Shares in technology giant Oracle Corporation soared in after-hours deals on Tuesday (Wednesday AEST) after it hailed a “brilliant” start to the 2026 financial year (FY26) despite statutory net income flatlining in the first quarter (Q1).

The company said it expected Oracle Cloud Infrastructure revenue to grow 77% to US$18 billion (A$27.2 billion) in FY26 and increase to $32 billion, $73 billion, $114 billion and $144 billion over the subsequent four years.

CEO Safra Catz said most of this revenue was already booked in its reported remaining performance obligations (RPO), which is a measure of booked revenue and which rose 359% year-over-year to $455 billion.

“Oracle is off to a brilliant start to FY26,” Catz said in an earnings release.

Oracle (NYSE: ORCL) jumped by $64.63 (26.76%) to $306.14 in after-hours trading at the time of writing, having earlier closed US$2.99 (1.25%) higher at $241.51, capitalising the company at $678.36 billion (A$1.026 trillion).

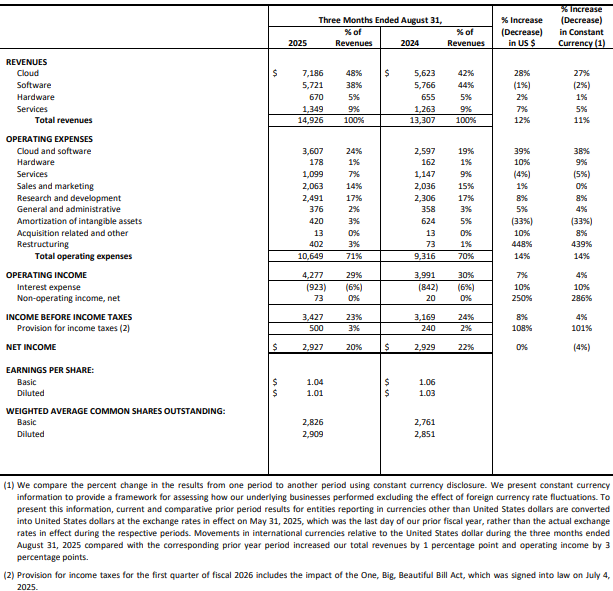

Net income of $2.927 billion in the three months ended 31 August was barely changed from the previous corresponding period, as a 14% increase in operating expenses and a doubling in taxes outstripped a 12% rise in revenue.

But the 48-year-old company, which specialises in database software, cloud computing and enterprise software solutions, quoted underlying figures showing earnings per share rising 6% and net income increasing 8% in Q1.

Revenue grew 28% from its Cloud business, 2% from hardware and 1% from services, but fell 1% from software.

Catz said that the signing of four multi-billion-dollar contracts with three customers in Q1 drove the increase in the RPO contract backlog, and in the next few months, it expected to sign up several more such deals to push RPO past $500 billion.

“It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build,” he said.

Chairman, joint founder and Chief Technology Officer Larry Ellison said ‘MultiCloud’ database revenue from Amazon (NASDAQ: AMZN), Google (NASDAQ: GOOG) and Microsoft (NASDAQ: MSFT) grew at the “incredible rate” of 1,529% in Q1.

“We expect MultiCloud revenue to grow substantially every quarter for several years as we deliver another 37 datacentres to our three Hyperscaler partners, for a total of 71,” he said.