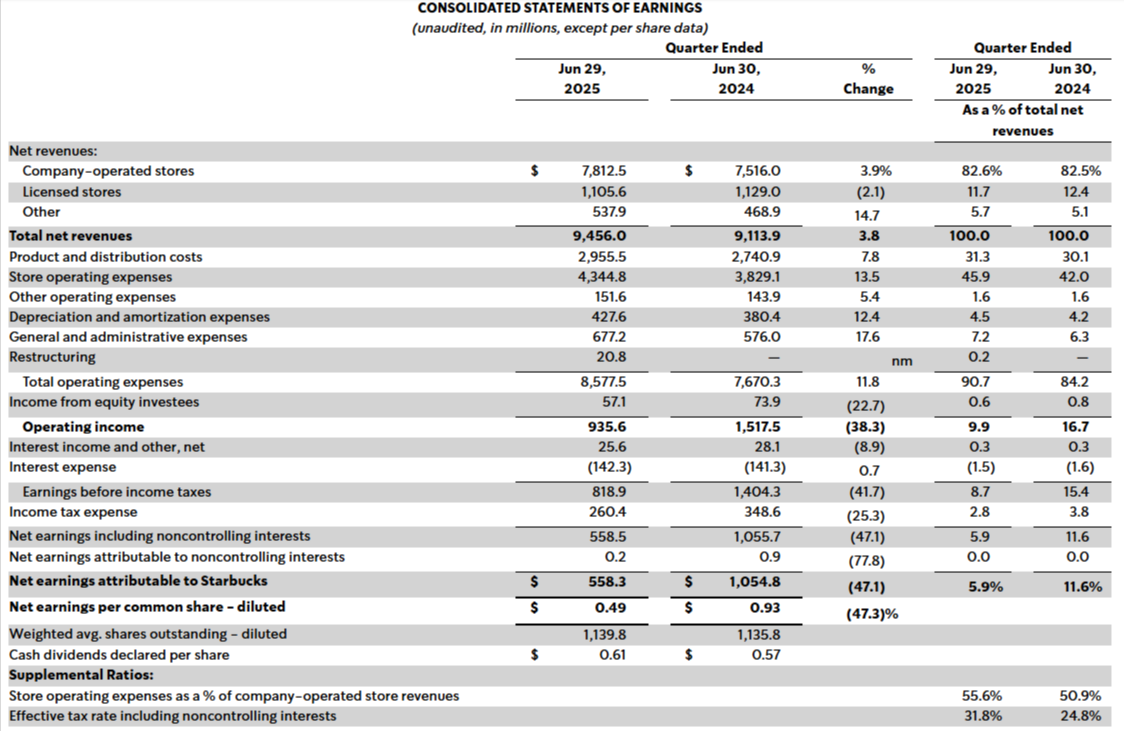

Starbucks reported Q3 FY2025 consolidated net revenues of $9.5 billion, up 4% year-over-year, driven by store expansion and international growth.

Analysts had expected that figure to be $9.31 billion, according to CNBC.

However, global comparable store sales declined 2%, with U.S. transactions down 4% and China showing a 6% increase.

GAAP earnings per share fell 47% to $0.49, while non-GAAP EPS dropped 46% to $0.50, impacted by one-time investments in labor and leadership development under the “Back to Starbucks” strategy.

North America revenue rose 2% to $6.9 billion, supported by a 5% increase in company-operated stores, though operating income fell 36% to $918.7 million due to inflation and higher labor costs. International revenue grew 9% to $2.0 billion, aided by favourable currency effects and a U.K. acquisition, but margins narrowed due to promotional activity.

The Channel Development segment saw a 10% revenue increase to $483.8 million, while operating income declined 7% amid cost pressures and joint venture income shifts.

The company added 308 net new stores in Q3, bringing its global footprint to 41,097 locations, with the U.S. and China accounting for 61% of the total.

Starbucks also completed a $1.75 billion bond issuance in May to support general corporate needs. In June, it hosted 14,000 leaders at its largest-ever “Leadership Experience 2025” event, reinforcing its focus on service, talent development, and operational efficiency.

Governance updates include the appointment of Marissa Mayer and Dr. Dambisa Moyo to the Board, expanding it to 11 members.

The Board declared a $0.61 dividend per share, continuing Starbucks’ 61-quarter streak of payouts.

“We've fixed a lot and done the hard work on the hard things to build a strong operating foundation, and based on my experience of turnarounds, we are ahead of schedule,” commented Brian Niccol, chairman and chief executive officer. “In 2026, we'll unleash a wave of innovation that fuels growth, elevates customer service, and ensures everyone experiences the very best of Starbucks. We're building back a better Starbucks experience and a better business.”

At the time of writing, Starbucks Corp (NASDAQ: SBUX) stock was trading after hours at $97.25 up $4.29 (4.61%). At the close it was $92.96, down 71 cents (0.76%) today. It has a market cap of around $105.64 billion.

All financials in U.S. dollars.