As the United States-China battle rages on, in the past 18 months alone, China has banned nine critical minerals pivotal to clean energy, Defence, tech changes and others.

The move is part of a rebooted trade war between the two superpowers that kicked off during U.S. President Donald Trump’s first term. So what's the latest?

As it faces an additional 10% tariff on its goods travelling into the United States, China has fired a warning shot with punitive measures on trade with America that include export restrictions on another five critical minerals:

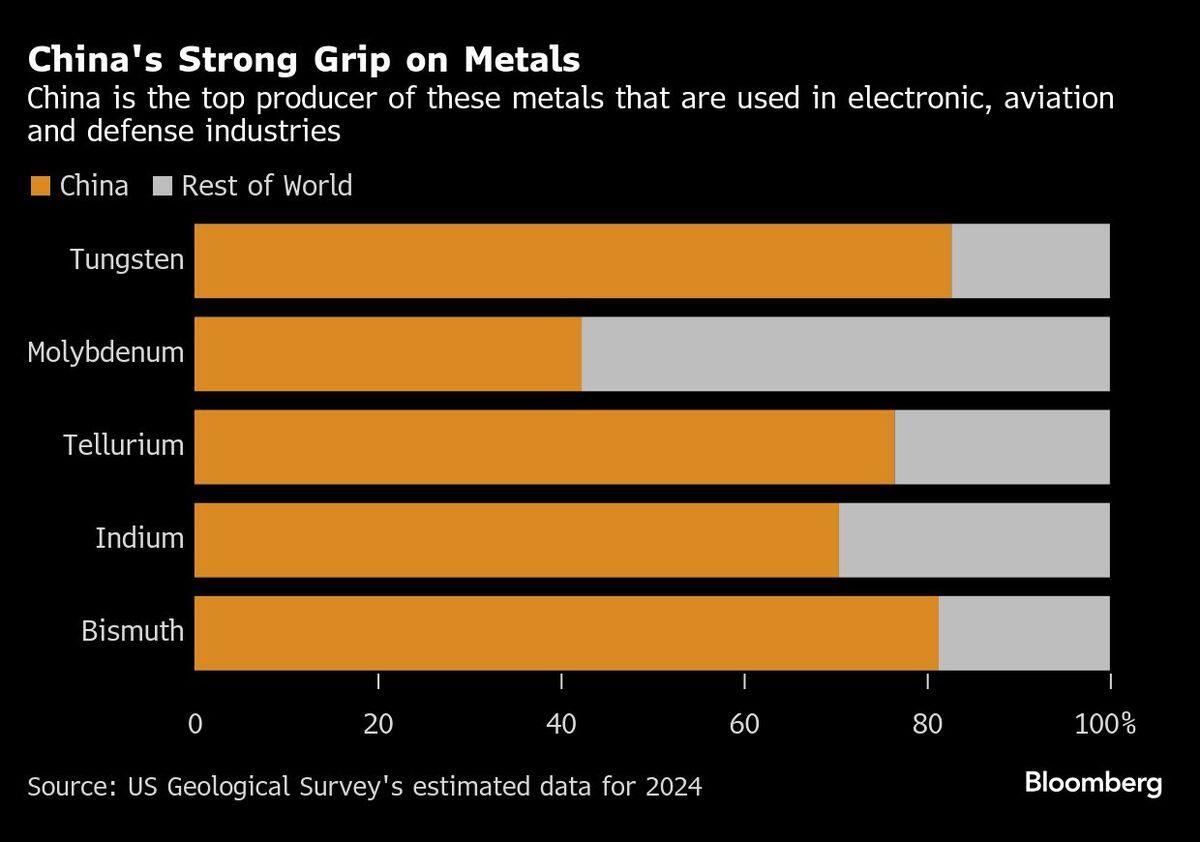

Molybdenum

Tungsten

Bismuth

Tellurium

Indium

It can flex this muscle as it holds a monopoly over an enormous percentage of the world's production and refinement of rare minerals. Why? Because they're rare and an expensive undertaking - producers often have to use high-polluting solvents to separate and extract the value from the orebodies that contain them.

It's also down to China's often lackadaisical approach to pollution from mining - yet granted, that's an issue it's sought to rectify since the turn of the millennium.

Yet a 2019 Harvard International Review report on China's mining practices tells a different story.

One of human rights abuses, pollution, cancer villages and 70,000 tonnes of radioactive thorium waste and cancer villages around its Bayan-Obo mine in Inner Mongolia - the largest rare earths mining operation in the world.

The snowballing trade war on minerals began when…

…Trump accused China of unfair trade practices and intellectual property theft in 2018, setting in motion the first lot of levy increases on Chinese products. Across the following two years.

For its part, China perceives America as trying to curb its global economic power rise.

Trump eventually made a deal with Xi Jinping's CCP and by August 2020:

- Total U.S. tariffs applied exclusively to Chinese goods: US$550 billion

- Total Chinese tariffs applied exclusively to US goods: US$185 billion

“From now on, we expect trading relationships to be fair and to be reciprocal,” said the two-term president in 2018.

Tariffs 2.0

Now back in power, President Trump has focused on implementing a further 25% tariff charge on goods coming into the U.S. from Mexico, Canada and again China.

These include the strategic metals tungsten, tellurium, bismuth, indium, and molybdenum - all crucial to major industries such as defence, tech and energy production.

China currently dominates the world’s supply chains for these metals.

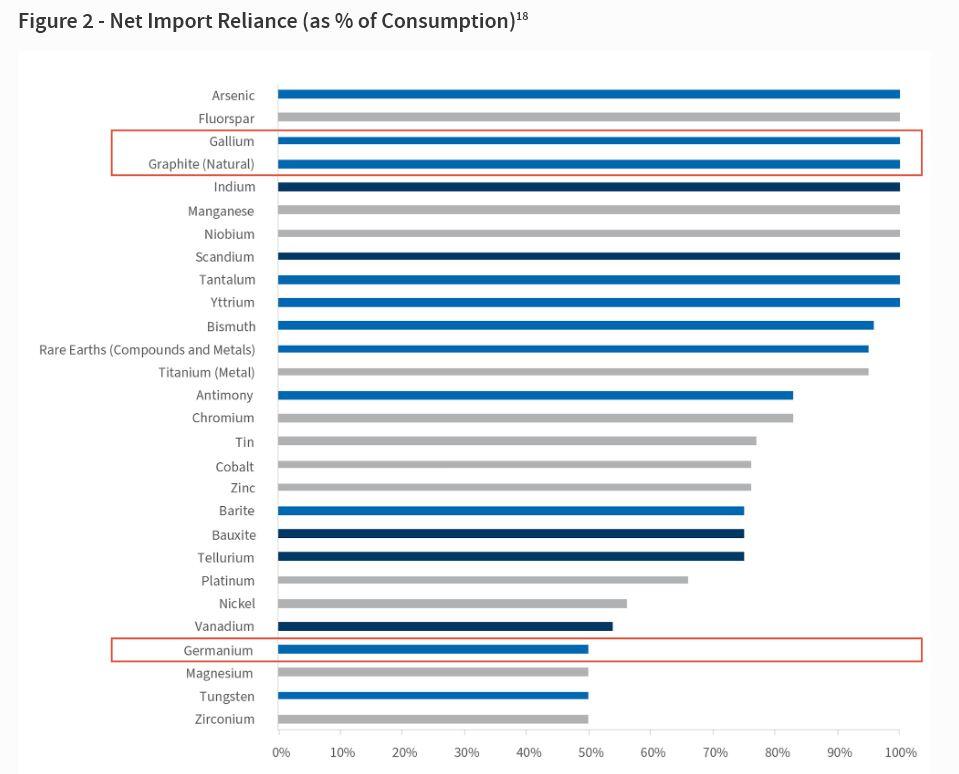

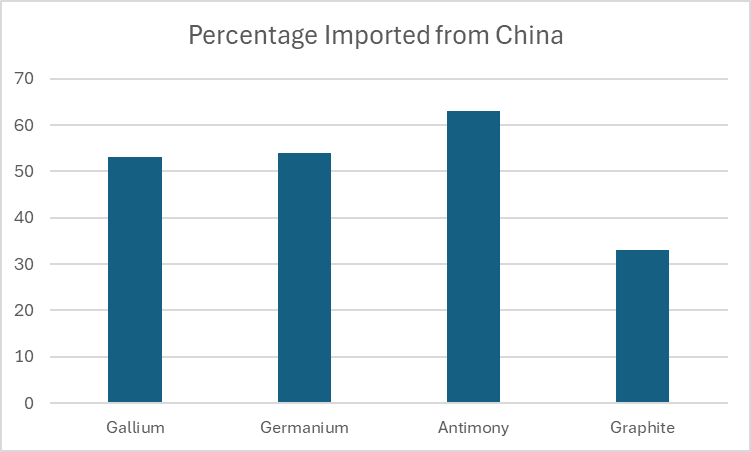

There are now nine critical minerals restricted for export by China in the past 18 months, including graphite, gallium, germanium and antimony, all of which the U.S. also imports in large quantities.

Production elsewhere?

Ex-China supply chains of tungsten, which is nearly as hard as diamonds, are not expected to see supplies drop significantly as both the United States and European Union slapped tariffs on Chinese imports of the metal last year because of the latter’s dumping practices.

That’s because Canadian miner Almonty is redeveloping operations at Sangdong in South Korea - the world’s largest tungsten deposit - which also has a large cache of molybdenum, a rare element used in steel alloys to increase strength, hardness, electrical conductivity and resistance to corrosion and wear.

The Almonty Korea Tungsten mine was none less than a powerhouse of the economy in the post-Korean War decades, contributing more than 50% of the country’s export revenue as one of the largest global tungsten producers.

Tellurium is found in copper deposits so it's not hard to find, though the refining capability is in China, as many other minerals are.; and while it's also a leading producer of indium Japan and South Korea may be able to pick up some slack.

Bismuth processing facilities would need to come back online too. Overall, these export restrictions have nowhere near the impact that the tightening of last year's four minerals. Oh, but who knows what China may do in reaction to President Trump's next moves?