Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from production, refinement, mergers & acquisitions, to manufacturing and consumer products.

United States President Donald Trump has ordered a probe into potential new tariffs on copper imports to counter China's hegemony over the raw material, which has an increasingly significant role in the world's shift towards greener energy solutions and electrification.

The White House says America faces significant vulnerabilities in the copper supply chain, with an increasing reliance on foreign sources for mined, smelted, and refined copper.

Domestication

Under section 232 of the Trade Expansion Act, government officials will investigate whether imports of copper related products threaten to impair national security. This is the same law Trump used in his first term to impose 25% global tariffs on steel and aluminum.

“A single foreign producer dominates global copper smelting and refining, controlling over 50 percent of global smelting capacity and holding four of the top five largest refining facilities,” the executive order said.

"This dominance, coupled with global overcapacity and a single producer’s control of world supply chains, poses a direct threat to United States national security and economic stability.

“[We] have ample copper reserves, yet our smelting and refining capacity lags significantly behind global competitors.”

To that end, the administration says it will aim to rebuild domestic production of a metal critical to electric vehicles, military hardware, the power grid and a plethora of other consumer goods.

Bringing production online

Currently, the U.S. consumes about 1.8 million tonnes per annum (Mtpa) of copper annually, equating to ~6% of global supply and its mines produce about 5% of global supply.

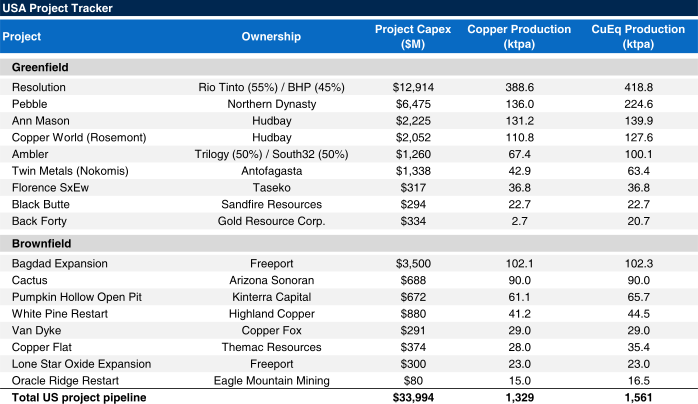

RBC Capital research said that while America has just two operating smelters and roughly half of its refined consumption (850ktpa) is imported, there's a plethora of known deposits that hadn't hit an economic price point for capex on development to tap into.

For instance, “restarting Grupo Mexico's Hayden smelter in Arizona (on care and maintenance since 2019) could produce about 300ktpa of refined copper but would take time to refurbish,” RBC Capital said.

“The bulk of the imports now come from Chile, Canada, and Peru."

Bringing online domestic production is good news for players such as BHP and Rio Tinto. The two mining heavyweights are in a JV to develop the Resolution copper mine in the U.S. - a project they've already poured billions into yet has long been held up over green and red tape.

Find out more: Rio has high hopes for copper mine Resolution

There's a whole bunch of proven yet undeveloped copper finds in the U.S. but capex and a low copper price has left them dormant for quite some time. Good news for Trump is there's a fair few to choose from and no doubt the administration would dangle a couple of incentives to make development attractive for both the miners and private equity.

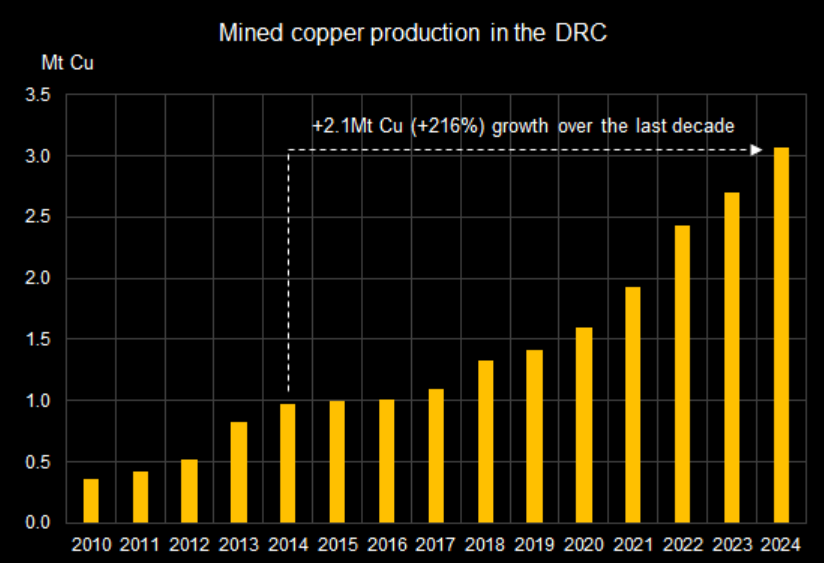

Trump is looking to thwart what his advisers see as a move by China to dominate the global copper market. He is reacting to the Middle Kingdom growing its copper supply chain with major projects coming online in the Democratic Republic of Congo (DRC) and an incessant increase in smelting capacity domestically - despite wonton efforts to curb overcapacity.

The DRC is China’s main source of refined copper imports (37% in 2024).

Trickle on effects

Apart from the foreseeable long-term demand for copper in the global green energy shift, concerns over Chinese consumption and America's drive to untether itself from the world's top producer are driving up prices of the red metal.

The move is likely to see more copper delivered into the U.S. in the short term and it won't be long until the commodity surpasses its all-time high price of US$5.20 set in May last year.

ING Global Head of Markets Chris Turner says the new White House investigation will likely lead to tariffs, as the US seeks to protect and grow strategic industries.

It should also benefit copper producing nations such as Chile - but not for long.

Chile - the world's number one copper producer - accounts for one-third of current U.S. imports and is a vital contributor to its overall GDP.

“While the spike in copper might seem like good news for Chile in the short run, the fear is that reduced U.S. demand will prompt a flood of exports elsewhere in the world and add to the gloom surrounding Chinese and global demand” Turner says.

Copper traded at US$4.52/lb today, up 20% this year alone, according to derivatives marketplace CME.

More to come.