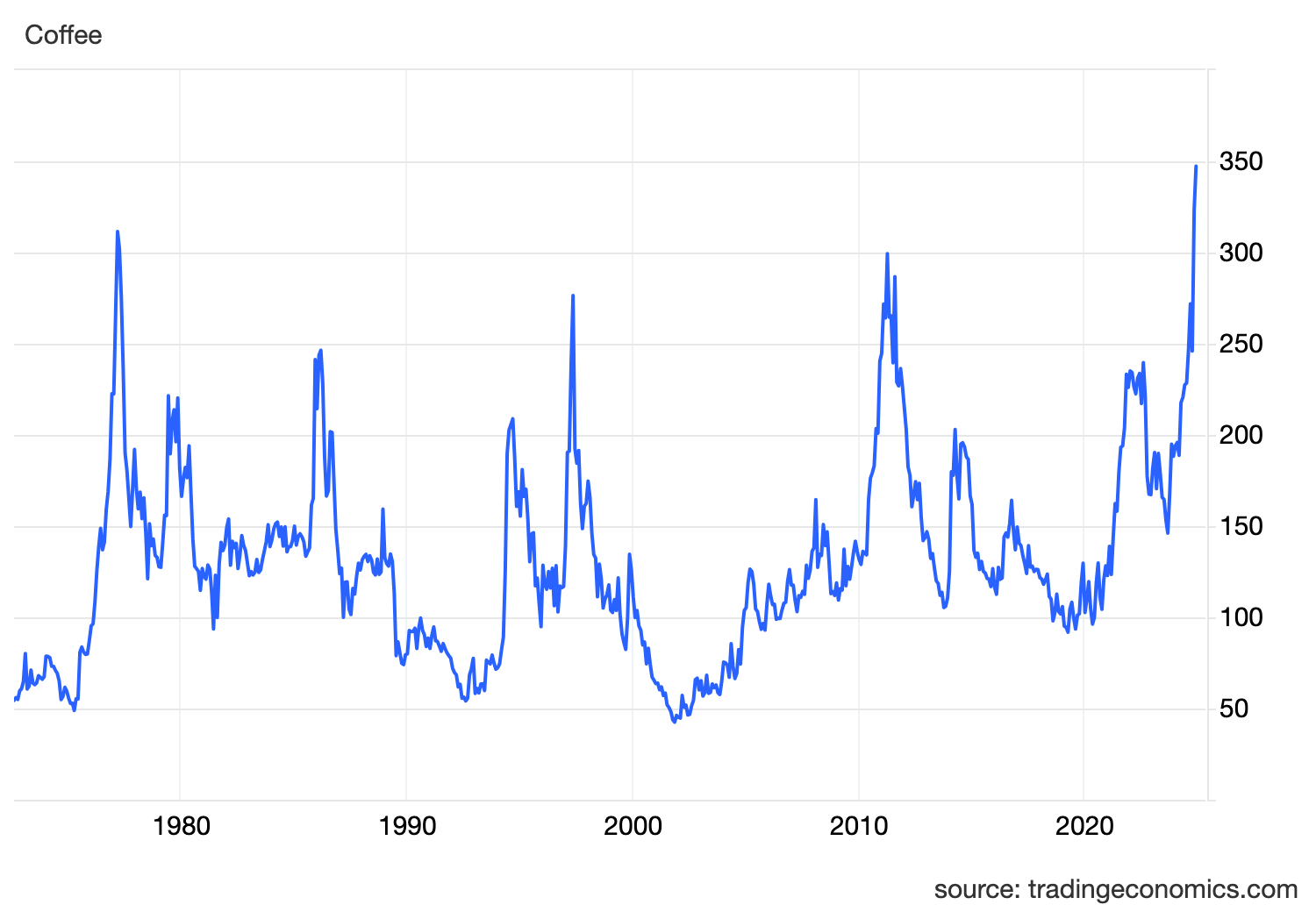

Some news you may not want to hear while drinking your daily coffee, but the price of the commodity surged to a new 47-year-old record high on Tuesday (Wednesday AEDT), amid supply concerns.

The price for Arabica beans, which account for most global production, hit a new high at US$3.47 (A$5.43) a pound (0.45kg), beating the previous record of $3.36 a pound set in April 1977.

Futures prices for the superior bean were driven higher by bad weather in Brazil, a key growing country, where drought conditions are threatening the lucrative coffee crop.

The rise comes after futures prices have nearly doubled over the past year, following a 40% hike since October, over Brazilian crop concerns.

Brazil is expected to produce just 34.4 million bags of arabica in the coming season, down around 11 million bags from a September estimate, according to Bloomberg.

This will push global coffee production to a demand shortfall of 8.5 million bags in the 2025-26 season, marking an unprecedented fifth year of deficits.

Meanwhile, the cost of Robusta beans, a lower-grade bean which coffee producers and brewers alike turn to when arabica prices rise, also reached a fresh high in September after Vietnam's growing season was hit with both drought and heavy rains, affecting the crop’s harvest.

The challenge for coffee producers and cafes is the fine art of balancing price increases, without pushing customers away. "We are not immune to the price of coffee, far from it," said David Rennie, Nestlé's head of coffee brands at an investor day in November.

Rennie said the coffee industry was facing "tough times", and cautioned that Nestlé were looking at adjusting prices and pack sizes.

Coffee is among one of the latest ‘soft commodities’ to jump in price driven by poor crops, as other soft commodities account for some of the year’s best-performing raw materials.

Prices for cocoa, which is the key ingredient of chocolate, skyrocketed this year as West Africa’s cocoa crisis deepened.

Elsewhere, orange juice prices also surged to a record high in October, with frozen orange juice prices up over 60% from last year, and nearly 200% since 2020, amid supply shortages in Brazil, the main global exporter of orange juice.