Well, the ink is barely dry on the federal government’s $12 billion cheque for the Henderson Defence Precinct, but the race for industrial dominance in Australia's West has effectively already been critically - and minerally, won.

Azzet’s Mission Critical is a weekly column that lays out the ebbs and flows around the critical minerals supply chains - from pricing, production, refinement and mergers & acquisitions, to manufacturing and consumer products.

As the eastern seaboard continues to navigate a landscape of sticky inflation and stagnating productivity, Western Australia has quietly decoupled from the national malaise.

Market data released this week confirms that the lithium price correction has bottomed out, with export volumes surging in November as Chinese refineries scramble to secure feedstock for 2026.

It's a resurgence in the minerals cycle - combined with the solidification of sovereign defence contracts - that's created a unique economic moat around the state.

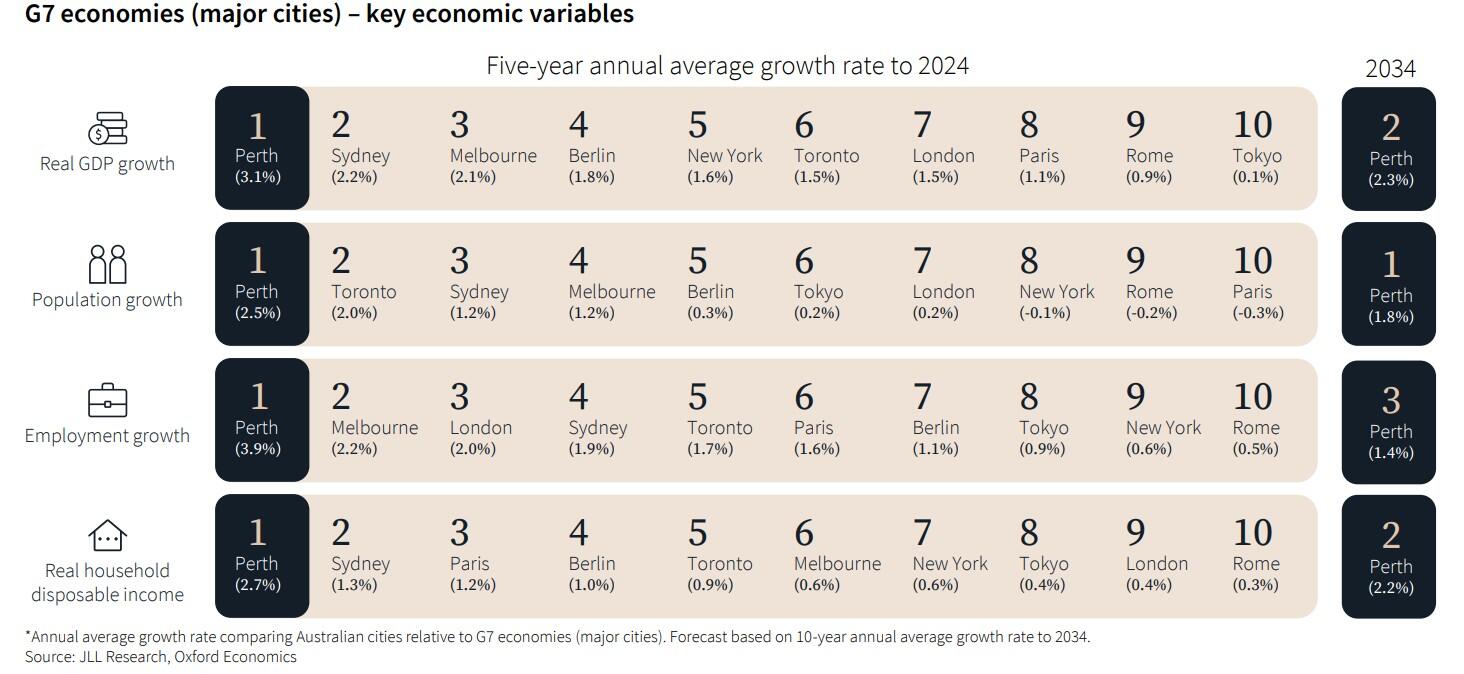

The narrative has shifted from the old cyclical resources playbook to structural growth, something that the rest of the country cannot replicate. And Perth, according to JLL, is the net winner on a global scale.

From quarry to chemical lab

The "dig and ship" model that has defined Western Australia’s prosperity for half a century is being dismantled in favour of onshore value addition.

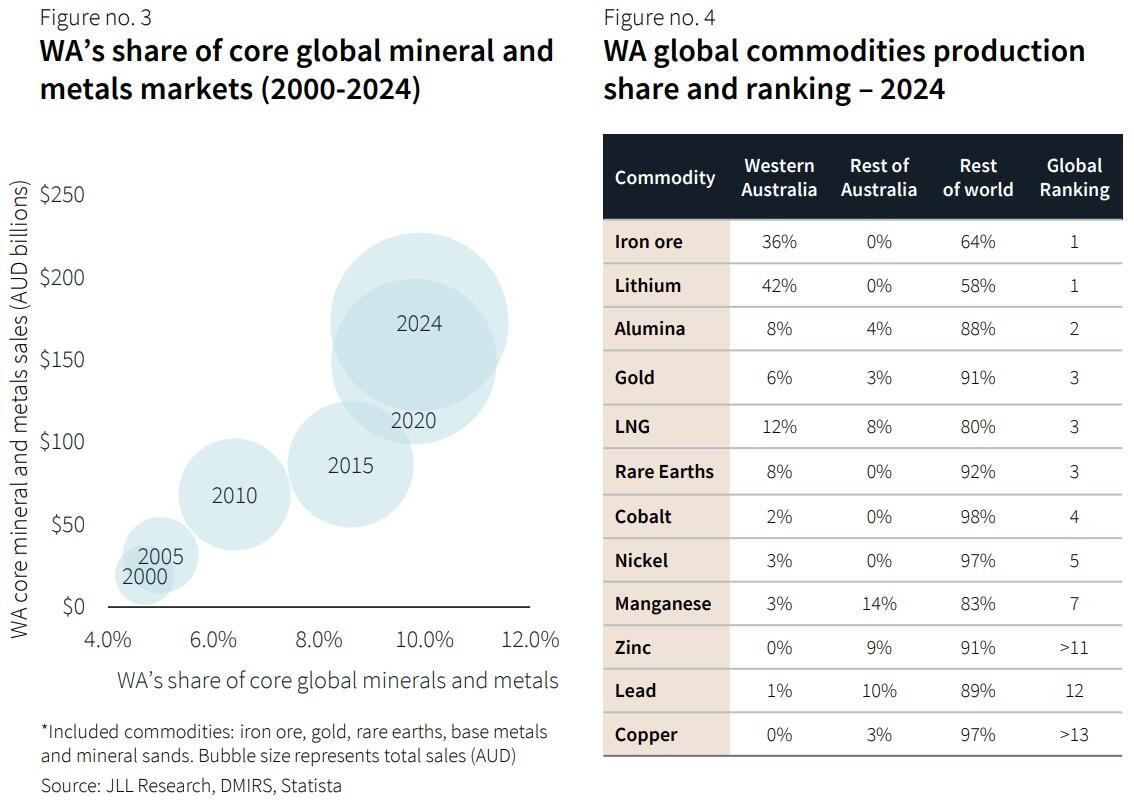

The state’s share of global critical minerals markets has doubled from 4.7% in 2000 to nearly 10% today.

Lithium sentiment shifted bullishly this week, with analysts projecting that a market deficit may emerge sooner than anticipated as global EV demand remains robust.

It's almost rubber-stamped the State Government’s aggressive capital deployment, including WA's Strategic Industries Fund, which aims to unlock industrial land for downstream processing.

Rather than exporting raw spodumene concentrate, WA is facilitating a transition to battery-grade chemicals, effectively capturing the margin previously gifted to offshore processors.

Feasibility studies are already underway for a common-user advanced processing facility designed to allow mid-tier miners to bypass the prohibitive capex of building standalone refineries - a boon for downstream mining ambitions.

With Australian ports loading significant volumes of lithium in November alone, the volume of raw materials available for future local downstreaming is immense.

In defense of defence

If critical minerals provide the ceiling for WA’s economic potential, the defence sector provides the floor.

Confirmation of $12 billion in funding for the Henderson precinct in late 2025 has removed the speculative risk from the state’s naval ambitions.

The capex looks to support the construction of surface vessels and the maintenance of nuclear-powered submarines, creating an ecosystem that is basically immune to commodity price volatility.

An eye-whopping 10,000 jobs are now linked to the precinct over the next two decades.

Unlike the transient workforce associated with remote mining projects, these roles are metro-based and permanent, driving sustained demand for local housing and services.

JLL Research forecasts that the defence sector’s industrial footprint in Perth will more than double by 2034, rising from 7% to 15% of total occupied space.

Real estate

The convergence of these two growth engines has triggered a severe dislocation in the commercial property market.

Perth has recorded the lowest industrial vacancy rate in the country, with availability plummeting to 2.0% in late 2025. Tenants, meanwhile, are facing a landlord’s market of unprecedented tightness.

Prime industrial rents have faced upward pressure as logistics operators, manufacturers, and mining services firms compete for dwindling stock.

The supply pipeline remains constrained by high construction costs and a shortage of serviced land, meaning this imbalance is structural rather than temporary.

The office market is witnessing a similar flight to quality. While headline vacancy remains elevated, a "blue-chip pull" has seen the net effective rental spread between prime and secondary assets blow out to 90%.

With no new office completions expected in the CBD until at least 2030, the window for tenants to secure premium space is closing rapidly.

Investment?

JLL reckons WA has successfully diversified its economic base while the rest of the world wasn’t looking.

The state, by merit or by credit, has insulated itself from global shocks through a dual strategy of critical minerals leadership and sovereign defence capability.

For capital allocators, could the yield arbitrage offered by WA assets - coupled with a growth profile that outpaces the OECD average - represent a mispriced opportunity?

As the East Coast struggles to find its footing in a high-rate environment, the West is simply reloading - as any West Coast Eagles fan would agree.