Global online real estate advertising company, the REA Group has reported strong Q3 results with significant revenue growth and increased audience engagement across its platforms.

REA Group Chief Executive Officer, Owen Wilson said: "REA delivered a strong third quarter result underpinned by double-digit yield growth as we continued to drive increased value for customers across our premium products. The first interest rate cut in 4 years, combined with expectations of more to come, spurred buyer demand and supported house price growth across the country.

“These conditions encouraged sellers to bring properties to market with listings matching the very strong levels of this time last year.”

Financial Performance

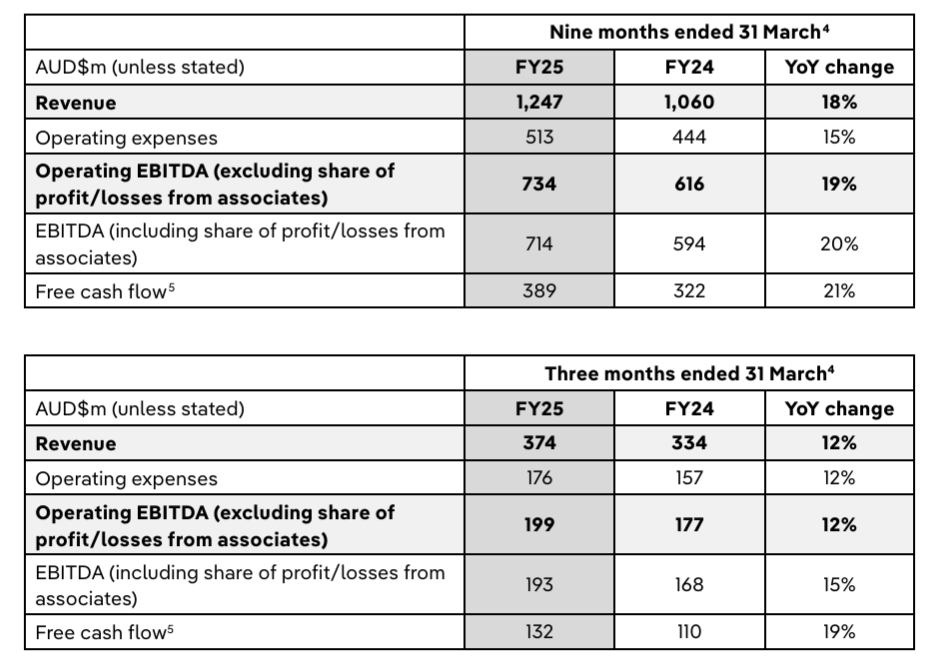

- Revenue for the nine months ended 31 March 2025: $1,247m, up 18% YoY.

- Q3 revenue: $374m, a 12% increase YoY.

- EBITDA excluding associates: $734m, up 19% YoY; Q3 EBITDA: $199m, up 12%.

- Free cash flow: $389m, a 21% increase YoY.

Australian Market

Australian revenue: $340m, up 11% YoY.

Residential revenue increased by 12% for the quarter.

National listings were flat YoY, but Buy revenue grew because of a 15% yield increase.

Rent revenue rose with an 8% average price increase and a 4% increase in listings.

Audience Engagement

Average monthly visitors to realestate.com.au: 12.3 million, with 6.4 million exclusively using the site.

133.4 million average monthly visits, 3.9 times more than the nearest competitor.

50% YoY increase in seller leads and 6% YoY increase in active members.

India Operations

REA India’s revenue increased by 28% YoY, driven by adjacency services.

Core revenue was flat due to increased competition, while PropTiger revenues declined.

Operating Costs

Group operating costs grew by 12%, with Australian costs up 9%.

Employee costs were the main driver of Australian cost growth.

India operating costs increased by 20% due to revenue-related costs.

Outlook

Continued strong employment and expected interest rate cuts support buyer demand.

Anticipated FY25 listings growth of 1-2%.

Residential Buy yield growth is expected between 13-15% in FY25.

Targeting positive operating jaws with low double-digit core operating cost growth.

At the time of writing, Group Rea Group Ltd's (ASX: REA) stock price was $250.08, with a market cap of approximately $33.04 billion.