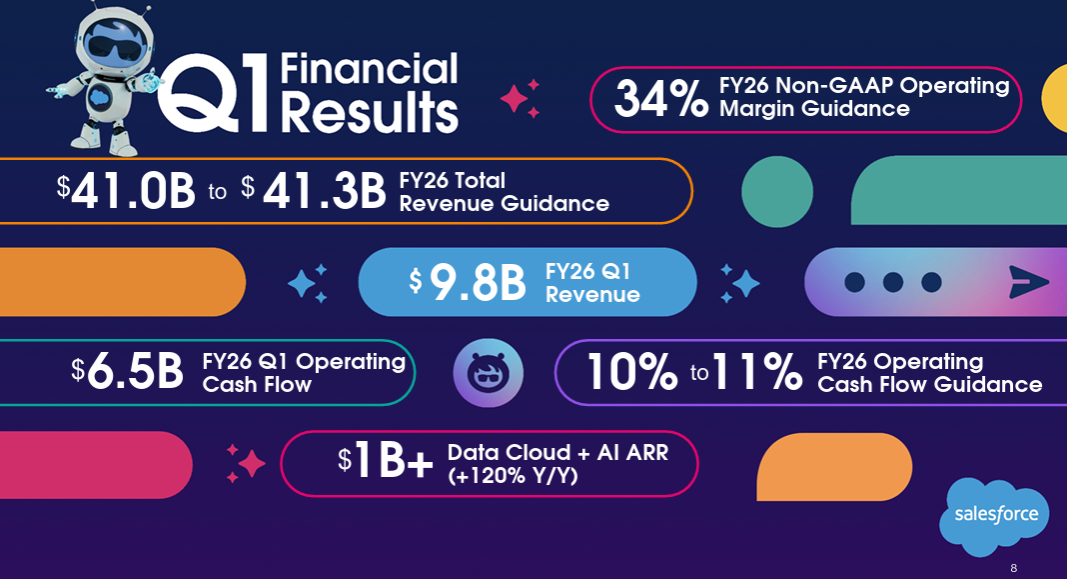

Salesforce (NYSE: CRM) posted strong fiscal Q1 2026 results, with revenue hitting $9.8 billion, up 8% year-over-year.

Subscription and support revenue climbed to $9.3 billion, while current remaining performance obligations (cRPO) surged 12%.

The company maintained robust profitability, reporting a GAAP operating margin of 19.8% and non-GAAP margin of 32.3%. Operating cash flow reached $6.5 billion, up 4%, with $3.1 billion returned to shareholders through buybacks and dividends.

Salesforce (CRM) Surpasses Earnings Expectations with Strong Q1 Results

“We delivered strong Q1 results and are raising our guidance by $400 million to $41.3 billion at the high end of the range,” said Marc Benioff, Chair and CEO, Salesforce.

“We’ve built a deeply unified enterprise AI platform - with agents, data, apps, and a metadata platform - that is unmatched in the industry. With Agentforce, Data Cloud, our Customer 360 apps, Tableau, and Slack all built on one trusted, unified foundation, companies of every size can build a digital labor force - boosting productivity, reducing costs, and accelerating growth. And, with our agreement to acquire Informatica, we will bring together the industry’s leading AI CRM and AI-powered MDM and ETL platform to create the most complete, intelligent AI and data platform for the enterprise.

"I’m pleased by our momentum as we capitalise on the exciting agentic AI opportunity,” said Robin Washington, President and Chief Operating and Financial Officer, Salesforce. “Our Q1 performance reflects solid execution, driven by our continued focus on innovation, operational excellence, and maximising value for our customers and shareholders."

AI and Data Cloud Drive Growth

Salesforce’s AI and Data Cloud offerings fuelled expansion, with annual recurring revenue surpassing $1 billion, marking a 120% year-over-year increase. Nearly 60% of its top 100 deals included AI and Data Cloud solutions. Agentforce handled over 750,000 customer requests, reducing case volume by 7%. The company ingested 22 trillion records into its Data Cloud, a 175% jump from the prior year.

Strategic Moves: Informatica Acquisition and Guidance Boost

Salesforce announced a definitive agreement to acquire Informatica, strengthening its AI-powered data management capabilities. Despite the acquisition, FY26 guidance remained unchanged, with revenue now expected between $41.0 billion and $41.3 billion, reflecting an 8%-9% growth. The company anticipates a currency tailwind, boosting its year outlook.

Q2 Expectations and Market Positioning

For Q2, Salesforce projects revenue between $10.11 billion and $10.16 billion, maintaining 8–9% year-over-year growth. Operating margins remain steady, with GAAP at 21.6% and non-GAAP at 34.0%. CEO Marc Benioff highlighted Salesforce's unified AI platform, integrating Agentforce, Data Cloud, Tableau, and Slack, positioning the company as a leader in enterprise AI.

Salesforce’s aggressive AI expansion and strategic acquisitions signal continued momentum, reinforcing its dominance in the CRM space.

At the time of writing, the Salesforce Inc (NYSE: CRM) stock price was US$276.03, down $1.16 (0.42%). In after-hours trade, the price was $279.60, up $3.57 (1.29%). It has a market cap of around $264.84 billion.

Related content