Palantir Technologies (NASDAQ: PLTR) just proved that trading at 265 times forward earnings might not be entirely barmy after all.

The data analytics giant smashed through the US$1 billion quarterly revenue barrier for the first time, delivering a staggering 48% year-over-year growth to $1.004 billion in Q2 2025.

The company's Rule of 40 score hit 94% - a metric that combines growth rate and profit margin to gauge software as a service (SaaS) company health.

Anything above 40% is considered solid, and Palantir's nearly hit triple digits.

Stateside commercial surge

The AI tech giant's domestic commercial operations exploded 93% year-over-year to $306 million.

Even Snowflake and Databricks, the data platform heavyweights, would struggle to match that acceleration.

"This was a phenomenal quarter. We continue to see the astonishing impact of AI leverage," Palantir CEO Alex C. Karp said.

"Our Rule of 40 score was 94%, once again obliterating the metric. Year-over-year growth in our U.S. business surged to 68%, and year-over-year growth in U.S. commercial climbed to 93%.

“We are guiding to the highest sequential quarterly revenue growth in our company’s history, representing 50% year-over-year growth.”

Palantir closed a record $2.27 billion in total contract value, up 140% year-over-year, with U.S. commercial TCV hitting $843 million - a 222% increase.

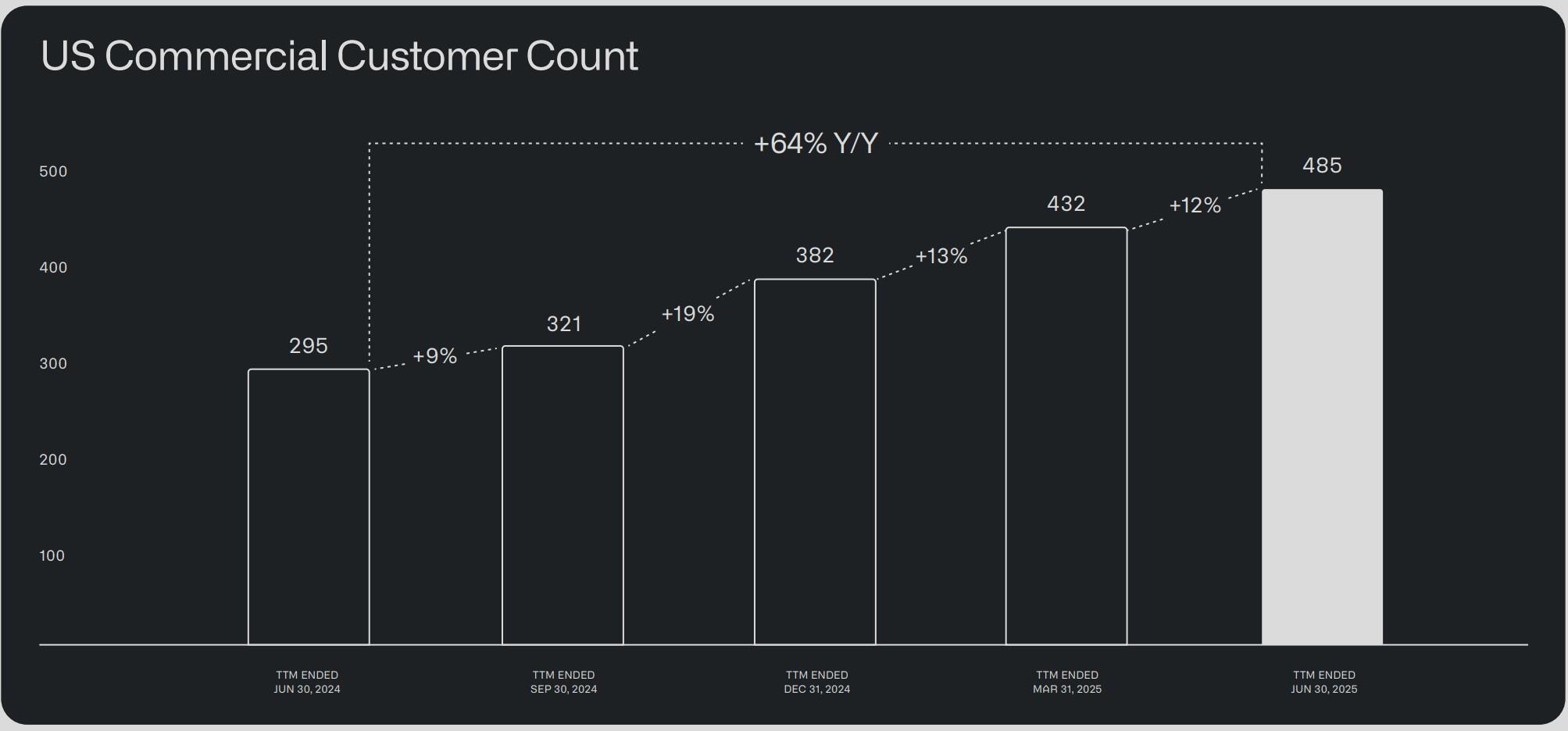

Customer count grew 43% year-over-year, with the AI Platform (AIP) creating bigger deals while attracting new customers to Palantir.

U.S. revenue grew 68% YoY and 17% QoQ, driven by acceleraton in U.S. commercial and U.S. government revenues.

Profitability puzzle solved

Palantir posted GAAP operating income of $269 million (27% margin) and adjusted operating income of $464 million (46% margin). Cash from operations hit $539 million, a 54% margin.

The Rule of 40 traditionally forces companies to choose between rapid expansion and profitability - and Palantir achieved both.

The company holds $6 billion in cash and short-term securities, providing substantial resources as competition intensifies.

Competition heats up in government goldmine

Palantir's unchallenged government dominance is ending as Silicon Valley startups and big tech are starting to get heavily involved.

The U.S. Department of Defense (DoD) recently granted contract awards of up to $200 million each to Anthropic, Google, OpenAI and xAI, marking the first serious challenge to Palantir's government monopoly.

OpenAI's $200 million DoD contract represents its first significant commercial deal with the Department of Defense, where Palantir has dominated.

xAI has launched 'Grok for Government,' making its frontier AI models available to U.S. government entities through the General Services Administration schedule.

The data lakehouse wars intensify

Palantir faces established competition from Snowflake and Databricks in the commercial data platform market.

Databricks excels in machine learning workflows and real-time analytics, while Snowflake dominates business intelligence and reporting with its end-to-end AI integration and government-grade security credentials.

Forrester ranked both Databricks and Snowflake as leaders in their 2024 Forrester Wave for Data Lakehouses, signs that the competitive landscape remains tight.

Growth expectations

Management has raised guidance across multiple metrics. Q3 2025 revenue is expected between $1.083-$1.087 billion, implying another 50% year-over-year growth.

Full-year revenue guidance jumped to $4.142-$4.150 billion, with U.S. commercial revenue expected to exceed $1.302 billion (at least 85% growth).

The company has also raised adjusted operating income and free cash flow guidance, while maintaining expectations for GAAP profitability across every quarter of this year.

Palantir's valuation has risen 111% year-to-date and 514% over the past year, trading at 265 times forward earnings and 91 times forward revenue. Yes, Palantir is growing rapidly, but sustaining this trajectory long enough to justify such a valuation remains uncertain.

At the time of writing, Palantir (NASDAQ: PLTR) stock was trading at US$166.62, up 3.7% from Monday's close of $160.66, an all-time high. Palantir's market cap stands at $379.14 billion.