Nike has reported a 31% fall in net income for the first quarter of the 2026 financial year (Q1 FY26), but its share price rose because revenue increased unexpectedly.

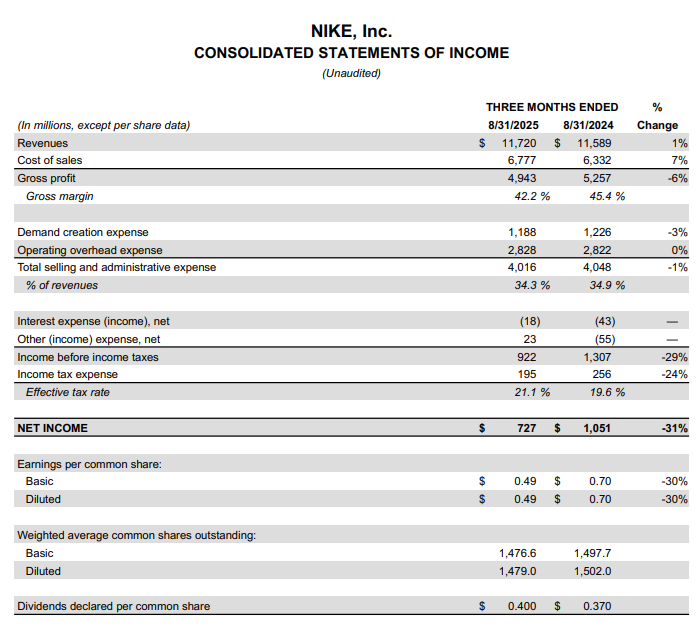

The global sportswear company said net income fell to US$727 million (A$1.098 billion) in the three months ended 31 August 2025 from $1.051 billion a year earlier on revenue, which increased 1% to $11.7 billion.

Analysts had expected revenue to drop by 5.1% to $11 billion, according to Reuters, which quoted data compiled by LSEG.

Diluted earnings per share (EPS) fell 30% to 49 cents.

Nike (NYSE: NKE) shares closed 16 cents (0.23%) higher at $69.73 on Tuesday (Wednesday), capitalising the company at US$102.98 billion, before rising 2.45% to $72.18 in after-hours trading.

The company said its gross margin fell 320 basis points to 42.2% in Q1, mainly because of a lower average selling price, which reflected higher discounts and the channel mix, along with higher tariffs in North America, but selling and administrative expenses dropped 1%.

Nike expected tariffs to cost it about $1.5 billion, compared with the $1 billion expected earlier, according to a Reuters story.

Direct revenues fell 4% to $4.5 billion, wholesale revenues rose 7% to $6.8 billion, and Converse revenue plunged 27% to $366 million due to declines across all territories.

President & CEO Elliott Hill said Nike drove progress through its Win Now strategic reset program in its priority areas of North America, Wholesale and Running.

“While we’re getting wins under our belt, we still have work ahead to get all sports, geographies, and channels on a similar path as we manage a dynamic operating environment,” Hill said in a press release.

“I’m confident that we have the right focus in Win Now and that our new alignment in the Sport Offense will be the key to maximising NIKE, Inc.’s complete portfolio over the long-term."

Executive Vice President & Chief Financial Officer Matthew Friend said he was encouraged by the momentum generated in the quarter, but progress would not be linear as the dimensions of the business recovered on different timelines.

“While we navigate several external headwinds, our teams are focused on executing against what we can control," Friend said.