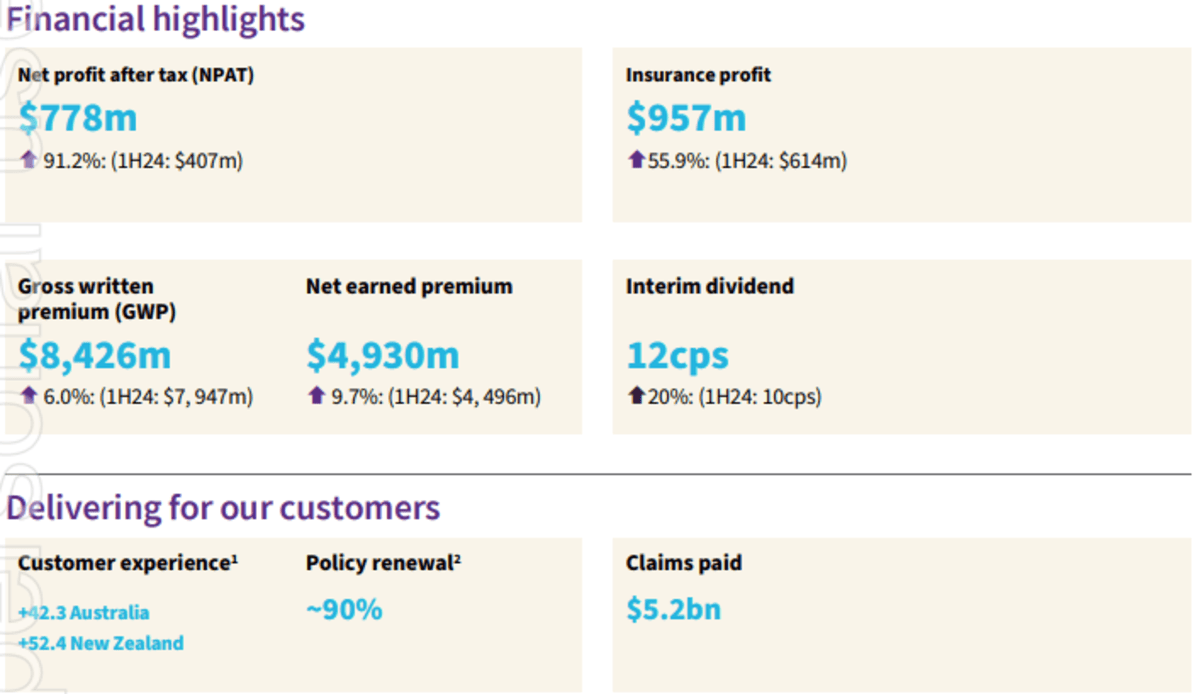

Australian general insurer Insurance Australia Group (IAG) has announced a 91% leap in net profit to A$778 million for the first half of the 2025 financial year (1H25).

IAG said pre-tax insurance profit surged 56% to $957 million on revenue which rose 4% to $9.036 billion in the six months ended 31 December 2024.

The company, whose brands include NRMA Insurance, CGU Insurance and RACV Insurance, said the increase in profit was driven mainly by the $140 million post-tax release of a COVID Business Interruption provision, an increase in net earned premiums, and an improvement in insurance profit.

Directors declared a fully franked interim dividend of 12 cents per share (franked to 7.2 cents), up from 10 cents in 1H24, to be paid on 7 March to shareholders on record on 19 February.

Managing Director and CEO Nick Hawkins said IAG finished 1H25 with strong momentum as it focused on supporting our customers and communities in Australia and New Zealand.

“Today’s result reflects the quality of our business as we continue to see consistent, reliable performance across our portfolios and steady progress against our strategic priorities,” Hawkins said in an ASX announcement.

“It follows a challenging four-year period for IAG, marked by extreme weather events, volatile investment markets, and COVID related issues that impacted our performance.”

He said relatively favourable weather, strong investment markets and the release of $200 million from a COVID Business Interruption provision positively impacted profitability, allowing the company to build reserves to pay future claims.

“Recent storms, floods and the LA fires are a stark reminder of the need to be a well-prepared nation,” IAG said.

The weather theme was taken up on Wednesday by rival insurer Suncorp (ASX: SUN) which said the same half year was a “benign natural hazard period” in Australia and New Zealand.

IAG entered the second half of FY25 in a position of strength with a scalable business ready to grow beyond its current 7.2 million direct and partner customers.

“As we move into the next phase of growth, I’m confident in IAG’s ability to support our customers, deliver strong returns for shareholders and help build resilience and strength across Australia and New Zealand,” Hawkins said.

IAG (ASX: IAG) shares closed on Wednesday at $8.92, up two cents (0.22%), capitalising the company at $21.1 billion.

IAG was floated out of the 105-year-old National Roads and Motorists Association (NRMA) group in 2000.