Oil prices fell for a third straight session during Asian trade on Friday, setting the market on track for its first weekly decline in three weeks, as expectations of increased supply and a surprise build in United States crude inventories deepened concerns over weakening demand.

By 3:30 pm AEST (5:30 am GMT), Brent crude futures were down 14 cents, or 0.2%, at $66.85 per barrel, while U.S. West Texas Intermediate (WTI) crude slipped 18 cents, or 0.3%, to $6.30 per barrel.

For the week so far, Brent is down 1% and WTI has retreated 1.1%.

“Crude oil remained under pressure amid concerns of rising OPEC+ supply,” ANZ research analysts wrote in a note on Friday.

“Market expectations are growing that the group will continue to push more barrels into the market, in an effort to gain market share lost to U.S. shale producers in recent years.”

Reuters reported earlier this week that eight members of the Organization of the Petroleum Exporting Countries and allies, including Russia – collectively known as OPEC+ – will consider raising production further in October at a meeting on Sunday, citing two sources familiar with the talks.

Another increase would see OPEC+, which supplies about half of the world’s oil, begin unwinding a second layer of output cuts totalling 1.65 million barrels per day, equivalent to 1.6% of global demand, more than a year earlier than planned.

Meanwhile, Data from the Energy Information Administration showed U.S. crude inventories rose by 2.42 million barrels last week as refineries prepared for seasonal maintenance, compared to market expectations of a 1.8 million-barrel draw.

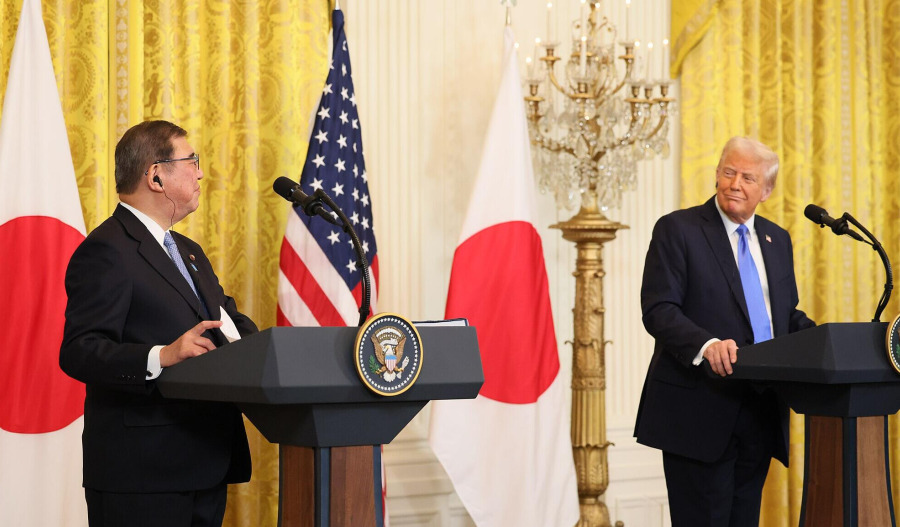

Despite oversupply concerns, geopolitical risks continue to loom over the market. A White House official said U.S. President Donald Trump told European leaders on Thursday that Europe must stop buying Russian oil. Any restrictions on Russian crude exports or disruptions to supply could push global prices higher.