and transition from combustible vehicles to electric have put high demand on copper, lithium, cobalt and nickel. Yet the last three elements have seen prices bottom out due to oversupply and other geopolitical machinations.

Let's take a gander at how they've been doing lately and a few catalysts for what could rebound prices…

Copper is one such paint point firmly within Trump's sights - which adds an extra layer of demand as the red metal is disrupted right across the value chain - yet spot prices will certainly benefit.

Earlier this week copper prices closed just short of US$10,000/t - the highest price since October last year - as multiple signs emerged of stronger demand against a backdrop of tyrann…. err, I mean backdrop of market volatility.

And according to a Bloomberg report, the U.S. is about to be flooded with somewhere between 100-150,000 tonnes of refined copper sometime in April, and says “traders are redirecting the metal from Asia to take advantage of the price premium and skirt any potential tariffs on the metal in coming months”.

What would that lead to? A tightening of markets such as the world’s biggest - China - just as signs emerge of stronger demand that could burgeon a further price revival.

“Recent economic data have been above expectations, while copper imports have been robust,” Bloomberg says.

“A shortfall appears to be forming already, with the copper front-month contracts on the Shanghai Futures Exchange trading at a premium to the second-month contracts, known as backwardation.”

Lithium

The Russia-Ukraine war has the potential to impact long-term lithium access to the West as it has the largest lithium reserves in Europe, estimated at around 500kt, or 1-2% of global reserves according to the United States Geological Survey.

Since the 2022 invasion Russia has captured two of Ukraine's four lithium deposits; and in January, Russia claimed to have seized control of the town of Shevchenko, which sits on top of one of Ukraine's biggest lithium deposits.

That's probably why Trump has been trying to push through a critical minerals deal with Ukraine's President Vlodomir Zelenskyy.

And there's a method to that madness: China’s dominance of critical minerals supplies. It controls an eye-popping 50% of global lithium refining capacity, compared with only 4% for the U.S. and virtually nothing in Europe.

ANZ says that while in the short run, the lack of Ukrainian lithium resources will not significantly impact global supply, it could enhance market stability by diversifying sources and potentially curbing price volatility.

“Specifically, additional lithium supply could help soften the price spikes witnessed in recent years. Moreover, Ukraine would be viewed as a preferred supplier to Europe and the U.S. as they look to build critical mineral supply chains outside those dominated by China,” ANZ said.

Cobalt

After benchmark prices for standard-grade cobalt fell to US$20,350/t, their lowest level in a century in real terms, the world's biggest producer, the Democratic Republic of Congo (DRC), which contributes ~70% of the global supply, announced a four-month halt on all exports to stop the prolonged price slide.

The move to restrict supply then saw a surge in prices, with the London Metals Exchange (LME) spot price moving up >67% to trade at US$35,800/t.

ANZ Research expects the four-month ban will create a shortage of ~55,000t of raw material in the short term, yet the impact on prices will be temporary.

“Firstly, China has substantial stockpiles, ensuring supply for its production needs,” ANZ said in a note.

"Secondly, cobalt production has not been banned in the DRC. Once the export ban is lifted, we expect the inventories will be released relatively quickly.

“Nevertheless, the DRC’s move suggests prices have fallen well below sustainable levels. Any further weakness in prices would likely see further action from major producers.”

U.S. and Congolese government officials have been holding talks over securing supplies of critical minerals from the country - of which China has a firm foothold in - into western supply chains in exchange for peacekeeping efforts.

Read more: US invited to tap DRC's rare earth minerals for peace

And then there's…

Nickel, which is also a battery metal that seems to be singing its swan song - especially after BHP :(BHP : ASX) shuttered its WA mines and refineries last year, as it pivoted further into copper, leaving Indonesia - which has the world's largest known deposits - to pick up the slack.

With demand down leading to price collapse, Indonesia recently considered restricting supplies, but ultimately chose to keep producing. This could see nickel prices stagnate at the bottom in the future.

The commodity is struggling to retain enough purpose in supply chains as new technology translates to less nickel being utilised in batteries.