Artificial intelligence (AI) giant Nvidia has expanded its push into the inference market by licensing the technology of emerging technology company Groq and hiring its executive team.

The cost of the deal was US$20 billion (A$29.9 billion) cash, according to this CNBC article quoting Alex Davis, CEO of Disruptive, which led the startup’s latest financing round in September.

Groq said it had entered into a non-exclusive licensing agreement with Nvidia for inference technology, and its founder, Jonathan Ross, President Sunny Madra and other employees would join Nvidia to help advance and scale the technology.

But Groq, a company whose hardware and software run AI models fast, would continue to operate independently with Simon Edwards as Chief Executive Officer.

“The agreement reflects a shared focus on expanding access to high-performance, low cost inference,” Groq said in a news release.

The agreement is consistent with the trend of tech giants licensing the technology of new companies and hiring their best employees without buying them.

Groq specialises in ‘inference’, which is when AI models make predictions or generate outputs, rather than Nvidia’s specialist and dominant area of ‘training’, where models learn from large amounts of data.

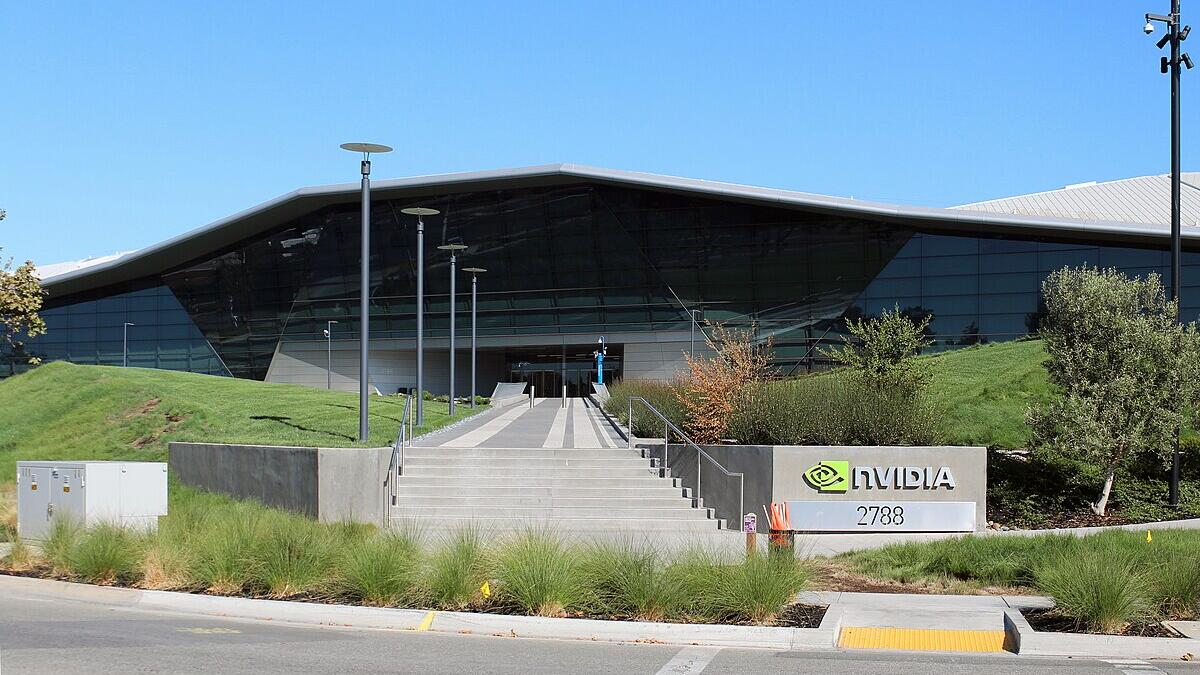

This is the largest acquisition by Nvidia, the world’s most valuable company by market capitalisation, which faces more competition in inference from traditional rivals like Advanced Micro Devices and new challengers like Groq and Cerebras Systems.

Groq, which was valued at $6.9 billion in a funding round in August 2024, avoids the use of external high-bandwidth memory chips to speed up interactions with chatbots and other AI models, which also limits the size of the model that can be served.

“We plan to integrate Groq’s low-latency processors into the NVIDIA AI factory architecture, extending the platform to serve an even broader range of AI inference and real-time workloads,” Nvidia CEO Jensen Huang wrote in an email quoted by CNBC.

Nvidia (NASDAQ: NVDA) shares closed on Friday (Saturday AEDT) up $1.92 at $190.53, capitalising it at $4.63 trillion.