Shares in neocloud specialist Nebius Group rocketed more than 60% in extended trading on Monday (Tuesday AEST), after inking an agreement with Microsoft worth up to a whopping US$19.4 billion (A$29.64 billion) over five years.

The Amsterdam-based computer infrastructure company announced a multi-year pact to deliver dedicated capacity to Microsoft from its new data centre in Vineland, New Jersey, starting later this year.

The deal is a game-changer for Nebius, which had already more than doubled this year on the back of the AI boom, closing on Monday with a market cap just north of $15 billion before the after-hours surge.

Alliances pay off

Nebius hasn't stumbled into this windfall by accident - it systematically built up its credentials through calculated partnerships.

Back in December last year, the tech hardware business secured $700 million from institutional heavyweights including Accel, NVIDIA, and accounts managed by Orbis Investments.

The company also maintains partnerships with Microsoft rival Meta Platforms, which taps NBIS technology to train its Llama large language model.

And earlier this year, DDN and Nebius announced a collaboration to deliver next-generation compute infrastructure, with DDN providing dual-stack solutions for high-performance data orchestration.

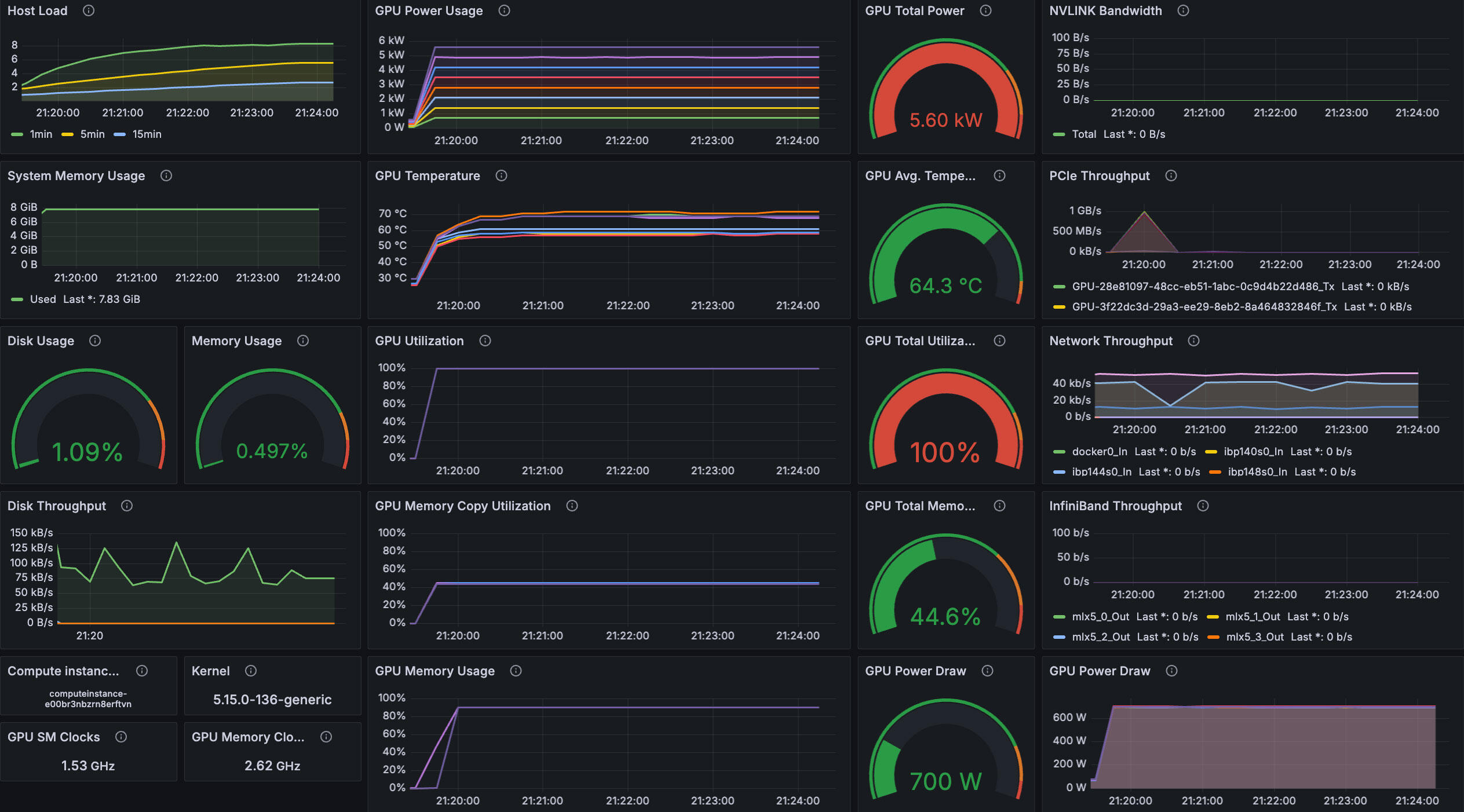

These moves have positioned Nebius as a ‘preferred cloud service’ provider in the NVIDIA Partner Network, offering tuned infrastructure for model training and inference.

Microsoft opens its warchest

Microsoft's deal with Nebius is a reflection of the broader industry supply bottlenecks that are reshaping the competitive landscape.

That's because compute workloads triggered cloud capacity constraints last year, sparking the ongoing data centre building boom.

The Bill Gates-founded tech giant responded by nearly doubling capex to $20 billion in Q1 this year.

Microsoft expects to send that figure up to $80 billion across the whole of FY25, yet demand is persistently outstripping capacity.

Microsoft CFO Amy Hood said the company is working with third-party data centres to satisfy its insatiable demand - explaining why bagging external partnerships with players like Nebius has become strategically critical.

"I am power-constrained, not chip-constrained," CEO Satya Nadella admitted recently.

That constraint creates opportunities for specialists like Nebius to fill the gaps.

Infrastructure arms race

The AI infrastructure market's fierce land grab continues - and analysts expect the industry to hit $87.60 billion in 2025, growing at a 17.71% CAGR to reach $197.64 billion by 2030.

Nebius is squaring off against the established Mag7 hyperscalers of AWS (31% market share), Azure (25%), and Google Cloud (11%).

But the real action is happening with emerging "neocloud" specialist small caps like CoreWeave, Paperspace, Lambda Labs and Vast AI.

Neoclouds offer GPU-backed services often at prices more competitive than hyperscalers - its dedicated GPU infrastructure model showing a substantial 66% in savings compared to equivalent traditional cloud providers.

Nebius CEO Arkady Volozh said the Microsoft deal is the first of many coming through the pipeline.

“In addition to our core business, we expect to secure significant long-term committed contracts with leading AI labs and big tech companies. I’m happy to announce the first of these contracts, and I believe there are more to come,” Volozh wrote.

"The economics of the deal are attractive in their own right, but, significantly, the deal will also help us to accelerate the growth of our AI cloud business even further in 2026 and beyond.”