Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around critical minerals supply chains - from production, refinement, mergers & acquisitions, to manufacturing and consumer products.

Demand prospects for major critical minerals are looking uncertain this year, and while supply disruptions in copper and aluminium will be able to offer downside protection against price drops, lithium, cobalt and nickel are set to remain weighed down by an oversupply of batteries from China.

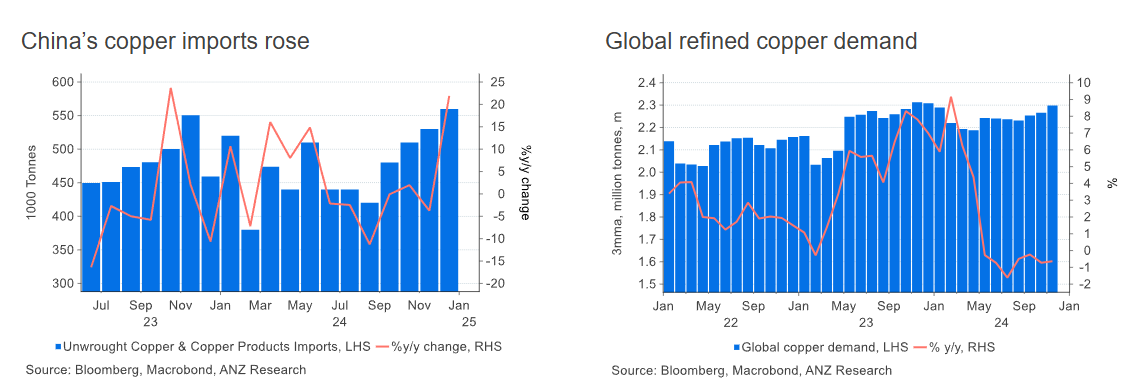

In the critical minerals scene, what happens in China sends ripples around the world. Copper prices are buoyant, and it just so happens that great investment in the country is estimated to rise this year - ergo, so are its copper imports, rising 20% YoY for December.

It makes sense then that refined copper out of China jumped to a record high of 1.2Mt in December, with annual production growth of 5% to 13.6Mt.

Feeding in to those smelters is rebounding South American copper production, increasing in both Peru and Chile 3% YoY to 8.3Mt for 2024.

China currently imports ~40% of Chile's copper and bought US$15.5 billion-worth of the red metal from Peru in 2023 - equal to 5.6% of the nation's GDP that year.

Copper imports into China picked up too, with a 20% rise YoY in December last year.

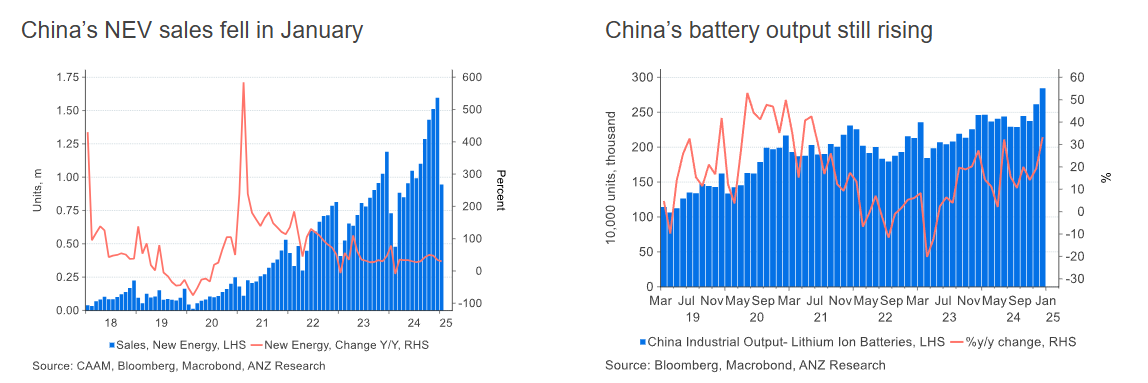

A data dump from the Middle Kingdom has shown that new energy vehicle (NEV) production fell below 1 million in January, yet its battery output - which is primarily linked to electric vehicle use - has kept on rising.

Growth stifled

ANZ Research said this week that while the energy transition and a recovery in economic growth in Europe would support metals demand, Trump’s proposed tariffs will limit demand growth.

“Aggressive import tariffs can weigh on capex growth as business confidence will remain subdued; [so] while credit growth in China remains depressed, deployment of additional stimulatory measures will be a wild card for metals demand,” ANZ said.

"Demand from green energy will also help to weather some of the economic growth headwinds.

“China’s recent stimulatory measures bode well for industrial metals. But the market will rely on economic data to reconfirm the positive impact.”

Perceived as a weak retaliation against Trump’s tariffs on its rival, China adding a further five critical minerals to its export control list (that stopped short of banning their outright sale) was more of a warning shot than anything.

The move has at a minimum increased China’s leverage in ongoing trade battles with the U.S. and leaves the door wide open for the tightening of measures if, or perhaps when, push comes to shove.

As demand prospects look uncertain, supply disruptions in copper and aluminium will be able to offer downside protection.

Hope for China's base metals

As signs of supply tightness emerge in base metals markets, the hope is China’s recent stimulus measures will spur the economic growth needed for demand for refined copper, aluminium and zinc.

China's prolonged stagnation has caused an increase in unplanned electricity supply outages further exacerbated by its incessant increased investment in its power-hungry refining sector.

That's also creating tightness in the ore concentrate markets and has caused treatment charges to fall in recent months.

A recent ANZ Commodity Insight expects the pursed-lipped raw material markets to have limited impact on refined metal supply in the short term.

“Inventories across the supply chain should mitigate the impact. However, this could change quickly if China’s recent stimulus measures have their desired effect on economic growth, boosting demand for refined metals such as copper, zinc and aluminium,” the financial institution said.

“In the meantime, it's likely to see Chinese demand for imports remain strong."

A difficult goal

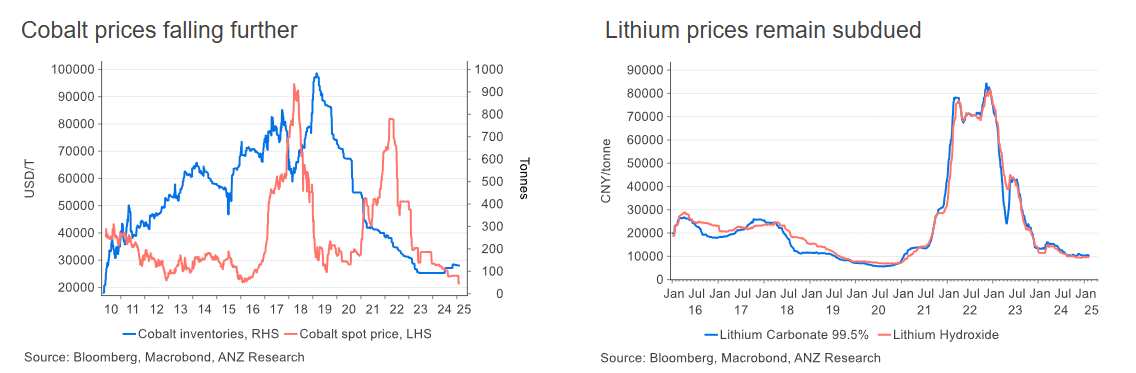

2023 was a bad year for realised prices of major critical minerals and they still haven't recovered.

Prices of lithium fell by 75% and nickel cobalt and graphite prices fell between 30-45% – a win for the consumer, as it helped drive battery prices down 14%.

With demand growth remaining robust, ANZ says the declines were mostly driven by a strong increase in global supply - helping to offset steep price rises in 2021 and 2022.

“As the demand prospects look uncertain, supply disruptions in copper and aluminium will be able to offer downside protection,” the bank said.

“Slowing growth in EV sales and an oversupply in China’s battery capacity are likely to weigh on demand for battery metals.

“Lithium, cobalt and nickel are likely to remain oversupplied in the short term, but the response from producers in cutting output amid the low prices should limit the downside.

“We see a strong long-term outlook. Supply still needs to increase by a factor of 1.5-3.5 over the next five years, which is a difficult goal.”