Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals and energy supply chains - from production, refinement, mergers & acquisitions, to manufacturing and consumer products.

Following a one-month suspension of 25% on all goods imported into the United States from Canada and Mexico, President Donald Trump and his administration have moved forward with the executive order. This could cause significant damage to all three countries’ supply chains

After both Canada and Mexico pandered to Trump’s request to bolster their border defences against illegal drug trafficking and immigration - that one month is up, and the tariffs are going ahead.

The underlying aim of the levies stems from the 43rd President’s wish to reinvigorate domestic manufacturing and correct trade imbalances, which widened to US$98.4 billion in December 2024.

Domesticating supply chains

Trump says it’s time to radically change the way the U.S. does business, yet analysts fear they will likely result in higher prices on everything from food to electronics.

“Open trade has cost Americans millions of jobs. What they [Canada and Mexico] need to do is build their car plants, frankly, and other things in the U.S.,” Trump said.

Yet Kellogg finance professor Phillip Braun says the real reason that manufacturing is done all over the world, is that everyone produces what they have a comparative advantage to produce.

“And that lowers the cost across the board for everyone,” Kellogg said.

Yet Trump indirectly responded by reiterating his mantra on the tariffs during his address to to Congress yesterday:

“If you don’t make your product in America, however, under the Trump administration, you will pay a tariff and in some cases, a rather large one," the U.S. President said in a press conference.

“Other countries have used tariffs against us for decades and now it’s our turn to start using them against those other countries.”

Energy dependency

With North America’s decades-long economic integration, some industries - such as energy - are “likely to suffer disproportionately”, says think tank Cato Institute.

That’s because oil and gas trade in the U.S. is significantly interconnected with the Mexican and Canadian economies, particularly crude oil imports.

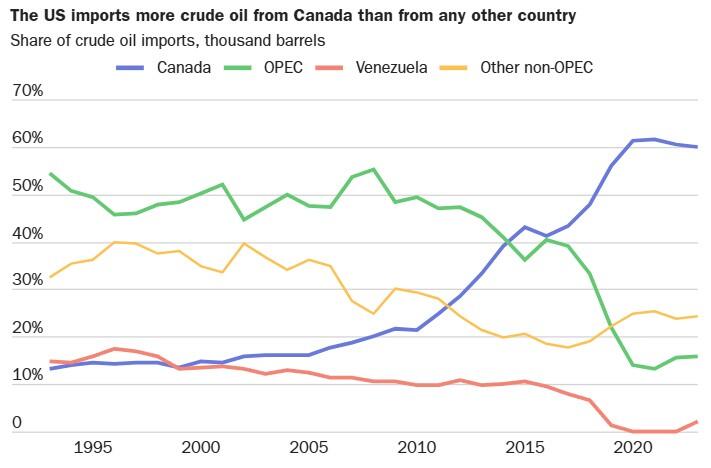

As Canadian oil production increased in recent years and geopolitical tensions rose elsewhere, US refiners turned to Canada for their heavy crude needs - with the latter replacing OPEC as America’s main source of imported crude with about 60% of the pie.

Offsetting that, since 2010, U.S. crude oil production has skyrocketed, with a boom in onshore shale oil extraction that mostly consists of lighter grades of crude oil.

However, that doesn’t address the full bill of the fact that ~70% of U.S. refinement is configured to run heavier grades of black gold.

Instead of spending billions of dollars to reconfigure their refineries to handle lighter crude oil, American refineries instead use imports to meet demand.

As for now, tariffs will discourage Canadian and Mexican exporters and the U.S. may face a time crunch to bring mining operations to sellf-suffice.