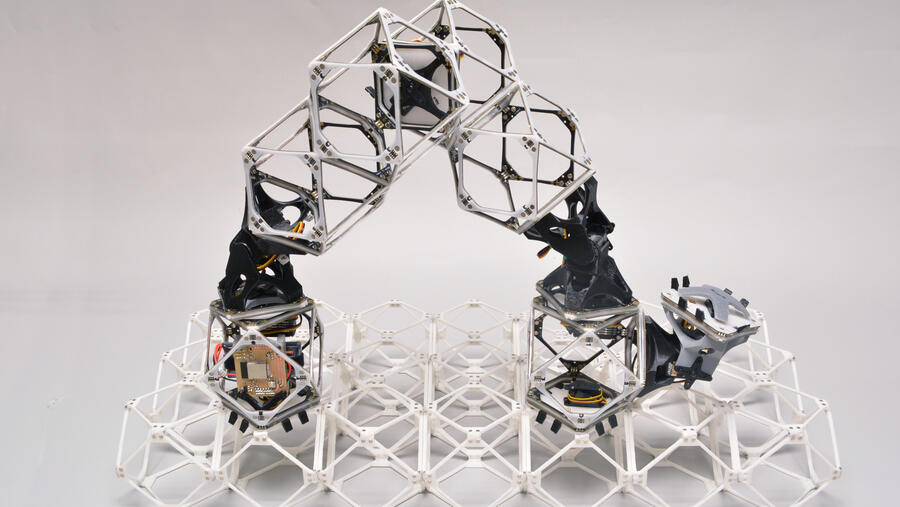

ABB shares peak after robotics unit sale to Softbank

ABB shares hit a record high after it decided to sell its robotics division to SoftBank Group Corp for an enterprise value of US$5.375 billion (A$8.18 billion) rather than spin it off as a separately listed company. ABB Chairman Peter Voser said SoftBank’s offer had been carefully evaluated by the Board and Executive Committee of the Swiss-based electrical engineering giant and compared with a spin-off and would create immediate value for ABB shareholders. “Our ambitions for ABB are unchanged and we will continue to focus on our long-term strategy, building on our leading positions in electrification and automation,” Vosser said in a news release. SoftBank Chairman and CEO Masayoshi Son said the Japanese investment conglomerate and ABB Robotics would unite world-class technology and talent under a shared vision to fuse artificial super intelligence and robotics. “SoftBank’s next frontier is Physical AI,” he said in a press release. The transaction is subject to regulatory approvals and further customary closing conditions and is expected to close in mid-to-late 2026. ABB said the sale will result in a non-operational pre-tax book gain of about $2.4 billion with expected cash proceeds, net of transaction costs, of