Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

-----------------------------------------------------------------------------------------------------------------------------------------------------

Summary

- Micron beats market expectations

- Fedex reports US$22.2 billion in revenue for the 2025 fiscal year

- Nike reports a 32% slump in net income

- Earnings for Accenture grow while its shares begin to fall

-----------------------------------------------------------------------------------------------------------------------------------------------------

8:37 am (AEDT):

Good morning and welcome back to the Azzet earnings blog! Chloe Jaenicke here to kick us off with Micron (NASDAQ: MU).

The company has exceeded expectations with results driven by soaring demand for high-bandwidth memory (HBM) chips used in artificial intelligence applications.

Its HBM revenue also surpassed US$1 billion for the first time in fiscal Q2, with earnings per share (EPS coming in at $1.56 and total revenue surpassing $7.89 billion.

“We expect record quarterly revenue in fiscal Q3, with DRAM and NAND demand growth in both data centre and consumer-oriented markets, and we are on track for record revenue and significantly improved profitability in fiscal 2025,” said Sanjay Mehrotra, Chairman, President and CEO of Micron Technology.

Oliver Gray has the full story here.

9:02 am (AEDT):

Fedex (NYSE: FDX) revenue rose from US$21.7 billion in fiscal year 2024 to $22.2 billion in 2025.

"The FedEx team delivered improved profitability while navigating a very challenging operating environment, including a compressed Peak season and severe weather events,” said Raj Subramaniam, FedEx Corp. president and chief executive officer.

The company also reported diluted EPS of $4.51, an increase from last year’s $3.86.

9:13 am (AEDT):

An inquiry has found Coles, Woolworths and ALDI are among the most profitable supermarkets in the world but has stopped short of recommending they be broken up or forced to sell assets.

The Australian Competition and Consumer Commission (ACCC) said the three supermarket businesses were among the most profitable among their global peers and their average product margins had increased over the last five financial years.

Publishing a report into pricing and competition in Australia’s A$140 billion (US$88 billion) supermarket sector, then ACCC made 20 recommendations, including clearer pricing practices, greater transparency for suppliers and reforms to planning and zoning laws.

In its initial response, The Australian Government said it would provide $2.9 million to help suppliers stand up to the big supermarkets but the 441 page report did not support a divestiture power or the claim that breaking up supermarkets would help consumers.

“This is about ensuring Australians aren't treated like mugs by the supermarkets,” Treasurer Jim Chalmers said in a joint media release with other ministers.

You can view the full story here and thank you Garry West for the write-up.

9:25 am (AEDT):

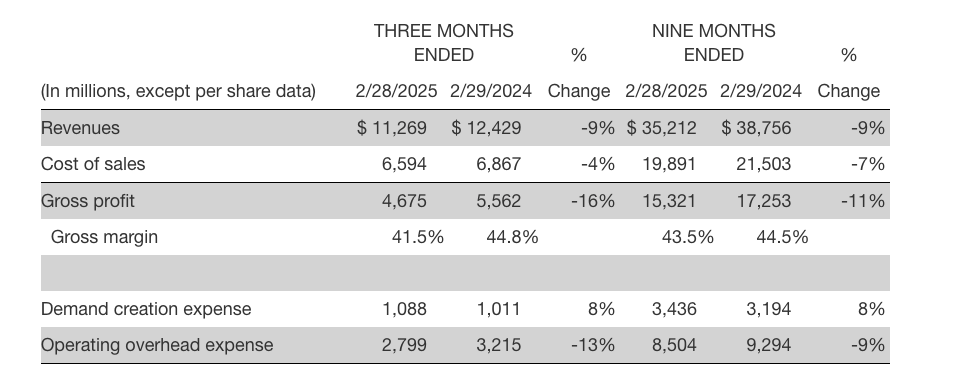

Global sportswear brand Nike Inc. (NYSE: NIKE) has reported a 32% slump in net income to US$794 million (A$1.26 billion) for the third quarter of the 2025 financial year.

Nike, the 61-year-old American company known around the world for its ‘swoosh’ logo, said revenue fell 9% to $11.269 billion in the three months ended 28 February 2025, less than the 11.5% drop forecast by analysts.

Diluted earnings per share slid 30% to 54 cents, which was a much better outcome than the 29 cents forecast by analysts. Nike said gross margin decreased 330 basis points to 41.5% as a result of higher discounts, an excess of outdated inventory and increased product costs.

President and CEO Elliott Hill said Nike’s progress against the 'Win Now' strategic priorities it committed to 90 days ago to drive growth and success reinforced his confidence the company was “on the right path.”

Nike (NYSE: NKE) shares closed $1.13 (1.55%) lower at $71.86, capitalising the company at $106.29 billion, before dropping further to $68.43 in after hours trading at the time of writing.

Garry West has the full story here.

9:40 am (AEDT):

Temu owner, PDD Holdings (NASDAQ: PDD) announced their total revenues for the quarter were RMB111,610.1 million, a 24% increase from RMB88,881.0 million in the same period last fiscal year.

According to the company, the increase was primarily due to the rise in revenues from online marketing services and transaction services, which experienced a 17% and 33% surge in revenue respectively.

“This quarter, we delivered stable financial results supported by the resolute execution of our high-quality development strategy,” said Ms. Jun Liu, VP of Finance of PDD Holdings.

“Looking ahead, we will continue to prioritise investments in the platform ecosystem as the cornerstone of our long-term value creation strategy.”

10:10 am (AEDT):

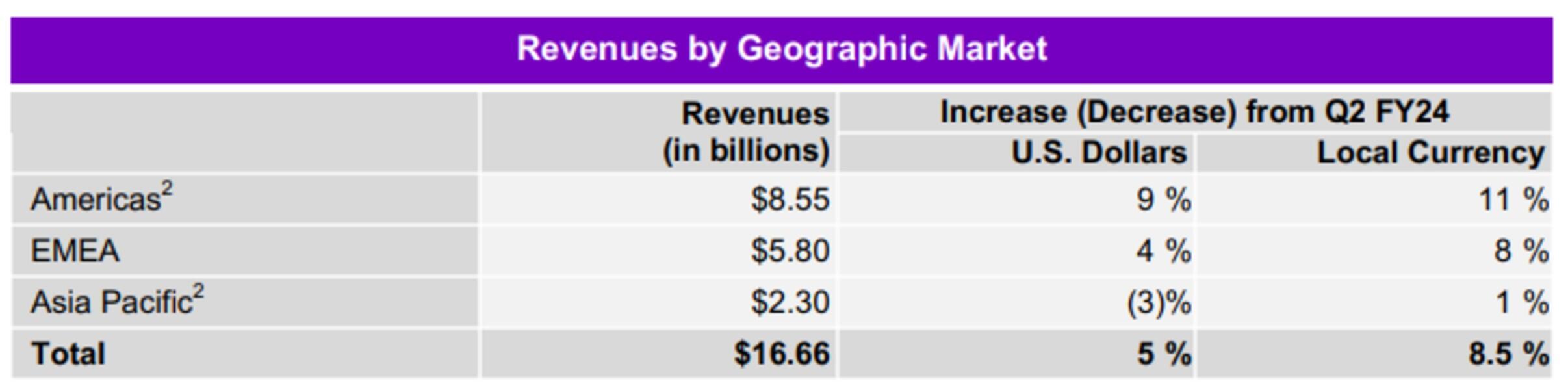

Information technology and management consulting company, Accenture (NYSE: ACN) reported strong earnings but has begun to slide in the share market.

Revenue for the company increased by 5% in U.S. currency from Q2 in fiscal year to US$16.7 billion in Q2 2025. Its EPS also grew to $2.82, a 7% rise from the same time last year.

“The trust and confidence in our unique strengths and capabilities is reflected in 32 clients with quarterly bookings greater than $100 million and we are very pleased to have another milestone quarter in Gen AI with $1.4 billion in new bookings,” Accenture Chair and CEO, Julie Sweet said.

“Our continued growth is made possible by the extraordinary work of our more than 800,000 people around the world who focus on delivering value to our clients every day.”

While Accenture reported positive earnings, the company’s shares fell 7.3%, becoming one of the first U.S. corporate giants to get hit by the Elon Musk’s Department of Government Efficiency.

“We are seeing an elevated level of what was already a significant uncertainty in the global economic and geopolitical environment, marking a shift from our first quarter FY 2025 earnings report in December,” Sweet said.

“At the same time, we believe the fundamentals of our industry remain strong.”

11:10 am (AEDT):

Moving away from the U.S. companies, owners of popular retail brands like Peter Alexander and Smiggle, Premier Investments (AXS: PMV) have reported a decline in profit.

This is in part due to the falling global sales of Smiggle, which dipped by 14.5% from 1H24 to A$157.3 million in 1H25.

Overall sales, excluding Peter Alexander UK, were down 1.8% to $455.0 million. The company did see some success in Peter Alexander's sales in 1H25, which were up 6.6% year-on-year to $297.7.

Premier’s Chairman, Solomon Lew said there have been some changes in the business during 1H25.

“Following the end of 1H25, Premier successfully completed the sale of the Apparel Brands to Myer which represents a significant development in the company’s history,” Lew said.

“Premier now ceases to own the Apparel Brands and no longer holds any interest in Myer shares.

“Looking ahead, Premier Retail is focused on the future growth opportunities of Peter Alexander and Smiggle with investment in new initiatives for these much-loved brands.”

That’s all from the big hitters on the market. Thanks for joining us.