Re-live our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Eli Lilly soars on weight loss drug revenue

- Qualcomm issues weak guidance amid memory shortage

- Alphabet forecasts massive capital expenditures

- Uber beats revenue estimates despite income hit

- Novo Nordisk shares plummet as it projects drop in sales

- The New York Times Company's profits and expenses both rise

- Sony lifts its guidance

_______________________________________________________________________________________

8:53 am (AEDT):

Good morning! Harlan Ockey here to walk you through the day's earnings.

Starting off on the NYSE, Eli Lilly (LLY) surged past estimates as revenue for its weight loss medications continued to rise.

Total revenue was up 43% year-over-year to US$19.29 billion, well above LSEG estimates of $17.96 billion. Earnings per share climbed 42% to $7.54, beating estimates of $6.67.

Revenue for weight loss drug Mounjaro grew 110% to $7.41 billion. Zepbound, its other major weight loss treatment, saw revenue climb 123% to $4.26 billion.

Revenue for cancer treatment medication Verzenio also rose 3% to $1.60 billion.

Across 2026, it expects revenue of $80-83 billion and earnings per share of $33.50-35.00.

"2025 was an important year for Lilly," said CEO David A. Ricks. “We reached millions more patients—launching Inluriyo, expanding Mounjaro and Kisunla globally, and submitting orforglipron for approval. We expanded our manufacturing capacity, and through our U.S. government agreement, opened new access to obesity medicines.” Inluriyo is a cancer medication, while Kisunla treats Alzheimer's and orforglipron targets weight loss.

The company's shares soared to close 10.3% higher, and dipped 0.2% after-hours.

Chloe Jaenicke has the full story.

9:18 am (AEDT):

Moving to the Nasdaq, Qualcomm (QCOM) shares fell 10% after-hours following weaker-than-expected guidance.

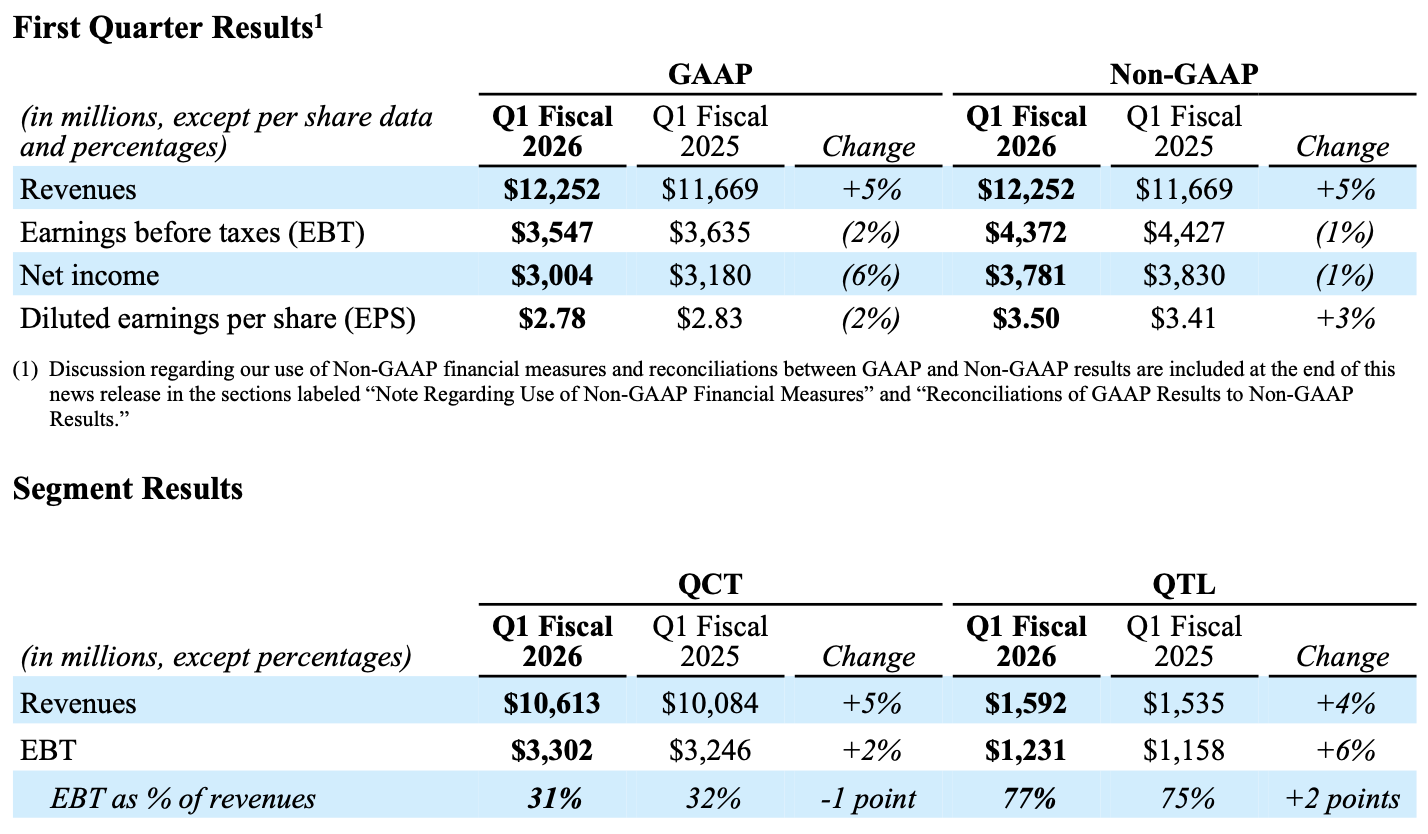

Revenue was up 5% to US$12.25 billion, besting LSEG estimates of $12.21 billion. Earnings per share rose 3% to $3.50, passing estimates of $3.41.

Its QCT segment, which includes wireless chipsets, posted a 5% revenue increase to $10.61 billion, This was supported by a 3% rise in handset chip revenue. Its QTL technology licensing segment's revenue grew 4% to $1.59 billion.

Operating income was $3.37 billion, declining from $3.56 billion. Total costs and expenses rose from $8.11 billion to $8.89 billion.

Qualcomm expects $10.2-11.0 billion in revenue and $2.45-2.65 in the second quarter of its fiscal 2026. Estimates had included $11.11 billion in revenue and $2.89 per share.

“We are pleased to deliver strong quarterly results, with record total company revenues,” said CEO Cristiano Amon. “Our momentum across personal, industrial and physical AI is growing, as evidenced by recent product announcements at CES and customer traction.

Its guidance was impacted by the ongoing memory shortage, said Amon. Chipmakers have been buying up large numbers of memory components for their artificial intelligence semiconductors.

9:38 am (AEDT):

Sticking with the Nasdaq, Google parent Alphabet (GOOG) said it may more than double its capital expenditure in 2026 as it continues to invest in AI.

Revenue was US$113.83 billion, up from $96.47 billion and beating LSEG estimates of $111.43 billion. Earnings per share were $2.82, rising from $2.15 and passing estimates of $2.63.

Google Services revenue grew from $84.09 billion to $95.86 billion, including search revenue of $63.07 billion. Google Cloud revenue increased from $11.96 billion to $17.66 billion, above StreetAccount estimates of $16.18 billion.

Total operating income was $35.93 billion, up from $30.97 billion. Google Services' operating income climbed from $32.84 billion, while Google Cloud's operating income rose from $2.09 billion to $5.31 billion.

"We’re seeing our AI investments and infrastructure drive revenue and growth across the board. To meet customer demand and capitalize on the growing opportunities we have ahead of us, our 2026 CapEx investments are anticipated to be in the range of $175 to $185 billion," said CEO Sundar Pichai. The company's capital expenditure was $91.45 billion across 2025.

Shares closed 2.2% lower, and fell a further 1.7% after-hours.

10:00 am (AEDT):

Back to the NYSE, Uber (UBER) passed revenue estimates, though net income took a $1.6 billion hit.

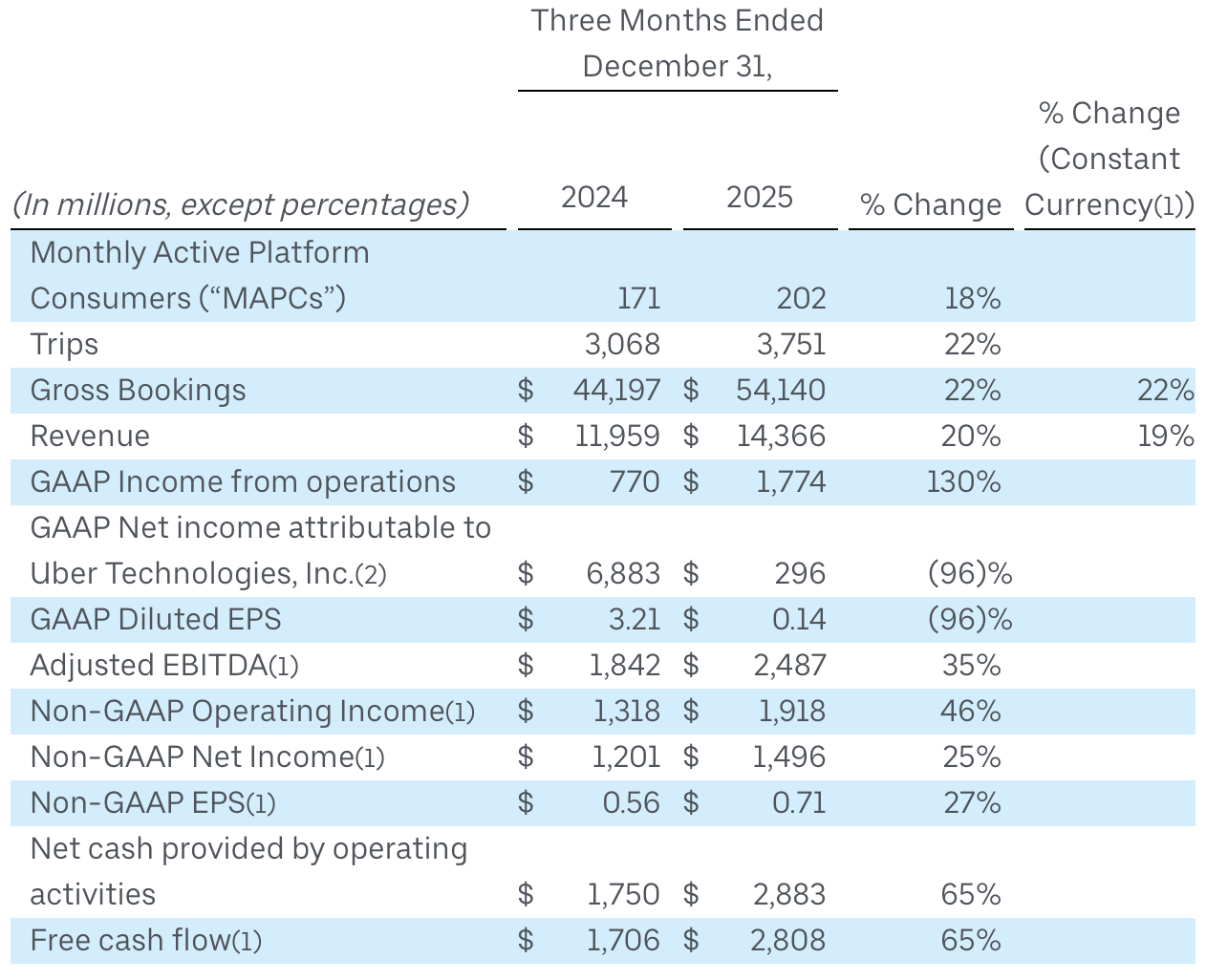

Revenue was up 20% year-over-year to US$14.37 billion, above LSEG estimates of $14.32 billion.

Earnings per share grew 27% to $0.71. Net income was $296 million, down 96% due to “a $1.6 billion net headwind (pre-tax) from revaluations of Uber’s equity investments," Uber said.

Uber's monthly active platform customers were up 18% to 202 million. Trips rose 22% to 3.75 billion.

Gross bookings grew 22% to $54.14 billion, above StreetAccount estimates of $53.1 billion.

The company projected gross bookings of $52.0-53.5 billion and earnings per share of $0.65-0.72 for the first quarter of 2026.

Chloe Jaenicke has the full story.

10:31 am (AEDT):

Still with the NYSE, e.l.f. Beauty (ELF) has raised its full-year guidance as revenue surged.

Revenue was up 38% year-over-year to US$489.51 million, besting LSEG estimates of $460 million. Earnings per share were $1.24, rising from $0.74 and passing estimates of $0.72.

Gross profit increased from $253.31 million one year ago to $347.50 million. Operating income nearly doubled from $35.09 million to $67.54 million.

Its guidance for fiscal 2026 now includes revenue of $1.600-1.612 billion and earnings per share of $3.05-3.10. e.l.f. had previously forecast revenue of $1.550-1.570 million and earnings per share of $2.80-2.85.

Chloe Jaenicke has the full story.

10:54 am (AEDT):

Turning to Nasdaq Copenhagen, Novo Nordisk (NOVO B) shares collapsed as the company projected sales and operating profit would fall in 2026.

Net sales increased 10% at constant exchange rates to DKK309,06 billion (US$48.9 billion) across 2025, which it said was driven by 31% growth in sales of its weight loss products.

Sales in the U.S. were up 8% at constant exchange rates, while international sales rose 14%.

Earnings per share were DKK23.03, up from DKK22.63 last year.

It forecast sales would decline by 5-13% in 2026. Novo Nordisk credited this to lower prices, including price cuts under the United States' Most Favoured Nations agreement, and the expiration of the patent for its weight loss drug ingredient semaglutide in some markets. Consensus estimates were for a 2% drop in sales this year, per a Novo Nordisk-compiled poll.

The company also expects operating profit will fall by 5-13%.

Novo Nordisk's Copenhagen-listed shares plummeted 17.2%, while its NYSE-listed shares closed 6.2% lower.

11:32 am (AEDT):

Over to Zurich's Swiss Exchange, UBS Group (UBSG) surpassed estimates last quarter and announced a US$3 billion share buyback, though shares fell amid a slump at its global wealth management unit.

Net profit attributable to shareholders was up 56% to $1.20 billion, beating LSEG estimates of $919 million. Revenue was $12.15 billion, rising 4% and in line with estimates.

“The strength of our global, diversified franchise powered our excellent full year performance as we helped clients navigate an unpredictable market environment," said CEO Sergio Ermotti. “We made great progress on one of the most complex integrations in banking history while facing ongoing regulatory uncertainty in Switzerland.”

UBS is continuing to integrate Credit Suisse into its operations, which it acquired in an emergency takeover in 2023. It has raised projected integration cost savings to $13.5 billion, and said gross cost reductions had reached $10.7 billion by the end of 2025.

The company aims to buy back at least $3 billion in shares across 2026, it said, having completed a previous $3 billion repurchase plan last quarter.

UBS' CET1 ratio was 14.4%, down from 14.8% in the prior quarter.

It reported net new assets of $8.5 billion at its global wealth management business, well below the $38 billion it saw the previous quarter. Outflows in the Americas were $14.1 billion, though the company said this was offset by inflow in the Asia Pacific and Europe, the Middle East, and Africa.

Shares closed 6.3% lower.

11:51 am (AEDT):

Back to the NYSE, The New York Times Company (NYT) beat profit estimates last quarter, though shares fell as operating costs grew.

Earnings per share were US$0.89, up from $0.80 last year and just above Zacks estimates of $0.88. Revenue increased 10.4% to $802.3 million.

The company reported 12.78 million subscribers at the end of the quarter. It added 450,000 net digital-only subscribers during the quarter, reaching 12.21 million.

Digital advertising revenues surged 24.9% to $147.2 million. Digital-only subscription revenues were $381.5 million, up 13.9% but slowing from the 16% growth seen one year ago.

Operating profit was $161.6 million, rising from $146.6 million, with a profit margin of 20.1%.

Adjusted operating costs climbed 9.7% to $610.0 million, partly due to litigation costs for the lawsuits it has filed against generative AI companies. In December, it sued AI search engine Perplexity AI, alleging it had scraped and distributed New York Times' journalists' work without permission.

Shares closed 6.3% lower, and dropped a further 0.9% after-hours.

12:10 pm (AEDT):

Still with the NYSE, Snap (SNAP) shares rose on strong revenue last quarter, though its daily active user numbers and guidance were weaker than expected.

Revenue rose 10% to US$1.72 billion, above LSEG estimates of $1.70 billion. Earnings per share were $0.03, above the $0.01 it reported a year ago.

Operating income was $49.72 million, compared with a loss of $26.88 million one year ago.

It reported 6% growth in monthly active users to reach 946 million. Daily active users were up 5% to 474 million, below StreetAccount estimates of 478 million.

“Our Q4 results began to reflect the impact of our strategic pivot toward profitable growth, translating into revenue diversification and meaningful margin expansion,” said CEO Evan Spiegel.

“This progress reflects our commitment to building a more financially efficient and profitable business while continuing to invest in the future of augmented reality and the consumer launch of Specs," Spiegel said. Specs Inc, Snap's augmented reality glasses business, was established as a distinct subsidiary in January, and its flagship product will be available to the public later in 2026.

It expects first-quarter revenue of $1.50-1.53 billion, under estimates of $1.55 billion.

Shares climbed 2.9% in after-hours trading following the earnings release.

12:24 pm (AEDT):

Sticking with the NYSE, Metlife (MET) beat profit estimates last quarter, boosted by an increase in private equity returns.

Earnings per share were up 19% to US$2.49, above Bloomberg-compiled estimates of $2.34. Total revenue was $23.81 billion, increasing from $18.67 billion year-over-year.

Net investment income rose 10% to $5.92 billion. Variable investment income climbed 70% to $497 million, which Metlife credited to higher returns on its private equity assets.

Its adjusted return on equity was 17.6%, up from 15.4% one year ago.

“For the full year, we achieved 10% adjusted earnings per share growth, 16% adjusted return on equity, and beat our direct expense and free cash flow ratio targets, while returning nearly $4.4 billion to shareholders,” said CEO Michel Khalaf.

Metlife's shares closed 1.4% higher.

1:03 pm (AEDT):

Good afternoon, it’s Chloe Jaenicke here to take over the blog for a bit.

Starting off, Fox Corporation (NASDAQ: FOXA) beat analysts' estimates in earnings and revenues.

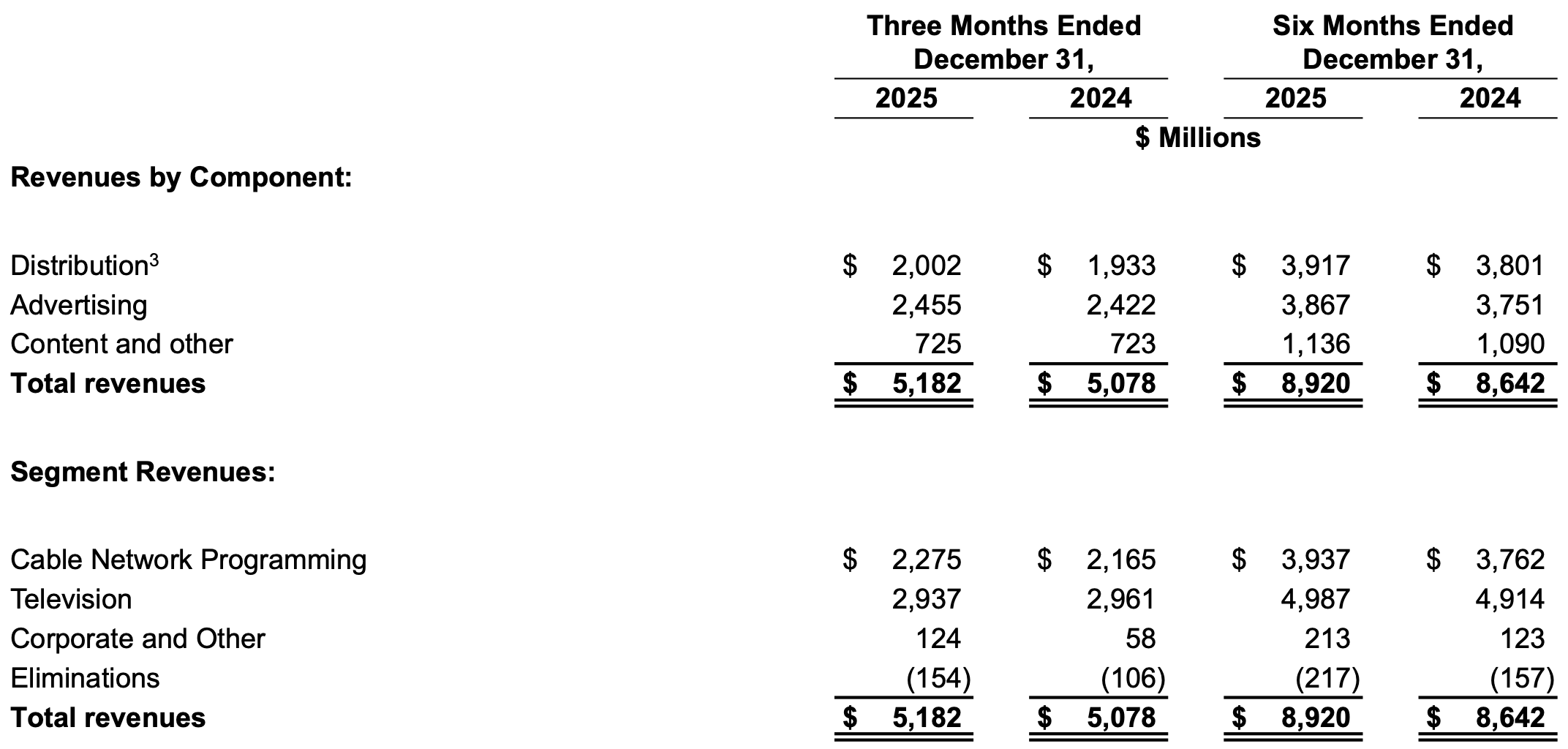

The company's total quarterly earnings were US$5.18 billion, an increase of $104 million from the year prior and beating estimates of $5.06 billion.

Advertising revenue grew by 7% as the company added more than 200 new brand advertisers after the U.S. presidential election cycle.

Net income for the company fell from $388 million to $247 million. Earnings per share were $0.82, which was down from last year’s $0.96 but beat estimates of $0.51.

“These results represent a continuation of the operating and financial momentum that we have delivered over the last several years and are a product of both a highly differentiated strategy and high quality execution that reflect the power of our leadership brands across news, sports, streaming and entertainment,” Fox executive chair and CEO Lachlan Murdoch said.

1:17 pm (AEDT):

Pharmaceutical company Novartis (SWX: NOVN) beat expectations and offered single-digit growth for Q4 2025.

Net sales for the company grew 1% to US$13.3 billion, surpassing the Zacks consensus estimate of $13.7 billion.

For the full year, net sales increased 8% to $54.5 billion.

Earnings per share also grew year-over-year from $1.98 to $2.03 and beat expectations of $1.99.

However, core net income for the quarter was down 1% to $3.9 billion.

For the full year, earnings per share grew 15% to $8.98, and net income grew 11% to $17.4 billion.

1:31 pm (AEDT)

GSK (LSE: GSK) revealed positive sales results for fiscal 2025 after the company’s new CEO Luke Miels took the reins.

Total sales for 2025 amounted to UK£32.7 billion, marking a growth of 7% from last year.

Its greatest driver of growth was Oncology, which grew 43% year-over-year to £2 billion. Speciality medicine sales grew 17% to £13.5 billion, Respiratory, Immunology & Inflammation grew 18% to £3.8 billion, and HIV sales grew 11% to £7.7 billion.

Earnings per share were £1.72 for the year.

In its outlook for 2026, the company said it expected operating profit to grow by 7% to 9% and predicted the same growth for core earnings per share.

1:56 pm (AEDT):

At the Nasdaq, Arm Holdings (ARM) shares plunged 7.5% after-hours despite surpassing earnings and revenue estimates.

Revenue was up 26% year-over-year to US$1.24 billion, above FactSet estimates of $1.23 billion. Earnings per share were $0.43, up from $0.39 and passing estimates of $0.41.

Royalty revenue climbed 27% to $737 million, which it said was due to increased adoption of Arm technology with higher royalty rates. Royalty revenue could see a impact of 1% to 2% from the ongoing memory shortage, however, said CFO Jason Child on an earnings call.

Licensing revenue increased 25% to $505 million, below estimates of $519.9 million.

Non-GAAP operating expenses were up 37% to $716 million. Research and development expenses were $512 million, rising 46% as the company increased its engineering staff.

Arm forecast revenue for the current quarter of $1.47 billion, plus or minus $50 million, with earnings per share of $0.58, plus or minus $0.04. This is above estimates of $1.44 billion in revenue and $0.56 in earnings per share.

“Arm delivered a record revenue quarter as demand for AI computing on our platform continues to accelerate” said CEO Rene Haas. “Record royalty results in the third quarter reflect the growing scale of our ecosystem, as customers design the Arm compute platform into next-generation systems across cloud, edge, and physical environments to deliver high-performance, power-efficient AI."

2:25 pm (AEDT):

At the NYSE, Yum Brands (YUM) posted mixed results, though Taco Bell saw solid sales growth.

Earnings per share were US$1.73, up from $1.61 but below LSEG estimates of $1.77. Revenue rose 6% to $2.51 billion, above estimates of $2.45 billion.

Taco Bell's same-store sales grew 7%, besting StreetAccount estimates of 5.6%, while KFC's climbed 3%. Pizza Hut's same-store sales were down 1%.

Globally and across brands, same-store sales increased 3%. The number of KFC locations rose 6%, while Taco Bell's were up 3% and Pizza Hut's declined by 1%.

“Yum! delivered another year of outstanding results at KFC and Taco Bell with our fundamentals stronger than ever at both brands," said CEO Chris Turner. “Taco Bell again gained market share with standout same-store sales performance, and KFC delivered another record-breaking year of unit development.”

Operating profit grew 12% to $738 million. Total expenses dropped 4% to $1.78 billion.

The company said in November that it would explore strategic options for Pizza Hut, which could result in a sale. The brand's same-store sales fell 1% across the full year, and its operating profit dropped 8%.

Pizza Hut's strategic review is underway and is set to be completed this year, said Turner on an earnings call. About 250 U.S. Pizza Hut locations will be closed in 2026's first half.

3:03 pm (AEDT):

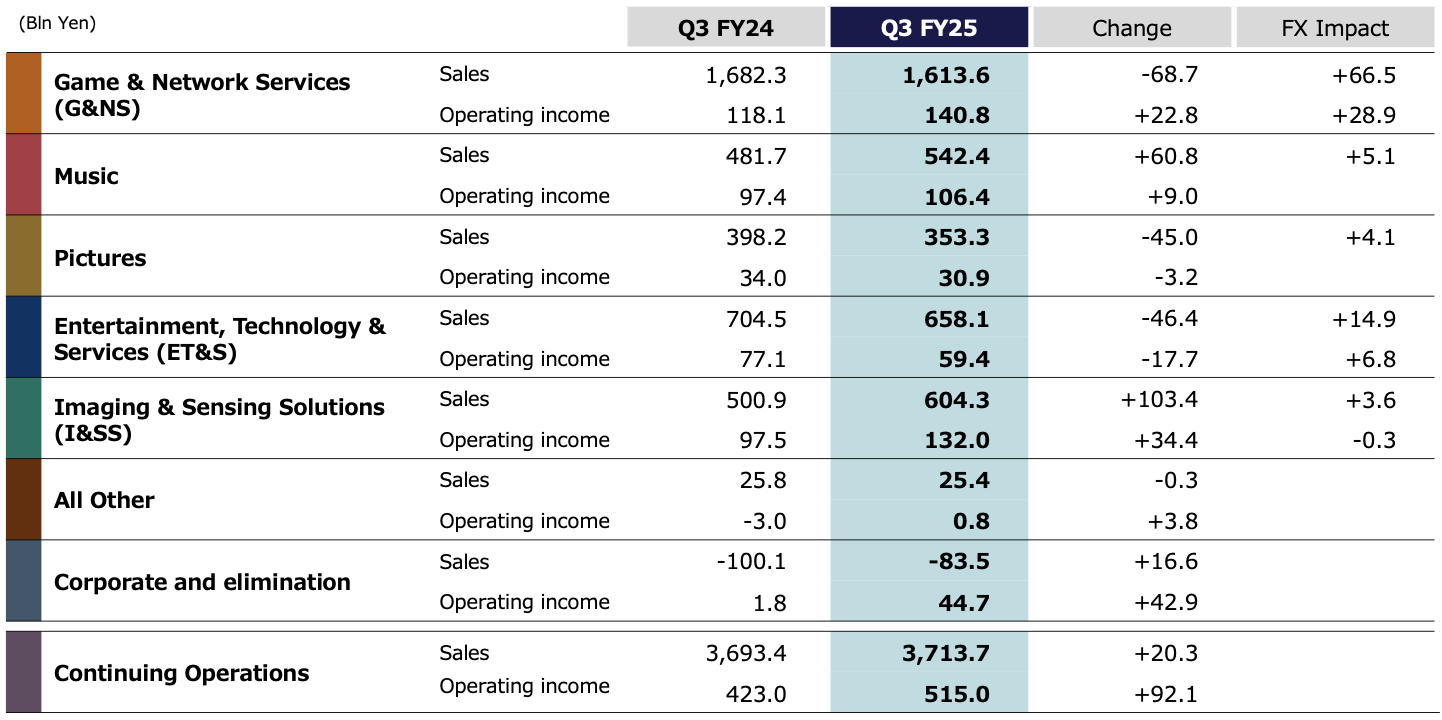

Turning to the TYO, Sony (6758) lifted its guidance as its revenue and operating income bested estimates.

Revenue was JP¥3.71 trillion (US$23.68 billion), up from ¥3.69 trillion year-over-year and above LSEG estimates of ¥3.69 trillion. Income per share from continuing operations was ¥62.82, rising from ¥56.42.

Operating income was ¥515.04 billion, growing from ¥422.97 billion and passing estimates of ¥468.9 billion.

Sales from its Game & Network Services, which includes PlayStation, declined from ¥1.68 trillion to ¥1.61 trillion. Its Music segment saw sales rise from ¥481.7 billion to ¥542.4 billion, and Pictures sales fell from ¥398.2 billion to ¥53.3 billion.

All segments except Pictures reported an increase in operating income.

Sony's updated forecast for its 2025 fiscal year includes ¥12.30 trillion in revenue and ¥1.43 trillion in operating income, increasing by 3% and 8% respectively from its November guidance.

3:27 pm (AEDT):

Back to the NYSE, Boston Scientific (BSX) shares shed 17.6% after its electrophysiology segment's sales fell short of estimates.

Total revenue was up 15.9% to US$5.29 billion, beating estimates of $5.28 billion. Earnings per share rose 14% to $0.80, above estimates of $0.78.

Electrophysiology sales increased 35% to $890 million, missing estimates by 4%.

Cardiovascular sales grew 16% and medical-surgical revenue was up 7%, both in line with expectations.

The company projects 10-11% sales growth across 2026, matching estimates of 10.5%, along with earnings per share of $3.43-3.49. Its first-quarter guidance includes earnings per share of $0.70-0.80, with sales growth of 8.5-10%.

Thank you for joining us today. We'll see you next time!