Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Reddit shares topple

- CVS reports first full quarter with new CEO

- Northern Star and Applovin shatter records

- Markets round up

_______________________________________________________________________________________

8:40 am (AEDT):

Morning all, Frankie Reid here to kick off the blog for Thursday!

Insurance Australia Group (ASX: IAG) released their latest earnings report this morning, announcing a huge 91% leap in net profit to A$778 million for the first half of this financial year (1H25).

The Australian general insurer, whose brands include NRMA Insurance, CGU Insurance and RACV Insurance, said the increase in profit was driven mainly by the $140 million post-tax release of the COVID Business Interruption provision.

Directors also declared a fully-franked interim dividend of 12 cents per share (franked to 7.2 cents), up from 10 cents in 1H24.

“Today’s result reflects the quality of our business as we continue to see consistent, reliable performance across our portfolios and steady progress against our strategic priorities,” Managing Director and CEO Nick Hawkins said.

8:55 am (AEDT):

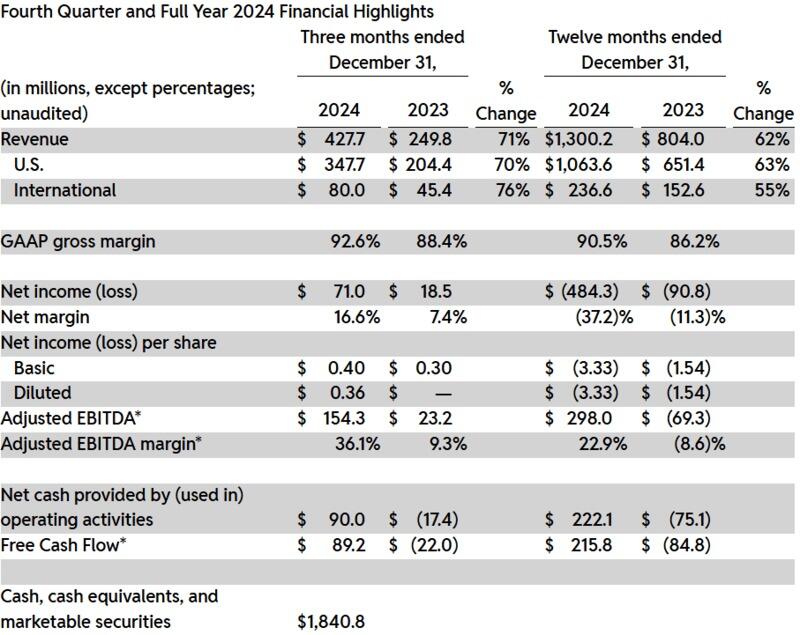

Reddit also released bright and early this morning, with their shares taking a tumble despite Q4 revenue and earnings per share looking good.

This was due to weaker-than-expected user numbers, with CEO Steve Huffman saying this “volatility” was caused by a change in the Google search algorithm, but that it “wasn't unusual”.

Despite this, EPS came out at 36 cents, against the 25 cents predicted, and Q4 revenue grew 71% year-over-year to $427.7 million, instead of the $405 million predicted,

9:10 am (AEDT):

Heading over stateside to CVS Health Corporation (NYSE: CVS) and its fourth quarter report which saw profit beating out predictions and an adjusted full year guidance.

EPS guidance range was adjusted from $5.75 to $6.00 and diluted EPS guidance range of $4.58 to $4.83 but no FY25 revenue guidance was given.

This was the first full quarter with David Joyner as CEO, who succeeded Karen Lynch in October last year, as part of a larger reshuffle to help the then struggling pharmacy chain.

This strong Q4 saw CVS shares close at 15% higher on Wednesday local time.

9:25 am (AEDT):

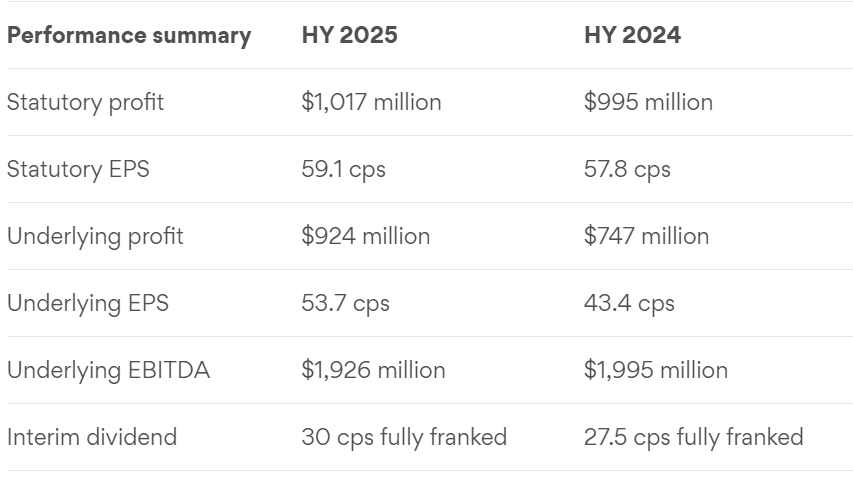

Bringing it back home to Origin Energy (ASX: ORG) released its report for the half year ending 31 December.

The energy retailer delivered a 2% increase in statutory net profit to A$1.017 billion for the first half of FY25, up from $995 million the same time the year before.

Underlying earnings before interest and taxes (EBITDA) fell 3% on revenue which rose 10% to the tune of $8.771 billion in the six months to 31 December 2024.

The Board determined a fully franked interim dividend of 30 cents per share and the company reported receiving fully franked dividends from Australia Pacific LNG of $612 million for this earnings period.

9:45 am (AEDT):

Now travelling all the way over to Euronext Paris with EssilorLuxottica (EL) and its Q4 and full year earnings report.

The eyewear company, which is home to brands including Ray-Ban, Oakley, Persol, Oliver Peoples, Vogue Eyewear, Oliver Peoples, announced an adjusted operating profit that rose 9.4% last year, to 4.4 billion euros.

The total revenues for the year finished at 26.5 billion euros, coming in just above expectations from analysts of 26.4 billion.

Francesco Milleri, Chairman and CEO, and Paul du Saillant, Deputy CEO said the company was celebrating “another year of remarkable achievements” and looking towards an “era of unprecedented opportunities” in 2025.

10:05 am (AEDT):

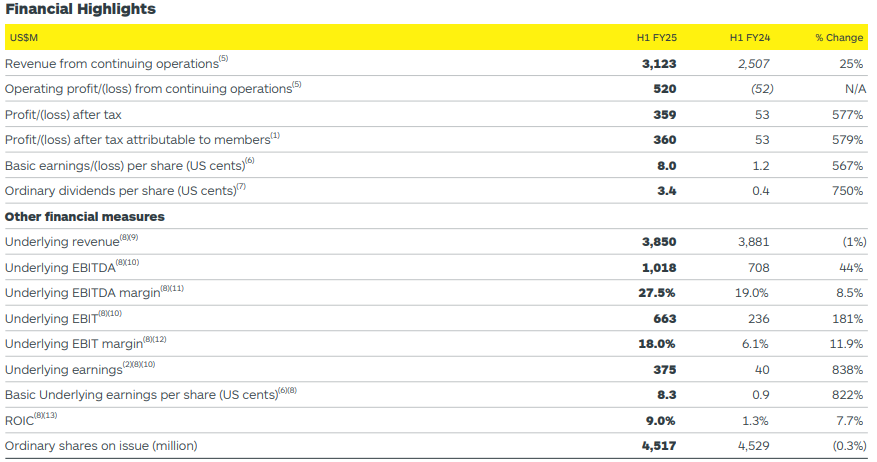

Back home again with South32 (ASX: S32), who reported a 25% increase in revenue, reaching US$3.12 billion.

Profit after tax attributable to members also soared to US$360 million, or 579%.

Kerr also reflected on South32's sale of Illawarra Metallurgical Coal during the same quarter, saying the move had “unlocked significant value and streamlined our portfolio to be focused on minerals and metals”.

10:35 am (AEDT):

Sticking with the ASX, Northern Star (NST) announced record earnings in its half yearly earnings report, following higher gold prices and sales in the first half of FY25.

The gold miner delivered cash earnings of $1,146 million, up 63% on the previous period, net cash of $265 million and revenue of $2,869 million, an increase of 28%.

Northern Star Managing Director Stuart Tonkin said that this "interim result again demonstrates the strength and value-creation that we are embedding in our business".

10:50 am (AEDT):

Another record breaker was Brookfield Asset Management (NYSE: BAM), with a 17% growth in earnings year-on-year to $677 million.

It's Q4 FY24 also saw $29 billion in organic fundraising, helped along by weighty contributions from renewable power, infrastructure, private equity and real estate sectors.

The company also announced a 15% increase in quarterly dividend, to $0.4375 per share, which will be payable March 31, 2025.

11:10 am (AEDT):

S&P 500 futures gained modestly on Wednesday night (Thursday AEDT).

By 10:28 am today local time (11:28 pm GMT) Dow Jones Industrial Average futures and S&P 500 futures lifted 0.1% respectively, while Nasdaq 100 futures gained 0.2%.

An hour later at 11:30 am (10:40 pm GMT) the S&P/ASX 200 March share price index (SPI) contract was trading 0.30% higher than the previous settlement at 8,561.20.

11:40 am (AEDT):

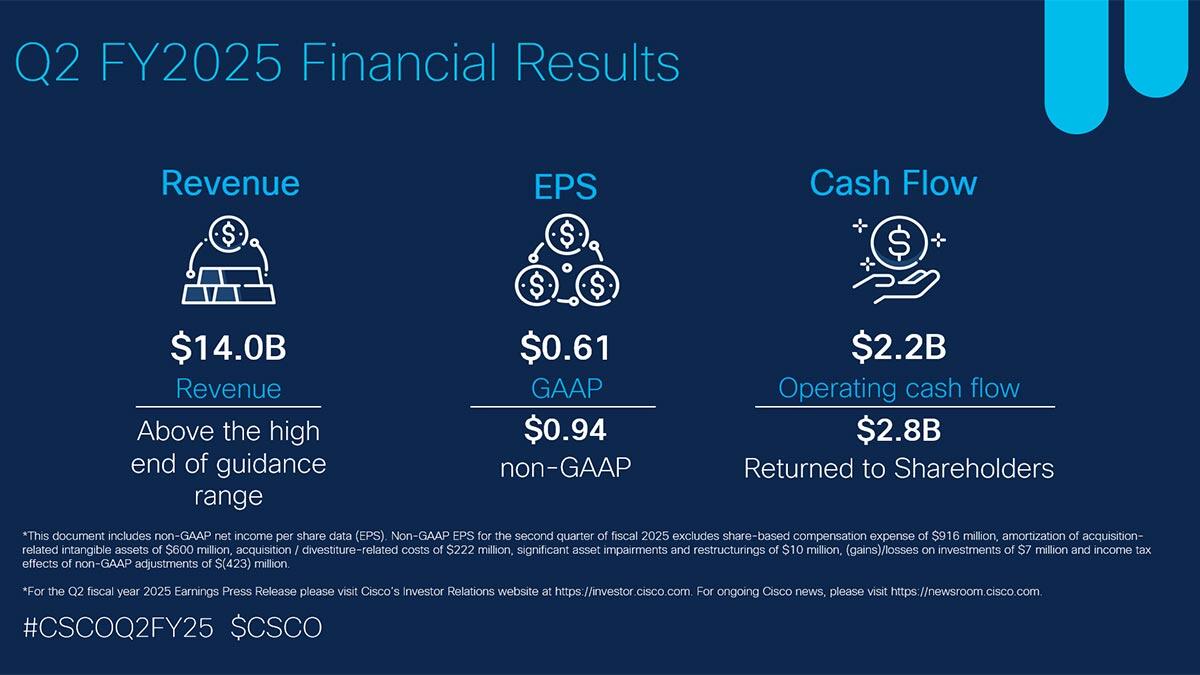

Cisco Systems (NASDAQ: CSCO) reported growth with their earnings for this quarter, and increased its full year guidance beyond analysts expectations.

Revenue reached $14.0 billion against the $13.87 billion expected, an increase of 9% year over year, and AI Infrastructure orders rose to more than $350 million.

Earnings came in at $0.94 per share, beating market expectations of $0.91 per share.

This saw shares increase by approximately 6% during extended deals on Wednesday, with CEO Chuck Robbins saying "Cisco's strong quarterly results were driven by accelerating customer demand for our technology."

“As AI becomes more pervasive, we are well positioned to help our customers scale their network infrastructure, increase their data capacity requirements, and adopt best-in-class AI security.”

12:00 pm (AEDT):

Sticking with NASDAQ, tech company AppLovin (APP) was yet another company breaking records, reporting a strong Q4 and full FY24.

Total revenue soared up 44% year on year to $1.37 billion in Q4 and $4.71 billion, or 43%, for the full year.

Advertising revenue for the quarter jumped 73% to $999.5 million.

Additionally, net income surged by 248% to the tune of $599.2 million in Q4 and 343% to $1.58 billion for the full year.

12:20 pm (AEDT):

Another strong performance came from Robinhood Markets (NASDAQ: HOOD), as the company saw its Q4 net deposits grow to a record $16 billion.

Revenues also shot up to 115% year-over-year, a record $1.01 billion.

Diluted EPS broke another record at $1.01, as did Gold subscribers which were up 86% year-over-year to 2.6 million.

“We see a huge opportunity ahead of us as we work toward enabling anyone, anywhere, to buy, sell, or hold any financial asset and conduct any financial transaction through Robinhood,” said Vlad Tenev, CEO and Co-Founder.

12:45 pm (AEDT):

Robust results continued on the NASDAQ with CME Group (CME).

The financial services company reported a record breaking revenue of $6.1 billion for full-year 2024, up 10%.

The company's contract volume saw a 14% increase, indicating a boost in international business.

Diluted EPS was $2.52, outpacing the forecast of $2.48 and revenue for the quarter matched expectations at $1.5 billion.

Terry Duffy, President and CEO, said “2024 was the best year in CME Group's history”.

1:00 pm (AEDT):

The Trade Desk (NASDAQ: TTD) plummeted 27.3% after weaker-than-expected fourth-quarter revenue and issued cautious guidance.

The advertising technology firm also announced an additional share repurchase authorisation, with the total amount of authorised future repurchases sitting at $1 billion of Class A common stock.

Jeff Green, founder and CEO, said the results were “disappointing” and it “fell short of our own expectations in the fourth quarter.”

1:15 pm (AEDT):

Good afternoon, it’s Chloe Jaenicke here to take you through the rest of the day.

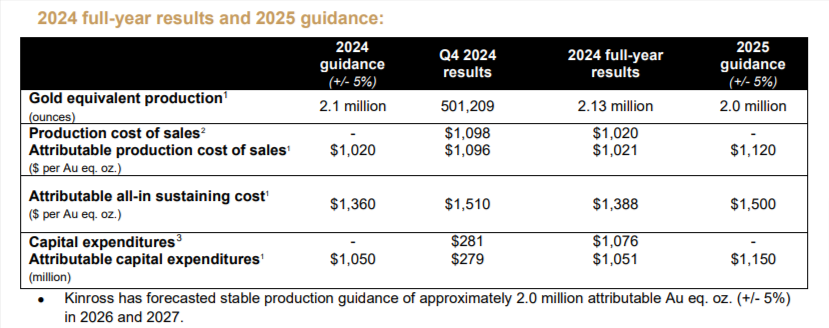

Kinross (NYSE: KGC) has announced its 2024 Q4 and 2024 earnings, with reported net earnings of US$275.6 million and $0.22 per share for Q4 and $948.8 million or $0.77 per share for the year.

CEO Paul Rollinson said 2024 marked an “excellent” year for Kinross where they met their production and cost guidance.

“We delivered record free cash flow of $1.3 billion, which more than doubled year-over-year, repaid $800 million of debt, and grew our margins by 37%, significantly outpacing the rise in gold price,” Rollinson said.

1:29 pm (AEDT):

Total revenues grew 34.9% to US$342.8 million for Dutch Bros Inc. (NYSE: BROS) in Q4 of 2024.

This marks a large jump from the same period in 2023 where they reported revenue of $254.1 million.

For the full year, the company grew 32.6% in revenue to $1.28 billion compared to $965.8 million in 2023.

CEO and President of Dutch Bros, Christine Barone said the company’s growth is attributable to its innovation, paid media and Dutch Reward loyalty programs.

“We believe our brand is resonating with customers, as we delivered 2.3% system same shop transaction growth, the largest year-over-year increase in over two years,” Barone said.

“We believe these efforts are contributing to current momentum and that there is considerable runway for further growth.”

Total revenues for 2025 are estimated to be between $1.555 billion and $1.575 billion.

1:44 pm (AEDT):

MGM Resorts (NYSE: MGM) reported its best full-year consolidated revenues in the history of the company of US$17.2 billion, jumping 7%. This is primarily due to an increase in revenue at MGM China thanks to the recovery of operations after the removal of COVID-19 restrictions.

According to MGM Resorts CEO and president, Bill Hornbuckle, all aspects of the business have been running strongly.

“Our digital businesses are also on a positive trajectory, with our BetMGM venture in North America expected to be profitable this year and our global MGM Digital business integrating and scaling to address its significant $41 billion market opportunity,” Hornbuckle said.

Chief financial officer and treasurer, Jonathan Halkyard said investments are being made into the company’s future.

"We continue to see significant value in our stock at current levels, and as such we repurchased 3 million shares in the quarter, bringing our total for 2024 to 33 million shares repurchased at $1.4 billion,” Halkyard said.

For the fourth quarter of 2024, MGM Resorts reported net revenues of $4.3 billion, a 1% decrease from the prior year quarter.

2:06 pm (AEDT):

Heineken (AMS: HEIA) shares are on track for their best since 1989.

Heineken's shares surged 12% and are expected to continue growing as the business announced a 1.5 billion euro share buyback.

The company also reported revenue of 35,955 million euros with the chairman of the executive board and CEO, Dolf van den Brink saying they delivered solid results with broad-based growth and profit expansion in 2024.

“Beer volume grew organically by 1.6%, and net revenue (beia) was up 5.0% with strong operating profit (beia) growth of 8.3%,” van den Brink said.

“Looking ahead, we are well-positioned to further increase our investment in marketing and selling and behind our EverGreen priorities in 2025. We expect to grow operating profit (beia) organically in the range of 4% to 8%.”

2:27 pm (AEDT)

GXO Logistics (NYSE: GXO) have delivered record revenue for both Q4 and full year 2024.

Revenue increased by 25% to US$3.3 billion year over year compared to $2.6 million for Q4 2023. For the full year, revenue rose 20% to $11.7 billion compared to $8.9 million in 2023.

The company have been growing their international markets and are confident moving into 2025.

“In 2024, we completed the acquisition of Wincanton, which will accelerate our growth in key verticals, and we expanded in new geographies like Germany, which is now our fastest-growing market,” CEO Malcolm Wilson said.

“Our pipeline is up 15% year over year, and our pipeline in the Americas is up 20%.

“We also accelerated our organic growth sequentially throughout the year and closed more than $1 billion of new business wins for the second consecutive year.”

2:50 pm (AEDT)

Treasury Wines Estate (ASX: TWE) shares plummeted 5% this afternoon after the winemaker warned investors that underperforming commercial wines will continue to be a drogue on profitability and cut its earnings guidance.

Net sales revenue (NSR) for the company was up 20.2% to A$1,544.2 million and NSR per case rose 16.4%, driven by strong growth from the Penfolds and Treasury Americas business.

3:08 pm (AEDT):

Motorola Solutions Inc (NYSE: MSI) is predicted to have positive earnings by Zacks Research.

The company is estimated to earn US$3.47 per share, up from the prior forecast of $3.46.

Wall Street analysts expect Motorola’s revenues to grow 5.3% from last year to $3 billion.

3:33 pm (AEDT)

Hey there, Sienna Martyn jumping in here to take you through this preview.

Sony Group Corp (TYO: 6758) is expected to report overnight (AEST) with an expected 20% drop in net profit to 290.5 billion yen, equivalent to US$1.90 billion, for the three months ended December, according to a poll of analysts by Visible Alpha.

According to analysts, Q3 revenue is estimated to have declined 1.6% from a year earlier to 3.7 trillion yen.

Investors will be paying attention to any steps taken to sharpen its focus on its entertainment businesses after the company spent billions of dollars in acquisitions in recent years.

In January, the company took an additional stake in Japanese publishing house Kadokawa for more than $300 million.

At the time of writing this, Sony stocks were trading at 3,421 Japanese yen (US$22.15) up 1.5% from the previous close.

4:31 pm (AEDT):

It’s Chloe, back again to take you through the rest of the day's previews.

Moody’s (NYSE: MCO) is expected to report earnings per share of US$2.58 and a revenue increase of 14% of $1.71 billion year on year.

Net profit for Honda Motor (TYO: 7267) is expected to rise 5.8% to 267.97 billion yen, an increase from 253.31 billion yen the previous year.

Estimates from Benzinga Pro expect Applied Materials (NASDAQ: AMAT) to report quarterly earnings of US$2.29 per share and revenue of $7.14 billion.

Shares for Airbnb (NASDAQ: ABNB) have declined over the past year, according to Market Insider and analysts expect the company to report Q4 earnings per share of US$0.58. Experts estimate that Q4 revenue will come to around $2.42 billion, reflecting a 9% year-on-year increase, however, Airbnb has missed earnings expectations two years in a row.

FactSet expects Coinbase (NASDAQ: COIN) to report earnings of US$2.11 per share, an increase from $1.04 last year, analysts also predict that revenue will spike by 93% to $1.84 million.

That’s all from me today! Check back in tomorrow for all the latest earnings updates from Harlan Ockey.

____________________________________________________________________________

An author of this blog holds shares in Origin.