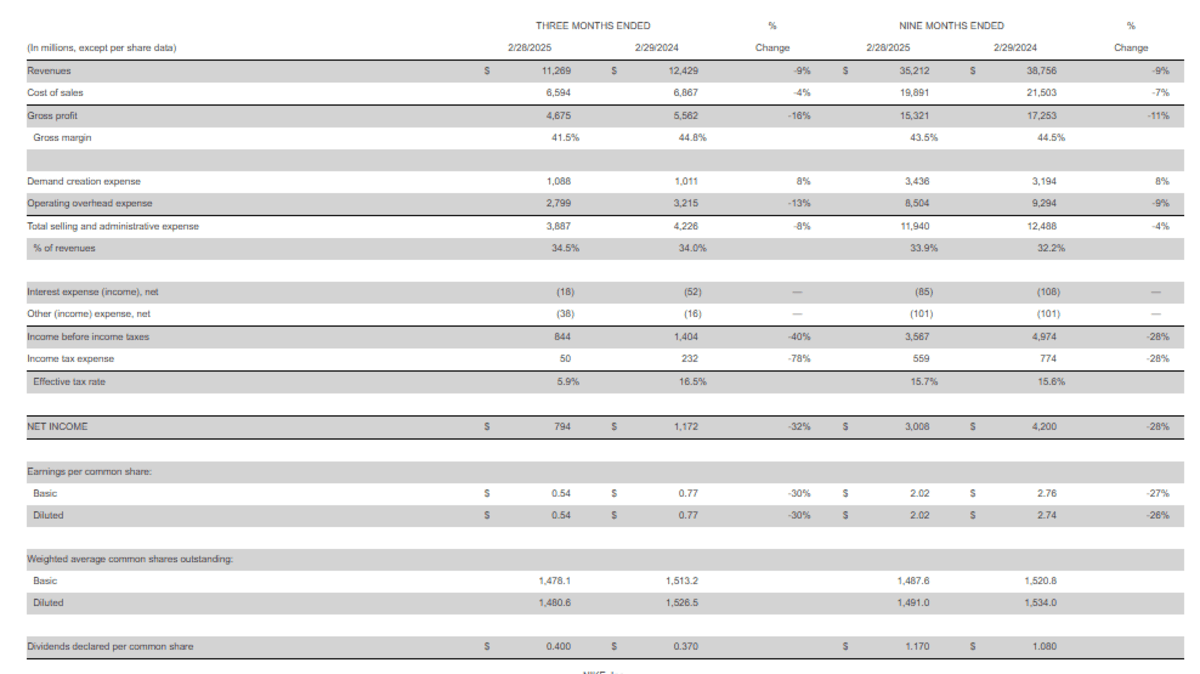

Global sportswear brand Nike Inc. has reported a 32% slump in net income to US$794 million (A$1.26 billion) for the third quarter of the 2025 financial year.

Nike, the 61-year-old American company known around the world for its “swoosh” logo, said revenue fell 9% to $11.269 billion in the three months ended 28 February 2025, less than the 11.5% drop forecast by analysts.

Diluted earnings per share slid 30% to 54 cents, which was a much better outcome than the 29 cents forecast by analysts.

Nike said gross margin decreased 330 basis points to 41.5% as a result of higher discounts, an excess of outdated inventory and increased product costs.

President and CEO Elliott Hill said Nike’s progress against the “Win Now” strategic priorities it committed to 90 days ago to drive growth and success reinforced his confidence the company was “on the right path.”

"What's encouraging is NIKE made an impact this quarter leading with sport – through athlete storytelling, performance products and big sport moments," Hill said in a statement.

Executive Vice President and Chief Financial Officer Matthew Friend said the operating environment was dynamic but Nike was serving athletes with new product innovation and “re-igniting brand momentum through sport”.

"Our outlook for the second half of fiscal 2025 driven by our 'Win Now' actions remains consistent with what we communicated last quarter," Friend said in the statement.

Based on revenue, NIKE Brand fell 9% $10.9 billion, driven by declines across all geographies, NIKE Direct dropped 12% to $4.7 billion, wholesale dipped 7% to $6.2 billion and Converse tumbled 18%.

Nike (NYSE: NKE) shares closed $1.13 (1.55%) lower at $71.86 on Thursday (Friday AEDT), capitalising the company at $106.29 billion, before dropping further to $68.43 in after hours trading at the time of writing.