General Motors is cutting electric vehicle production at its Tennessee facility and delaying expansion plans as demand weakens following the Trump administration's withdrawal of federal EV incentives.

The automaker will halt production of two Cadillac electric SUVs during December and significantly reduce output through early 2026.

“General Motors is making strategic production adjustments in alignment with expected slower EV industry growth and customer demand by leveraging our flexible ICE (internal combustion engine) and EV manufacturing footprint,” GM told Reuters.

GM's move follows the elimination of the US$7,500 consumer tax credit that expires on 30 September 2025, down from its original 2032 sunset date.

"The $7,500 tax credit is driving demand; without that, that'll slow," GM chief exec Mary Barra said in December last year.

Yet analyst McKinsey projects that worldwide demand for EVs will grow sixfold from 2021 through 2030, with annual unit sales going from 6.5 million to roughly 40 million over that period.

The firm maintains that "It is very clear that the automotive future in passenger cars is electric. There is no alternative to decarbonise the passenger car transport sector effectively."

Global momentum strong

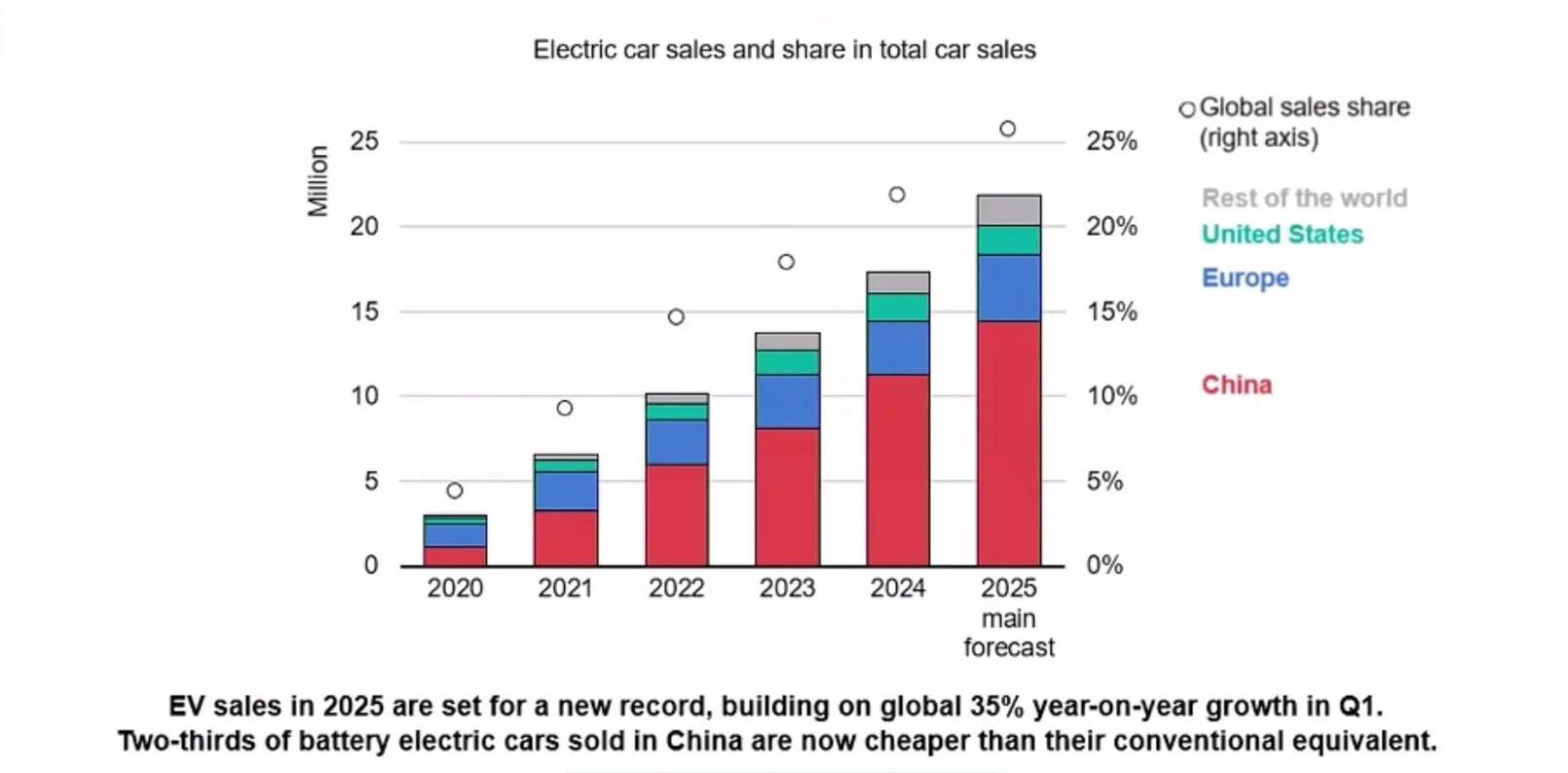

International Energy Agency (IEA) data shows electric car sales exceeded 17 million globally in 2024, reaching a sales share of more than 20%.

The agency expects EV sales in 2025 to exceed 20 million worldwide to represent more than one-quarter of cars sold worldwide.

China leads this transformation, with electric cars accounting for almost half of all car sales in 2024.

Bloomberg NEF forecasts suggest that despite rising demand, there is significant overcapacity among battery manufacturers, which has helped drive prices down.

Industry 180

Once fighting against the proliferation of EVs, automotive lobbyists are now mobilising to preserve any remaining federal support.

The main U.S. trade group representing major automakers has urged the incoming White House to "preserve auto-related provisions in the current tax code," arguing they "have fuelled investment in domestic EV and battery manufacturing and increased good-paying jobs in automotive communities."

The Alliance for Automotive Innovation - an industry group with members from 42 U.S. automotive companies, including GM, Ford, Nissan and Volkswagen - listed support for EV manufacturing among its 2025 policy priorities.

Goldman Sachs remains cautious about immediate impacts but suggests underlying commercial drivers of sustainable investment opportunities—including sustainable-focused sectors in the mid-market space—remain resilient.