Reports from China have unearthed another significant 1,000 tonnes (t) plus gold find, adding to its discovery of the US$83 billion, 1,000t Wangu gold field in Hunan Province in November last year.

Chinese state media says the initial figures at Wangu are substantial, with core sample grades of up to an eye-whopping 138 grams per tonne (g/t) and over 40 distinct gold veins identified.

Exploration, reportedly utilising advanced 3D geological modelling, has traced mineralisation to depths of around 3,000m, with 300t of gold contained in the field's core mining area.

Getting into full production on a deposit of that size could take up to 10 years - and there's significant interest in what methods and how much capex the Chinese will spend to get the operation going.

Another 1,000t deposit has also been found in Central China using the same 3D modelling - and together, those deposits would likely add significantly to the CCP's gold reserves.

While China is the world's top gold producer per annum, its reserves are far depleted compared to countries such as Australia, South Africa and Russia.

An addition of 2,000t of bullion would help reinforce China's financial system with an extra US$166 billion in value, as gold is used to hedge against currencies.

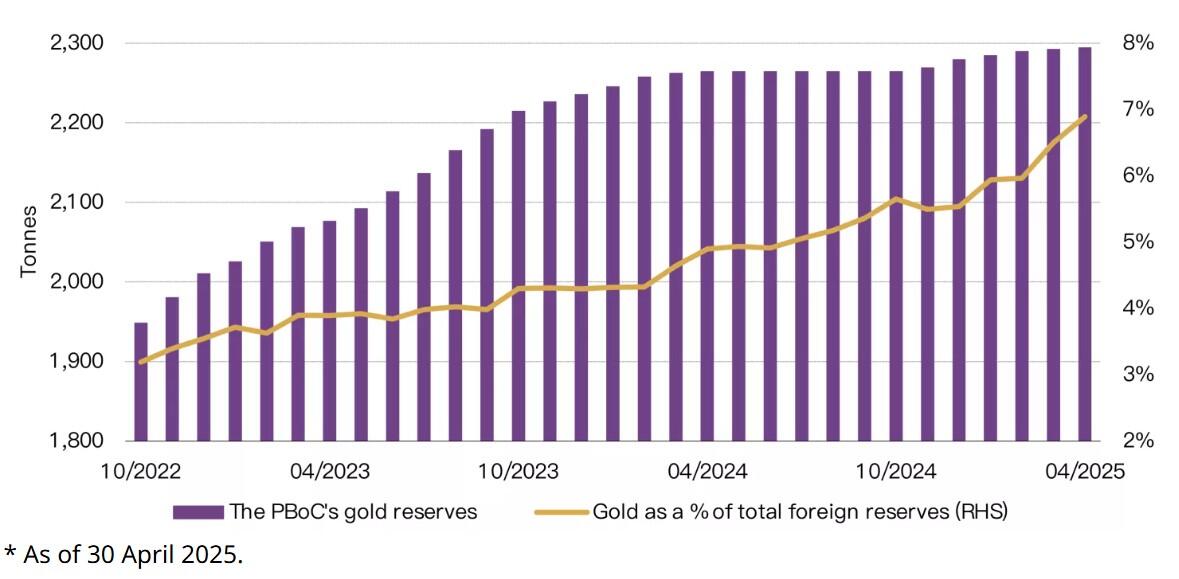

The CCP over the last few years has increased its bullion holdings from about 1,900t in 2022 - with 3% imported - to over 6.8% (2,295t) with a total value of US$243.6 billion by April.

Importing gold obviously costs money, and China would prefer nothing more than to produce it domestically - especially considering bullion consistently punches through all-time highs.