The United States is holding “exploratory talks” with Democratic Republic of Congo (DRC) over a deal that would give it access to its critical minerals in exchange for military support for peace, the Financial Times reported over the weekend.

In an interview with the New York Times last month, Congolese President Felix Tshisekedi said the Trump administration had shown interest in its vast mineral wealth.

Many of the mineral-rich areas in eastern DRC are under the control of the M23 rebel group which smuggles minerals over its borders and backed by neighbouring Rwanda.

DRC spokesperson Tina Salama has urged the U.S. to “directly buy critical minerals” from Kinshasa rather than sourcing its “looted” and “smuggled” resources through other countries and is looking to make a protection deal for its raw materials.

This coincides with a letter sent to U.S. secretary of state Marco Rubio on behalf of Congolese Senator Pierre Kanda Kalambayi late last month proposed that the DRC could collaborate with US companies extraction rights for mining projects.

High grade critical mineral wealth

The DRC is home to the world’s lion share (70%) of cobalt mining operations and has come under scrutiny from the international community for child labour practices at the largely artisenal mines, while also known to contain significant reserves of gold, copper, tin, lithium, tantalum and rare earths.

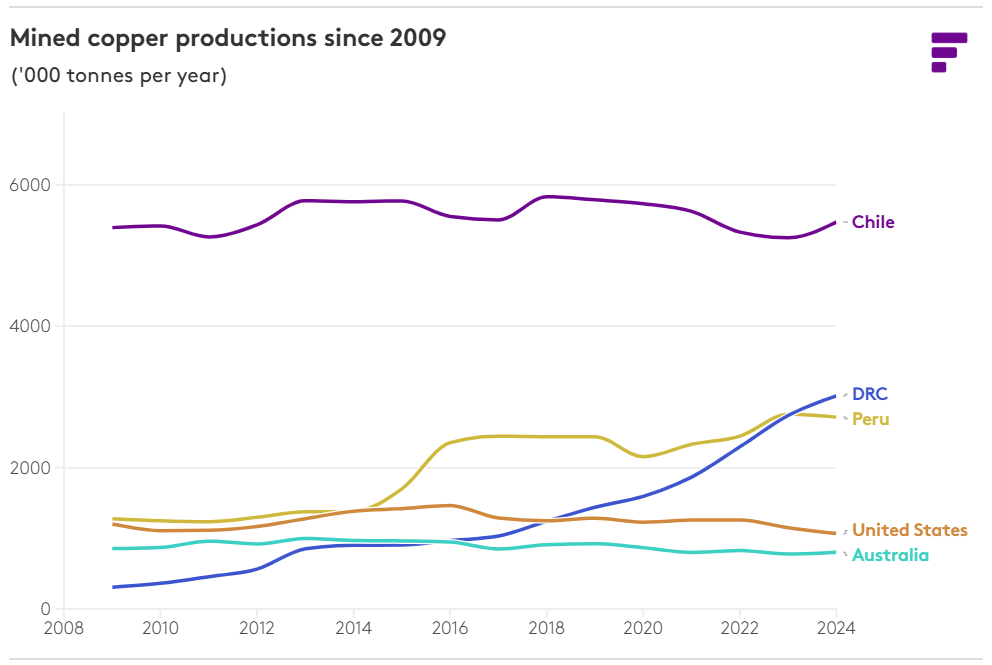

It's now the world's fourth-largest producer of copper thanks to the discovery of super-high grade deposits such as Kamoa-Kakula in the mineral-rich central African copper belt.

The deposit has an average ore grade of a whopping 4.58% - to put that into perspective, the world's largest copper mine, BHP's Escondida operation in Chile, started with a copper grade average of around 2.75% and as of September last year, throughput carried an average of just 1% Cu.

“The first big reason why DRC production is growing is that there are excellent resources that are relatively untapped,” a mining source told Fastmarkets.

“In Latin America, there is a high percentage of decades-old projects that are past their prime, as opposed to new-builds in the DRC,” Fastmarkets analyst Andy Cole said.

From a 15,000 tonnes per month (tpm) copper output in 2009 to over 250,000tpm in just 15 years, the Congo's copper revolution exemplifies its potential for further low-cost, high-grade mining opportunities.

Mining operations such as Kamoa Kakula in the DRC are largely funded from investment by China and owned by Canada's Ivanhoe (39.6%), Zijin Mining (39.6%) and the DRC government (20%).

Ivanhoe itself has a significant amount of Chinese interests on its register, with CITIC Bank and Zijin Mining together owning almost 35% of the company.