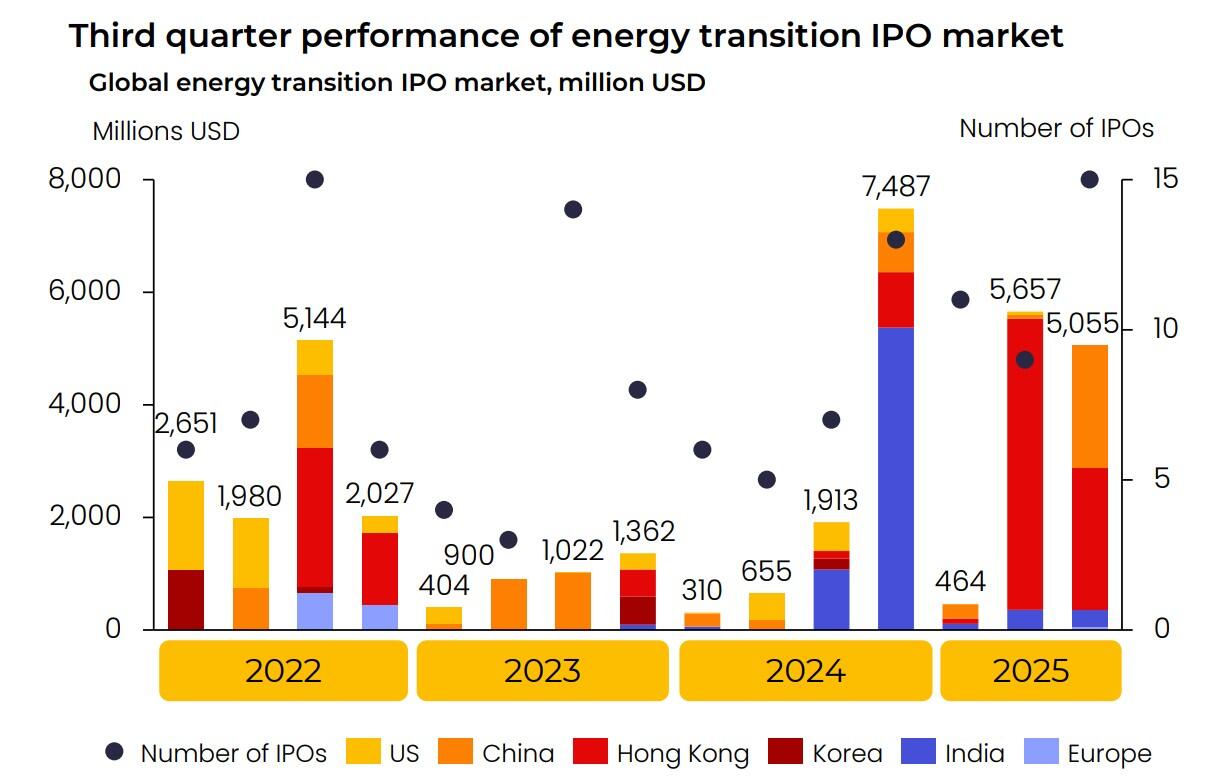

November was a month of a relocation from East to West for electrification capital markets, as China's pull as the beating heart of the world's energy transition continues to build momentum.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around the critical minerals supply chains - from markets, pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

According to the latest data from Benchmark Mineral Intelligence (BMI), Hong Kong has solidified its position as the key route for electric vehicle (EV), battery and critical mineral players looking to raise equity funds.

While North American markets remain treacherous for new entrants, the Hong Kong Stock Exchange (HKEX) saw a flurry of activity last month, hosting initial public offerings (IPO) for autonomous driving firms WeRide and Pony AI, alongside battery material heavyweight CNGR.

However, this IPO shift eastward is not without its turbulence, as BMI analysts note that an oversupply of new listings is beginning to weigh heavily on performance.

Of the major debuts in Hong Kong this month, only CNGR managed to post positive returns immediately post-IPO, while the autonomous driving segment struggled to get going.

Hong Kong pivot

The most significant trend in the November data is the geographic shift in equity capital, with the HKEX absorbing demand as U.S. markets prove difficult for Chinese-linked tech firms.

Three major players hit the Hong Kong bourse on November 6th - Pony AI, WeRide and Ningbo Joyson Electronic - but the reception was decidedly lukewarm.

Pony AI - which holds an existing NASDAQ listing and focuses on developing autonomous mobility solutions and raised US$863 million - had its shares close 9% down on the first day of trading.

Similarly, WeRide’s dual listing raised $308 million to support its operations across 30 cities in China, Europe and the Middle East, yet it saw its share price dip 10% upon debut.

The outlier in this tranche of listings was CNGR, a critical producer of precursor cathode active material (PCAM) for lithium-ion batteries with expanding operations in Indonesia and Morocco.

Listing on November 17th, the company raised $436.5 million and bucked the downward trend entirely, delivering a robust 35% gain by the close of its first day.

This divergence suggests that while investors are wary of the capital-intensive, revenue-distant autonomous driving sector, there is still significant appetite for the industrial backbone of the battery supply chain.

Debt and grants dominate funding in the West

Beyond the public markets, the private funding landscape remains active, though the mechanism of choice is shifting from venture equity to debt and government-backed grants in the West, incentivised by the Trump administration.

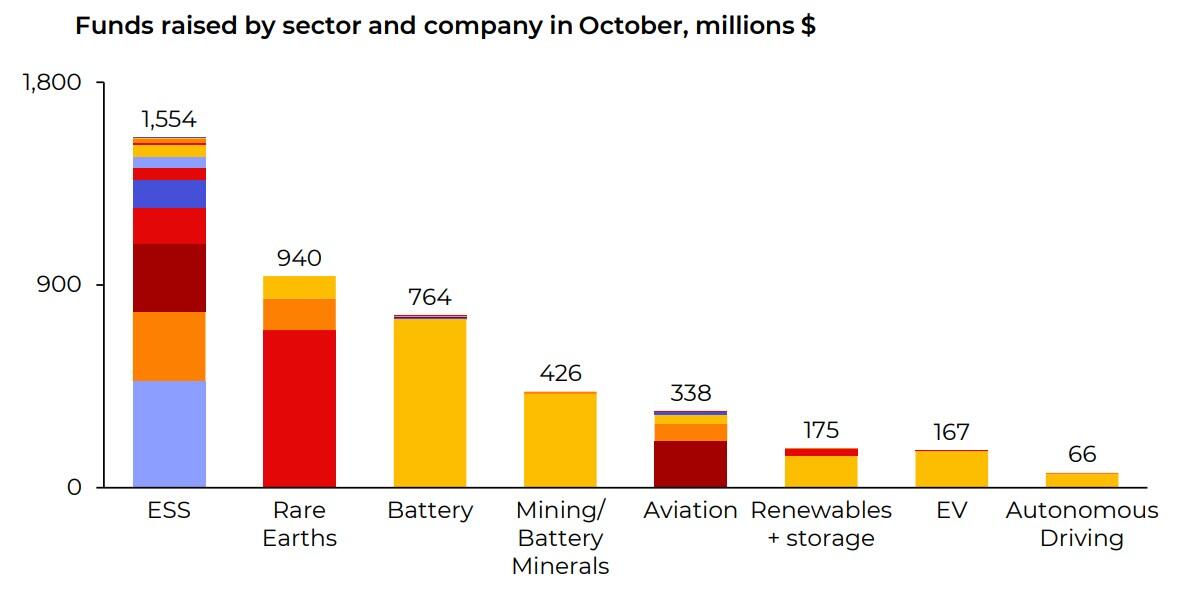

BMI tracked over $4.7 billion worth of funding across 57 deals in the energy transition space in October.

In the growing rare earths sector, U.S.-based Vulcan Elements secured $700 million in debt financing to advance its neodymium-iron-boron (NdFeB) magnet production facilities, a critical step in decoupling Western supply chains from Chinese dominance.

The EU continues to aggressively subsidise its own battery manufacturing base, with a consortium of five European cell developers - including 46inEU and AGATHE - securing a combined €643 million ($744 million) from the EU Innovation Fund, as the continent attempts to close the competitive gap with Asia.

In the energy storage sector, long-duration storage manufacturer Eos secured $474 million in debt financing to expand its zinc-based battery energy storage system (BESS) capacity in the U.S.

Over in the UK, developer Statera saddled $309 million in finance for a 1.36 GWh facility - one of the largest BESS financing deals in the UK.

Further supporting the European supply chain, the Cinovec lithium project received a $417 million government grant to accelerate development of what is expected to become one of Europe's largest lithium-mining and processing operations.

Consolidation and distress

Over to the East and CATL is ruthlessly consolidating its position through its substantial holding in Canmax - notably for those tracking the ASX, a 150,000tpa offtake agreement with Liontown Resources (ASX: LTR) for spodumene concentrate from the miner's Kathleen Valley operations.

It's the second time this year the Chinese battery giant has increased its holding in lithium suppliers, and Canmax shares have rocketed 71% over the month as the market rewarded the latest strategic alignment.

Conversely, the bottom end of the market is crumbling, with Geely subsidiary and carmaker Polestar receiving a delisting warning from the NASDAQ after its share price languished below a buck for consecutive weeks.

The situation is even more dire for Bollinger Motors - the U.S. EV truck maker is reportedly on the brink of bankruptcy, facing legal action from suppliers and allegations of unpaid wages.

Similarly, Canadian battery recycler Lithion Technologies filed for creditor protection after failing to secure the further funding necessary to continue operations.

And the post-IPO performance of recent listings such as AIRO Group Holdings perhaps precipitates a warning for American energy transition shareholders, too.

The drone and eVTOL developer listed on the tech-heavy NASDAQ in June, but by the end of last month, shares were trading 64% below their offering price.

To the markets

Despite the volatility, there were significant gains for specific equities in November - particularly in the mining and semiconductor sectors.

Budding sub-mariner miner The Metals Company was the standout performer, with its share price exploding by 511% year-to-date, aligning with a broader upstream recovery where copper and nickel prices have shown resilience.

It's all conjecture, though, as the company is in “pre-revenue” - meaning it hasn't made a single dollar off its promises yet.

Other notables include Huper Strong (Haibo Sichuang), an energy storage system (ESS) player that saw shares rise 375% YTD, driven by China's insatiable growth in the sector.

Bloom Energy also performed well, with the hydrogen systems manufacturer posting a massive 329% gain YTD.

Sigma Lithium shares rose 74% in November alone following positive Q3 results, offering some relief to the lithium sector.

Benchmark says the solar and charging infrastructure sector bottoming has continued unabated, with Sunation effectively dropping to zero with a -100% YTD change, while charging company Nu is down a heavy 94%.

Looking ahead though, the IPO pipeline remains buoyant, suggesting companies are still willing to brave the volatile conditions.

Swedish electric heavy-duty transport firm Einride, for instance, plans to list on the NASDAQ via a SPAC merger in 2026.

In Hong Kong, Deye Group, a Chinese battery storage integrator, and Avita Technologies - an EV joint venture between Changan, Huawei and Ningde Era - have both signalled intentions to list on the resurgent HKEX.