Oil prices edged higher on Tuesday, supported by ongoing supply concerns and a weakening United States dollar, while a smaller-than-expected output increase from major producers supported the market.

By 3:30 pm AEST (5:30 am GMT), Brent crude futures were up $0.20, or 0.3%, at $64.83 per barrel, while U.S. West Texas Intermediate crude gained $0.27, or 0.4%, to $62.79 per barrel.

ANZ analysts commented in a note to clients: “Crude oil rallied after cracks appeared in OPEC’s decision to accelerate its production hikes. Eight OPEC+ alliance members agreed on Saturday to increase output by 411kb/d in July. It’s the third month in a row that the group has raised output more than its original agreement of 138kb/d.

"However, some members objected, including Russia. These eased concerns of further large production hikes in the second half of the year. With the worst fears not panning out, investors unwound their bearish positions they had built prior to the weekend’s meeting.”

Geopolitical tensions further underpinned oil prices after an Iranian diplomat said on Monday that Iran was likely to reject a U.S. proposal to resolve a long-standing nuclear standoff.

Should the nuclear negotiations collapse, sanctions on Iranian oil exports are likely to remain in place, curbing global supply and supporting prices.

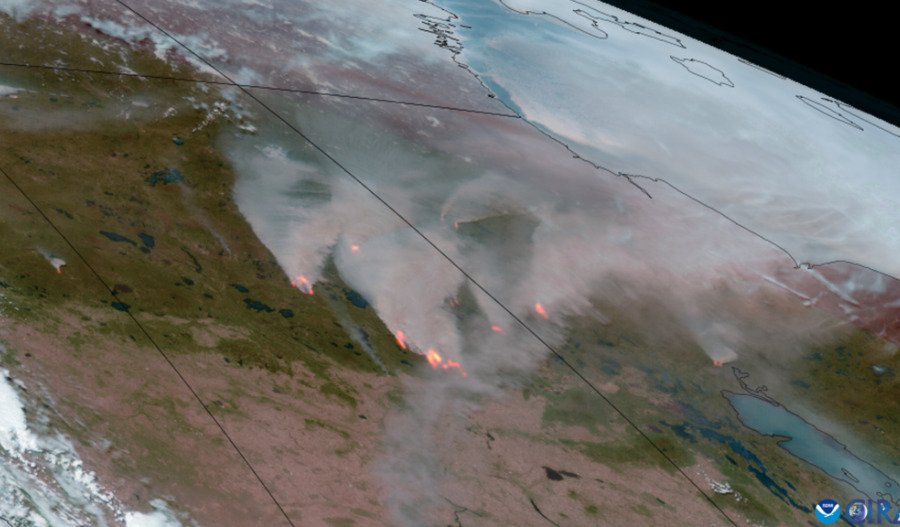

Compounding the supply-side concerns, a wildfire in Alberta, Canada, has led to a temporary shutdown of some oil and gas production facilities in the region, potentially tightening supply further.