Caught in the middle of a United States-China trade war, the world’s largest chipmaker Nvidia still posted a beat on lowered Q1 analyst expectations, with earnings per share (EPS) of US$0.81.

That's compared with the $0.73 that was expected. Without the geopolitical blowback, the company would have landed at $0.96, instead of the posted $0.81 and a gross margin of 71.3%.

Other financial beats include:

Revenue: $44.1 billion, up 69% from a year ago ($43.3 billion expected)

Adjusted EPS: 81 cents, up 33% from a year ago (73 cents expected)

Its impairment also came in under expectations. On April 9, the Trump administration informed Nvidia that it would need a license to sell its H20 chips to China as part of its tariff agenda.

Almost overnight, demand for the H20 evaporated and Nvidia said it would be left with a $5.5 billion write-down on unsold inventory. Saving a cool $1 billion, earnings showed that figure came in at just $4.5 billion.

Its Blackwell AI hardware is tipped to drive AI infrastructure among the tech industry and will be implemented for Google's Distributed Cloud and the Gemeni and Gemma models.

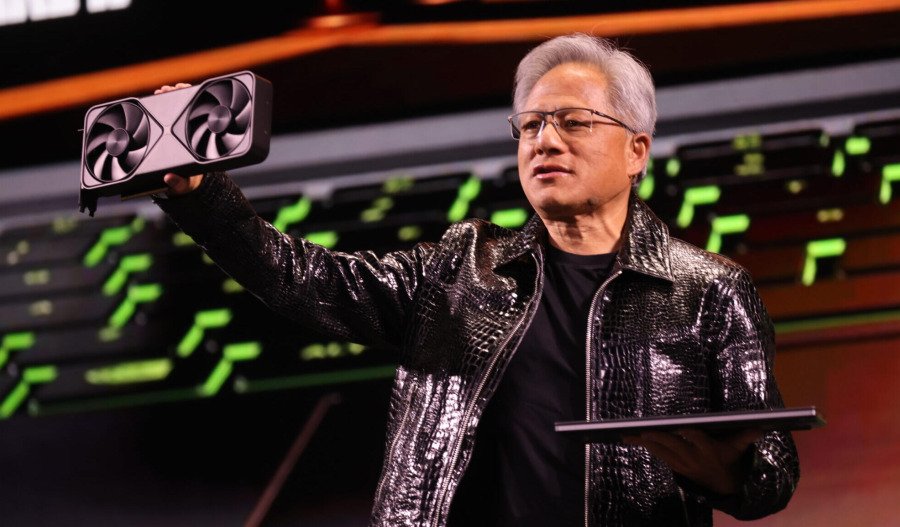

“Our breakthrough Blackwell NVL72 AI supercomputer — a ‘thinking machine’ designed for reasoning — is now in full-scale production across system makers and cloud service providers,” Nvidia CEO Jensen Huang said.

“Global demand for Nvidia’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate."

Sector by sector

Data Centre revenue grew by 73% year-over-year, reaching $39.1 billion.

“The strong year-on-year and sequential growth was driven by demand for our accelerated computing platform used for large language models, recommendation engines, and generative and agentic AI applications," according to CFO Colette Kress.

The company has also ramped up production on its Blackwell chip architecture in a bid to expand into all consumer categories, Kress said.

While H20 chips have been restricted in China, Nvidia reportedly will launch a new AI chipset for the Chinese market based on its Blackwell processors.

Last quarter, the company said it would build factories in the U.S., as well as AI factories in Saudi Arabia in partnership with Humain and in Taiwan alongside Foxconn. Rival Qualcomm also expanded into the Gulf last quarter, revealing plans to open an engineering centre in Abu Dhabi.

The tech behemoth's gaming and AI PC revenue reached new highs of $3.8 billion for the quarter, up 42% from one year ago. The upcoming Nintendo Switch 2 console, due in June, will include Nvidia processors.

Its Professional Visualisation revenue rose by 19% year-over-year, while its Automotive revenue grew by 72%.

Nvidia said in March that it would partner with General Motors to build AI systems for both General Motors’ factories and driver assistance abilities. Intel, meanwhile, showcased its second-generation system-on-chip architecture for vehicles in Shanghai last month.

Its guidance for the next quarter projects revenue of $45 billion, plus or minus 2%. This was 1.6% below consensus estimates, with the company saying it expects a loss of around $8 billion due to U.S. restrictions on sales of its H20 chips in China.

“Despite these near-term headwinds we maintain Buy on NVDA, a top sector pick given its unique leverage to the global AI deployment cycle, and possibility for China sales recovery on new redesigned/compliant products later in the year,” said Bank of America analyst Vivek Arya ahead of the earnings release.

AI expectations

In Silicon Valley’s race to shape the architecture of AI, Nvidia's Huang said there were three positive surprises unfolding in the AI boom:

On reasoning AI

“I think it is fairly clear now that AI is going through an exponential growth and reasoning AI really busted through concerns about hallucination, or its ability to really solve problems,” Huang said.

“I think a lot of people are crossing that barrier and realising how incredibly effective generative AI is and reasoning AI is.”

On AI diffusion

“It's really terrific to see that the AI diffusion rule was rescinded. President Trump wants America to win and and he also realises that that we're not the only country in the race,” Huang said.

"Countries around the world are aware of the importance of AI as an infrastructure - not just as a technology of great curiosity and great importance, but infrastructure for their industries and startups and society.

“Just as they had to build out infrastructure for electricity and internet, you've got to build out an infrastructure for AI.”

On Enterprise:

“AI agents work [and] are really quite successful — much more than generative. AI, agentically, is game changing,” Huang said.

"You know, agents can understand ambiguous and rather implicit instructions, and are able to problem solve and use tools and have memory and so on, and so I think enterprise AI is ready to take off.

"It's taken us a few years to build a computing system that is able to integrate one and this is the RTX Pro Enterprise server that we announced at Computex just last week.

“But remember, enterprise is really three pillars: compute, storage and networking — and we've now put all three of them together.”

Nvidia's (NASDAQ: NVDA) share price closed at US$134.81, but jumped by 4.93% in after-hours trading following the earnings release. Its market capitalisation is $3.29 trillion.

Related content