General Motors (GM) reported second-quarter 2025 earnings that reflect a challenging operating environment, particularly in North America.

Revenue declined 1.8% year-over-year to $47.1 billion, still exceeding Wall Street's estimate of $45.84 billion, while net income attributable to stockholders fell sharply by 35.4% to $1.9 billion.

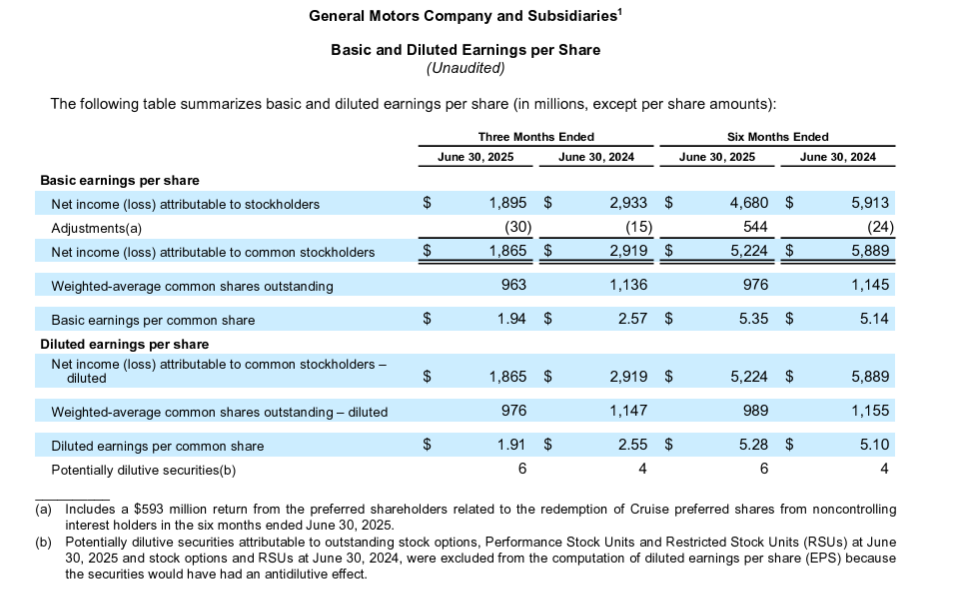

With certain items removed, earnings per share came to $2.53. Analysts polled by FactSet were expecting $2.34.

EBIT-adjusted dropped 31.6% to $3.0 billion, and net income margin narrowed to 4.0% from 6.1%. Automotive operating cash flow and adjusted free cash flow also saw steep declines, down 39.7% and 46.6% respectively.

The company attributes part of the pressure to increased costs, including a $1.1 billion tariff hit.

Despite the quarterly setback, GM’s year-to-date performance has shown resilience in some areas.

Total revenue for the first half of 2025 edged up 0.2% to $91.14 billion, although net income dropped 20.9% to $4.68 billion.

EBIT-adjusted for the six-month period fell 21.5% to $6.53 billion.

Notably, diluted EPS rose 3.5% to $5.28, while adjusted EPS declined 6.5% to $5.31. GM reaffirmed its full-year guidance, projecting net income between $7.7 billion and $9.5 billion and EBIT-adjusted between $10.0 billion and $12.5 billion.

Segment performance varied across geographies. GM North America’s EBIT-adjusted plunged 45.5% to $2.42 billion, reflecting weaker margins and higher costs.

In contrast, GM International posted a notable improvement, with EBIT-adjusted rising to $204 million from $50 million.

China operations rebounded with $71 million in equity income, reversing a $104 million loss a year earlier.

GM Financial’s EBT-adjusted declined 14.4% to $704 million.

The company also highlighted strong EV momentum, with 46,300 units sold in Q2, securing the No. 2 spot in the U.S. EV market.

Looking ahead, GM remains focused on mitigating tariff exposure through domestic manufacturing expansion and cost controls.

The automaker plans to offset up to 30% of the full-year tariff burden, estimated between $4 billion and $5 billion, via pricing strategies and operational shifts.

CEO Mary Barra emphasised GM’s commitment to electric mobility and long-term profitability, even as the expiration of EV tax credits looms.

“In addition to our strong underlying operating performance, we are positioning the business for a profitable, long-term future as we adapt to new trade and tax policies, and a rapidly evolving tech landscape,” Barra said.

"Despite slower EV industry growth, we believe the long-term future is profitable electric vehicle production, and this continues to be our north star. As we adjust to changing demand, we will prioritise our customers, brands, and a flexible manufacturing footprint, and leverage our domestic battery investments and other profit-improvement plans.

"Overall, GM is well positioned to succeed in an ICE market that now has a longer runway.

“We will continue to drive improved overall profitability and focus on EV profitability improvement to generate ongoing strong free cash flow. In addition, we will continue to drive American innovation in batteries, autonomous technology and software.”

At the time of writing, General Motors Co (NYSE: GM) was trading at $48.89, down $4.32 (8.12%) today, but was up 9 cents (0.18%) to be $48.98. It has a market cap of around $47 billion.

All financials are in U.S. dollars.