Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Netflix misses estimates amid Brazilian tax dispute

- Coca-Cola beats estimates despite soft demand

- Texas Instruments issues weaker-than-expected guidance

- GE Aerospace, Lockheed Martin, RTX, Northrop Grumman beat estimates

- General Motors lowers expected tariff hit, shares jump

- Capital One revenue spikes after Discover acquisition

_______________________________________________________________________________________

8:50 am (AEDT):

Good morning! Harlan Ockey here to walk you through today's earnings.

Starting with the NASDAQ, Netflix (NFLX) tanked 6.2% in after-hours trading after falling below earnings per share estimates, driven by an unexpected charge from its tax dispute in Brazil.

Earnings per share were US$5.87, missing LSEG estimates of $6.97, but above the $5.40 seen one year ago. Revenue was $11.51 billion, up from $9.83 billion and in line with estimates.

The company was charged $619 million from its dispute with Brazilian tax authorities. This covered periods from 2022 until 2025's third quarter, and was due to a 10% tax on some payments made by Brazilian businesses to foreign entities.

"The cumulative impact of this expense (approximately 20% of which is for the year 2025 with the remainder related to 2022-2024) reduced our Q3’25 operating margin by more than five percentage points. Absent this expense, we would have exceeded our Q3'25 operating margin forecast, and we don’t expect this matter to have a material impact on our results in the future," wrote Netflix.

Netflix's Q4 forecast includes revenue of $11.96 billion and earnings per share of $5.45.

Revenue was up across regions. The Asia Pacific led with 21% year-over-year growth, while revenue was up 17% in the United States and Canada, 18% in Europe, the Middle East, and Africa, and 10% in Latin America.

Quarterly view share rose by 15% in the U.S. and 22% in the U.K., the company said.

Read Chloe Jaenicke's full report here.

9:14 am (AEDT):

Turning to the NYSE, Coca-Cola (KO) beat estimates on earnings per share and revenue and has reaffirmed its guidance, though it said demand remained soft.

Earnings per share were US$0.82, above LSEG estimates of $0.78 and rising 6% year-over-year. Revenue was up 5% to $12.46 billion, beating estimates of $12.39 billion.

“While the overall environment has continued to be challenging, we’ve stayed flexible — adapting plans where needed and investing for growth,” said CEO James Quincey. “By offering choice across our total beverage portfolio and leveraging our franchise model’s unique strengths, we’re gaining ground and strengthening our leadership position.”

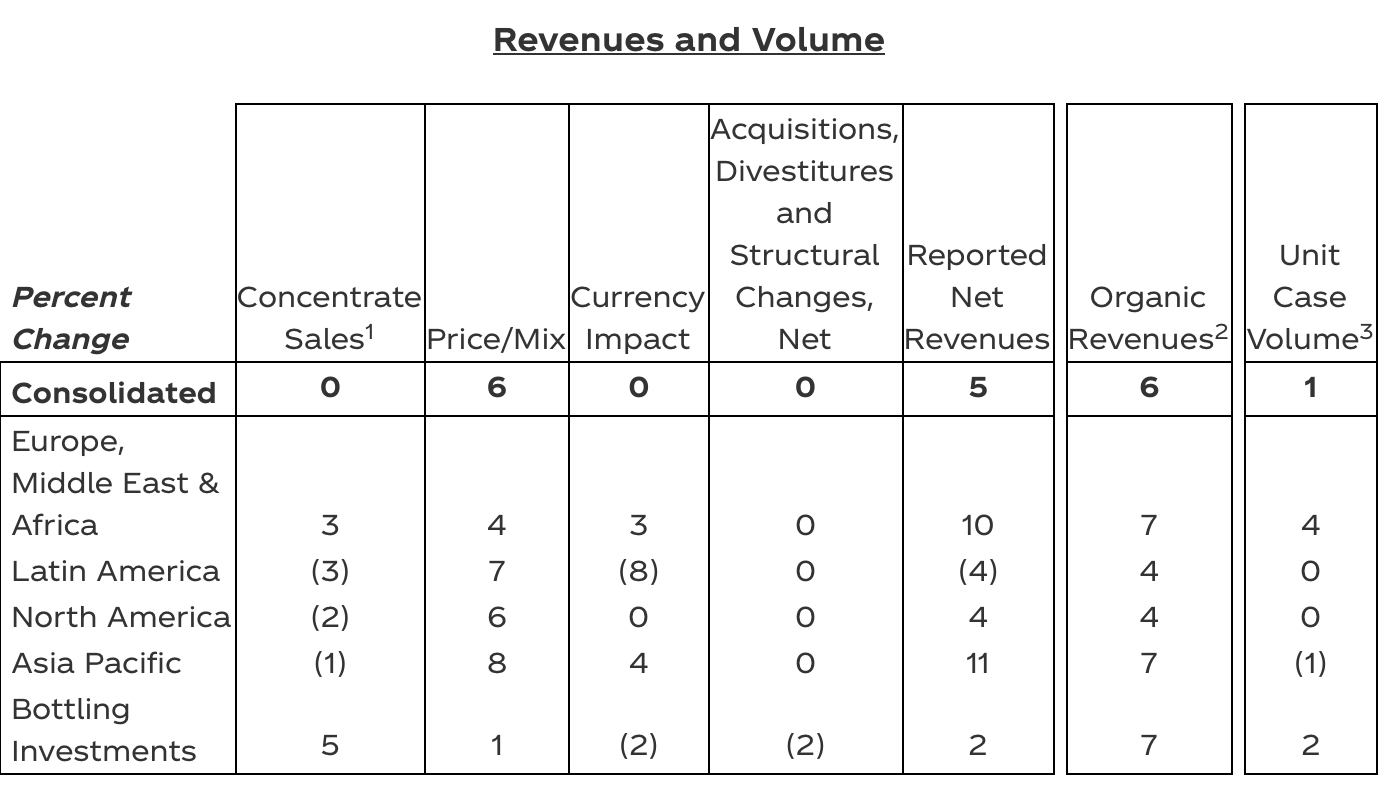

Europe, Middle East, and Africa revenue rose by 10% and Asia Pacific revenue grew by 11%. Latin America revenue fell 4%, and North America revenue was up 4%.

Unit case volume grew by 1% overall. It was up 4% in Europe, the Middle East, and Africa, but remained flat in North and Latin America and dropped 1% in the Asia Pacific.

Coca-Cola's full-year guidance remains unchanged. The company projects revenue growth of 5-6%, and earnings per share growth of 8%.

The company's shares closed 4.0% higher after reporting results.

Read Garry West's full story here.

9:28 am (AEDT):

Back to the NASDAQ, Texas Instruments (TXN) surpassed estimates on revenue, but shares dropped 8.2% in after-hours trading on weaker-than-expected guidance.

Revenue was US$4.74 billion, above estimates of $4.65 billion and up 14.2% year-over-year. Earnings per share were $1.48, up 1% but slightly below estimates of $1.49.

“Revenue increased 7% sequentially and 14% from the same quarter a year ago with growth across all end markets,” said CEO Haviv Ilan. “Our cash flow from operations of $6.9 billion for the trailing 12 months again underscored the strength of our business model, the quality of our product portfolio and the benefit of 300mm [silicon wafer] production.”

Operating profit was up 7% to $1.66 billion.

Analog segment revenue grew by 16% to $3.73 billion, and operating profit was up 13%. Embedded Processing revenue rose by 9%, but operating profit dropped by 1%.

The company's Q4 outlook projects revenue of $4.22-4.58 billion, largely below estimates of $4.51 billion, and earnings per share of $1.13-1.39, under estimates of $1.41.

Oliver Gray has the full report.

9:49 am (AEDT):

And moving back to the NYSE, GE Aerospace (GE) exceeded estimates on revenue and earnings per share, and has raised its full-year guidance.

Adjusted revenue was US$11.31 billion, passing Zacks estimates of $10.3 billion. Earnings per share were $1.66, above estimates of $1.46.

“GE Aerospace delivered an exceptional quarter with revenue up 26%, EPS up 44%, and more than 130% free cash flow conversion. Given the strength of our year-to-date results and our expectations for the fourth quarter, we're raising our full-year guidance across the board,” said CEO H. Lawrence Culp Jr.

Its total orders rose 2% to $12.8 billion. This was driven by Commercial Engines & Services orders, which were up 5% to $10.3 billion.

Defense & Propulsion Technologies orders fell 5% to $2.9 billion, which the company credited to timing across quarters.

GE Aerospace's full-year guidance expects an adjusted revenue growth percentage in the high teens, raised from the mid teens. It projects earnings per share will be $6.00-6.20, up from previous forecasts of $5.60-5.80.

Shares closed 1.31% higher after the earnings report.

10:15 am (AEDT):

Still with the NYSE, General Motors (GM) surged past estimates last quarter as it lowered its projected hit from U.S. tariffs, with shares up 14.9%.

Earnings per share were US$2.80, down from $2.96 one year ago and passing Zacks estimates of $2.28. Revenue was $48.59 billion, down 0.3%, beating estimates of $44.27 billion.

Operating income was $1.08 billion, compared with $3.65 billion year-over-year.

Automotive sales were $44.26 billion, falling from $44.74 billion. Its market share in the U.S. rose from 16.5% to 17.0%, and its worldwide market share was up from 6.7% to 6.9%.

The company delivered 710,000 vehicles in the U.S., up 8%, and was the leading automaker by U.S. sales.

“Thanks to the collective efforts of our team, and our compelling vehicle portfolio, GM delivered another very good quarter of earnings and free cash flow. In the U.S., we achieved our highest third-quarter market share since 2017 with strong margins, and our restructured China business was profitable once again,” wrote CEO Mary Barra.

General Motors lowered its projected full-year tariff impact from $4-5 billion to $3.5-4.5 billion, after the U.S. agreed this week to give up to 3.75% in rebates on the suggested retail price of cars built domestically. The forecast assumes tariffs will remain at current levels and that these rebates will be expanded.

It has raised its full-year guidance to include earnings per share of $9.75-10.50, up from $8.25-10.00.

Garry West has the full story.

10:47 am (AEDT):

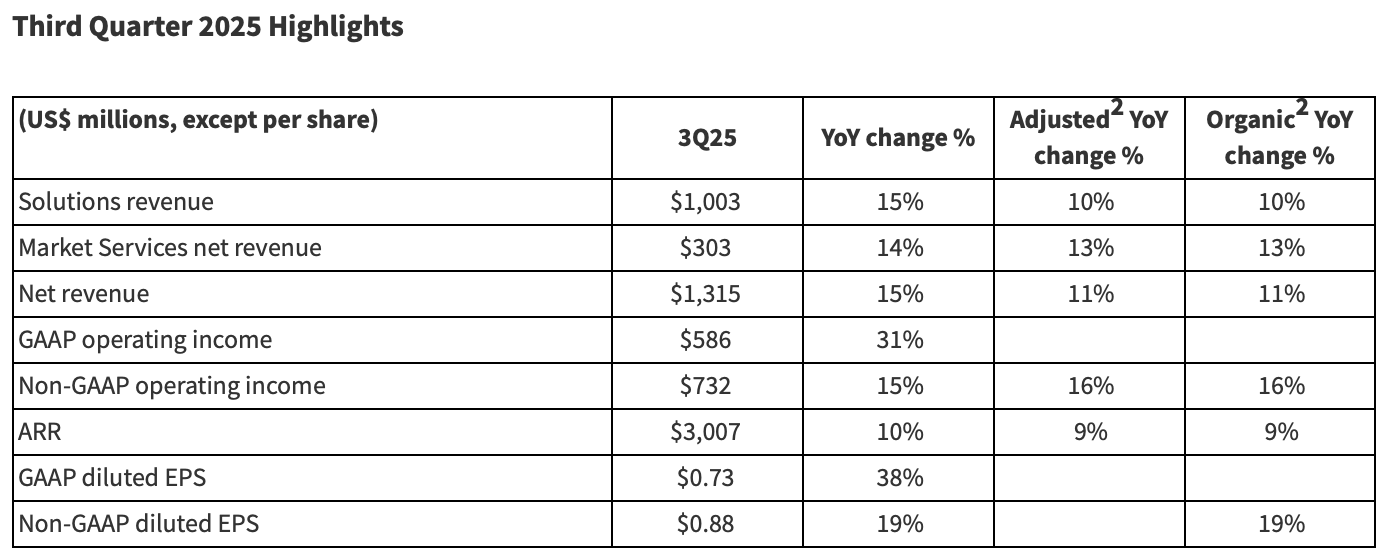

Back to the NASDAQ, Nasdaq (NDAQ) reported strong growth in revenue and earnings per share, driven by a sharp rise in Solutions revenue.

Revenue was US$1.3 billion, up 15%. Earnings per share rose 19% to $0.88.

“Nasdaq achieved significant milestones in the third quarter, with Solutions quarterly revenue surpassing $1 billion and annual recurring revenues reaching $3 billion for the first time. This achievement reflects our successful transformation into a leading technology platform,” said CEO Adena Friedman.

Solutions revenue was up 15% to $1.00 billion. This was due to 23% growth in its Financial Technology sub-segment, and a 13% rise in Index revenue.

Market Services revenue increased 14% to $303 million.

Nasdaq's U.S. listings added companies that raised $6 billion in proceeds during the quarter.

Operating expenses were $583 million, increasing by 5%, which Nasdaq credited to higher technology investments and greater employee compensation. Its full-year operating expense guidance is $2.305-2.335 billion, raised from $2.295-2.335 billion.

Nasdaq shares closed 1.7% higher after the report.

11:35 am (AEDT):

And at the NYSE again, Capital One (COF) beat estimates on earnings per share, as it continues to integrate Discover into its business following the acquisition in May.

Revenue rose 23% to US$15.36 billion. Diluted earnings per share were $5.95, up from $4.51 and passing Bloomberg estimates of $4.39.

"In the third quarter, our adjusted earnings, top-line growth, credit results, and capital generation continued to be strong," said CEO Richard D. Fairbank. "The Discover integration continues to go well and we are well positioned to capitalize on the opportunities that lie in front of us."

Discover integration expenses resulted in an $0.41 hit to its after-tax diluted earnings per share last quarter. Capital One laid off at least 597 Discover employees at its former headquarters in Illinois during the quarter.

Net interest income was $12.40 billion, up from $8.08 billion. Pre-provision earnings rose by 29% to $7.10 billion.

Its CET1 ratio was 14.4%, increasing from 13.6%.

Capital One shares jumped 3.8% in after-hours trading following the report.

12:06 pm (AEDT):

Still with the NYSE, Equifax (EFX) passed estimates on both earnings per share and revenue, despite declines in the U.S.' mortgage market.

Earnings per share were US$2.04, up 10.3% year-over-year and above Zacks estimates by 5.7%. Revenue was $1.55 billion, rising 7.2% and beating estimates by 1.5%.

Workforce Solutions revenue increased by 5% to $649.4 million, with Verification Services and Employer Services sub-segment revenue up 5% and 1% respectively.

U.S. Mortgage revenue rose by 13%. The U.S.' 30-year fixed mortgage rates largely declined across the quarter, and were at 6.30% during its last week on 24 September, according to Freddie Mac.

U.S. Information Solutions revenue grew 11% to $530.2 million. International revenue was up 6% to $365.3 million, led by 11% growth in Canada.

“Equifax delivered strong third quarter revenue of $1.545 billion, up 7% on both a reported and local currency basis, that was $25 million above the midpoint of our July Guidance. This was led by strong 13% U.S. Mortgage revenue growth, strong Workforce Solutions Government vertical results, and continued momentum in New Product Innovation with a Vitality Index of 16% despite headwinds from the U.S. Mortgage and Hiring markets,” said Equifax CEO Mark Begor.

Its full-year guidance projects $6.03-6.06 billion in revenue and $7.55-7.65 in earnings per share.

Shares fell from $235.42 to a low of $219.56 shortly after opening, but recovered to close 0.5% lower.

12:44 pm (AEDT):

At the NYSE, Chubb (CB) saw net income rise by 20.5%, driven by premiums growth worldwide.

Net income was US$2.80 billion last quarter, with earnings per share at $6.99. Core operating income reached a new record of $3.00 billion, up 28.7%, which the company credited to record underwriting and investment income.

Net premiums written were up 7.5% to $14.87 billion. Total U.S. property and casualty insurance premiums grew 4.4% to $8.94 billion, while overseas general insurance premiums increased 9.7% to $3.70 billion.

Global reinsurance premiums dropped 13.5% to $304 million, however. Life insurance premiums were up 24.6% to $1.93 billion.

Pre-tax net investment income increased 9.3% to $1.65 billion.

“We had a simply outstanding quarter. The results again put a point on the broad-based, diversified nature of our company geographically, by customer segment both and within commercial and consumer, by product and distribution channel,” said CEO Evan Greenberg.

Chubb shares jumped to a high of $273.60 in after-hours trading following a close at $269.26.

1:20 pm (AEDT):

Good afternoon! Chloe Jaenicke here, taking over the blog from Harlan.

Aerospace and defence conglomerate RTX (NYSE: RTX) posted better-than-expected results, causing stocks to rise.

In its Q3 earnings, the company reported a 17% rise in earnings per share year-over-year to US$1.70. Sales also rose by 12% to US$22.5 billion.

This was higher than Wall Street’s predictions of US$1.41 earnings per share and sales of US$21.3 billion.

"Strong execution in the third quarter enabled us to deliver double-digit organic sales growth across all three segments and our sixth consecutive quarter of year-over-year adjusted segment margin expansion,” RTX chairman and CEO Chris Calio said.

RTX also updated its outlook for 2025 to an adjusted EPS of US$6.10 to US$$6.20, up from US$5.80 to US$5.95.

Following the earnings announcement, shares surged 7.7% to US$173.04.

1:50 pm (AEDT):

Lockheed Martin (NYSE: LMT) beat expectations in its Q3 earnings.

Net earnings for the defence company came in at US1$1.6 billion or US$6.95 per share compared to US$1.6 billion or US$6.80 at the same time last year.

This is higher than the Zacks Consensus Estimate of US$6.33.

The company’s revenue came in at US$18.61 billion, beating the Zacks Consensus estimate of US$18.56 billion.

Lockheed Martin managed to beat sales expectations in all areas except Rotary and Mission Systems.

The company’s highest sales came from Aeronautics, which came in at US$7.26 billion.

"Based on the effectiveness and reliability of our products and systems, strong demand from Lockheed Martin's customers—both in the United States and among our allies—continues,’ Lockheed Martin chairman, president and CEO Jim Taiclet said.

“As a result of this unprecedented demand, we are increasing production capacity significantly across a wide range of our lines of business.”

2:13 pm (AEDT):

Staying on the NYSE, Northrop Grumman (NOC) also exceeded analyst expectations.

The aerospace and defence company reported earnings per share of US$7.67 for the third quarter, which was US$1.21 higher than expected.

Revenue for the company increased 4% year over year to US$10.42 billion, despite falling short of the US$10.71 billion.

Organic growth increased by 5% from the last period last year.

Following the earnings release, the company’s CEO and president, Kathy Warden, said it would be raising its full-year guidance.

Northrop Grumman now expects earnings per share of US$25.65 to US$26.06, up from previous guidance of US$25 to US$25.40.

Despite the growth, Northrop Grumman shares fell by 1.3% following the announcement.

2:33 pm (AEDT):

Danaher Corp (NYSE: DHR) reported strong growth across the board in its most recent earnings.

Adjusted diluted earnings per share were up 10% year over year to US$1.89, and net earnings came in at US$908 million.

The healthcare company reported revenues of US$6.1 billion, representing a 4.5% increase from the same period last year.

Danaher President and CEO Rainer Blair said that the company was encouraged by its third-quarter results.

“We're investing in breakthrough innovation, enhancing our commercial execution, and driving meaningful productivity gains across our businesses,” he said.

“We believe these efforts will strengthen our long-term competitive position and help to solve some of the world's most difficult healthcare challenges."

3:04 pm (AEDT):

Intuitive Surgical (NASDAQ: ISRG) stocks surged following earnings that smashed Wall Street expectations.

In Q3 of 2025, procedure growth from its Da Vinci system grew by 20%, leading to US$1.52 billion in sales of instruments and accessories to match.

Sales for the company totalled US$2.51 billion, which is an increase of 23% and beats expectations of US$2.41 billion.

Adjusted earnings per share came in at US$2.40, which surpasses analysts' forecasts of US$1.99.

Following the positive growth in Q3, the company has increased its procedure growth guidance for the full year from 17% to 17.5%.

Thank you for joining us today. Tomorrow, we'll see reports from companies like Tesla and IBM. We'll see you next time!