Oracle Corporation posted robust financial results for Q4 and fiscal year 2025, exceeding Wall Street estimates, driven by cloud expansion.

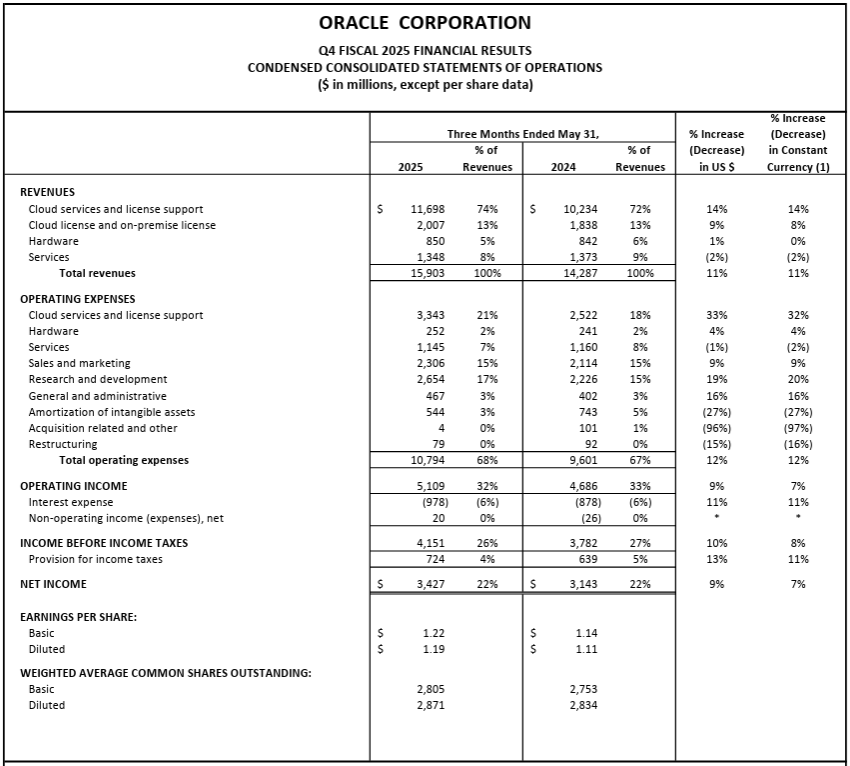

Quarterly revenue hit $15.9 billion*, marking an 11% year-on-year increase.

Cloud services revenue surged 27% to $6.7 billion, with cloud infrastructure (IaaS) soaring 52%.

Net income reached $3.4 billion, while non-GAAP earnings per share stood at $1.70.

For the full fiscal year, Oracle reported $57.4 billion in revenue, up 8% from 2024.

Cloud services and license support revenue climbed 12% to $44 billion, reinforcing Oracle’s dominance in enterprise cloud solutions.

GAAP net income totalled $12.4 billion, with non-GAAP earnings per share at $6.03.

The company’s multi-cloud database revenue skyrocketed 115% from Q3 to Q4, signalling strong demand for hybrid cloud solutions.

Looking ahead, Oracle projects over 40% cloud growth in fiscal 2026, with cloud infrastructure expected to expand by more than 70%.

Remaining Performance Obligations (RPO) are forecast to grow over 100%, reflecting strong future commitments.

Oracle’s aggressive datacentre expansion and AI-driven cloud offerings position it as a key player in the evolving cloud landscape.

Oracle’s board declared a $0.50 per share quarterly dividend, reinforcing its commitment to shareholder returns. The dividend will be paid on 24 July, 2025, to stockholders of record as of 10 July.

With cloud revenue accelerating, Oracle’s strategic investments in AI and multi-cloud infrastructure could reshape enterprise computing in the coming years.

“FY25 was a very good year — but we believe FY26 will be even better as our revenue growth rates will be dramatically higher,” said Oracle CEO Safra Catz.

“We expect our total cloud growth rate — applications plus infrastructure — will increase from 24% in FY25 to over 40% in FY26. Cloud Infrastructure growth rate is expected to increase from 50% in FY25 to over 70% in FY26. And RPO is likely to grow more than 100% in FY26. Oracle is well on its way to being not only the world’s largest cloud application company — but also one of the world’s largest cloud infrastructure companies.”

“MultiCloud database revenue from Amazon, Google and Azure grew 115% from Q3 to Q4,” said Oracle Chairman and CTO, Larry Ellison.

“We currently have 23 MultiCloud datacentres live with 47 more being built over the next 12 months. We expect triple-digit MultiCloud revenue growth to continue in FY26. Revenue from Oracle Cloud@Customer datacentres grew 104% yearover-year. We have 29 Oracle Cloud@Customer dedicated datacentres live with another 30 being built in FY26. Overall Oracle Cloud Infrastructure consumption revenue grew 62% in Q4. We expect OCI consumption revenue to grow even faster in FY26. OCI revenue growth rates are skyrocketing — so is demand.”

At the time of writing, Oracle Corp's (NYSE: ORCL) stock price was $189.75 in after-hours trading, up $13.37 (7.58%). It has a market cap of around $494.61 billion.

*All financials are in US dollars.