Intel Corp has reported an 81% increase in losses for the second quarter of the 2025 financial year (Q2 FY25) as a restructuring and impairments took their toll.

The United States-based semi-conductor manufacturer said the net loss widened to US$2.9 billion (A$4.4 billion) in Q2 from $1.6 billion in the previous corresponding period (pcp).

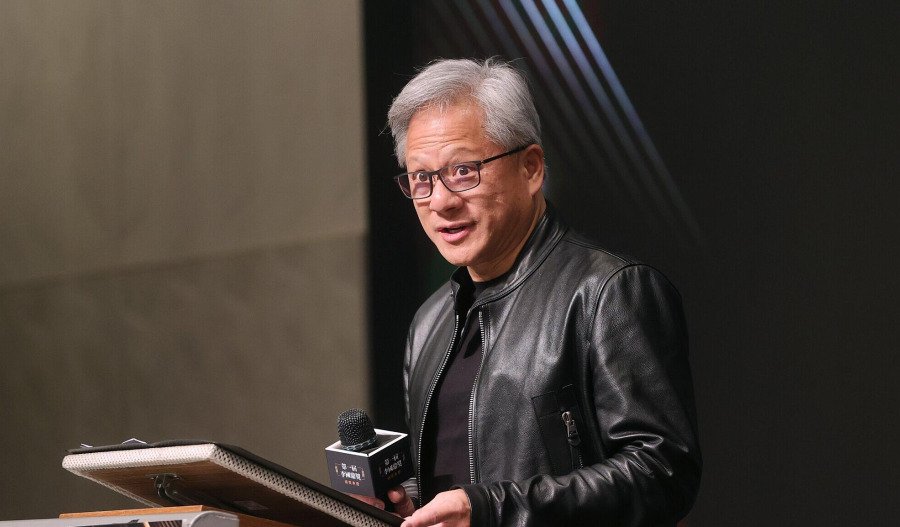

Intel also said it was laying off 15% of its 96,400 employees in a cost-cutting drive by new CEO Lip Bu Tan, who in March took charge of the company, which is best known for its Intel Core series of central processing units used in desktop and laptop computers.

Intel said diluted losses per share increased 76% to 67 cents as revenue was flat at $12.9 billion.

The loss included $1.9 billion of restructuring charges, $800 million of non-cash impairment and accelerated depreciation charges related to “excess tools with no identified re-use” and $200 million of one-time period costs.

Intel said it was forecasting a loss per share of 24 cents and revenue of between $12.6 billion and $13.6 billion in the third quarter.

It was also taking action to improve execution and efficiency, aiming for $17 billion (using non-standardised account principles) of operating expenses in 2025 and $16 billion in 2026 and $18 billion in gross capital expenditures for 2025.

“Our operating performance demonstrates the initial progress we are making to improve our execution and drive greater efficiency,” Tan said in a press release.

He said Intel was focused on strengthening its core product portfolio and artificial intelligence (AI) ‘roadmap’ to better serve customers and taking actions needed to build a more financially disciplined chip-making process.

“It’s going to take time, but we see clear opportunities to enhance our competitive position, improve our profitability and create long-term shareholder value,” Tan said.

Although Q2 revenue was higher than analysts expected, the company’s forecast Q3 losses were also above estimates.

Intel shares (NASDAQ: INTC) closed 86 cents (3.66%) lower at $22.63 capitalising the company at $98.71 billion, before falling another 73 cents to $21.90 in after-hours trading.

Shares in the company, which was founded in 1968, have fallen by 65% over the last four years as it made strategic mistakes, including failing to leverage the AI boom, which allowed competitors like Nvidia to win market share.