Shares in General Motors (GM) surged after it upgraded its full year profit forecast despite announcing a 56.6% plunge in net income for the third quarter of the 2025 (Q3 FY25) financial year.

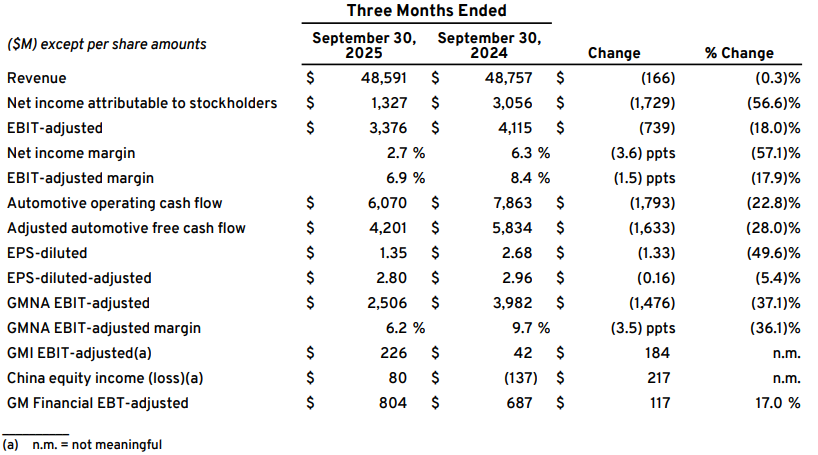

The automotive manufacturer said net income was US$1.327 billion (A$2.044 billion) in the three months ended 30 September 2025 compared with $3.056 billion in the previous corresponding period.

Earnings before interest and tax (EBIT) fell 18% to $3.4 billion, diluted earnings per share (EPS) dived 49.6% to $1.35 and revenue was little changed at $48.591 billion.

GM updated FY25 guidance for EBIT to between $12 billion and $13 billion from $10 billion to $12.5 billion and diluted EPS to $8.30-$9.05 ($8.22-$9.97) but downgraded the forecasts for net income to $7.7 billion-$8.3 billion ($7.7 billion-$9.5 billion).

The company also revised down the gross impact of United States tariffs to between $3.5 billion and $4.5 billion in FY25 from $4 billion to $5 billion, assuming they stayed at current levels.

The shares (NYSE: GM) closed $8.62 (14.86%) higher at $66.62 on Tuesday (Wednesday AEDT), capitalising the company at $63.43 billion, after earlier reaching an intra-day peak $67.55, the highest for at least 10 years.

CEO Mary Barra said Q3 was another “very good” quarter for earnings and free cash flow, the company achieved its highest third-quarter market share since 2017 with strong margins, and its restructured China business was profitable once again.

“Based on our performance, we are raising our full-year guidance, underscoring our confidence in the company’s trajectory,” Barra said in a letter to shareholders.

She also said GM was reassessing its electric vehicle (EV) capacity and manufacturing footprint, resulting in a special charge in Q3 with more charges to come, because near-term EV adoption would be lower than planned due to the evolving regulatory framework and end of federal consumer incentives.

“By acting swiftly and decisively to address overcapacity, we expect to reduce EV losses in 2026 and beyond,” Barra said.