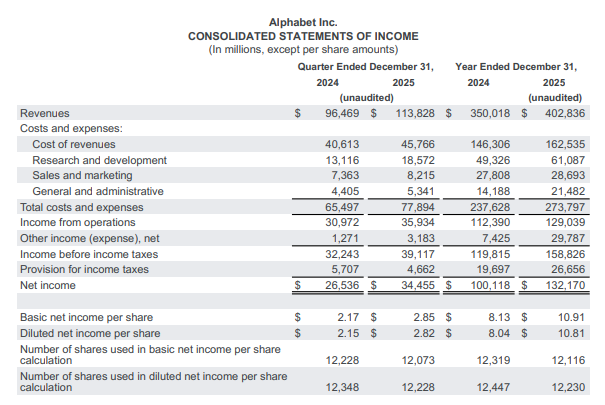

Alphabet Inc shares slid in after-hours deals on Wednesday (Thursday AEDT) despite the company reporting a 30% surge in profits for the fourth quarter (Q4) of 2025.

Google’s parent company said net income rose to US$34.455 billion (A$49.4 billion) in the quarter ended 31 December from $26.536 billion in the previous corresponding period (pcp), and diluted earnings per share (EPS) jumped 31% to $2.82 as revenue grew 18% to $113.83 billion.

Markets were expecting EPS at $2.63 on revenue of $111.32 billion

For 2025, net income rose 32% to $132.17 billion, diluted EPS climbed 34% to $10.81, and revenue grew 15% to $402.836 billion.

“It was a tremendous quarter for Alphabet and annual revenues exceeded $400 billion for the first time,” Chief Executive Officer Sundar Pichai said on an earnings call.

He said the launch of the Gemini 3 large AI model was a major milestone.

The company had great momentum with first-party models like Gemini processing more than 10 billion tokens per minute via direct application programming interface use by customers, and the Gemini app has grown to over 750 million monthly active users.

“Search saw more usage than ever before, with AI continuing to drive an expansionary moment,” Pichai said.

Alphabet continued to drive strong growth across the business, with YouTube’s annual revenues surpassing $60 billion across advertisements and subscriptions.

The company had more than 325 million paid subscriptions across consumer services, led by strong adoption for Google One and YouTube Premium, and Google Cloud ended 2025 at an annual run rate of over $70 billion, driven by demand for AI products.

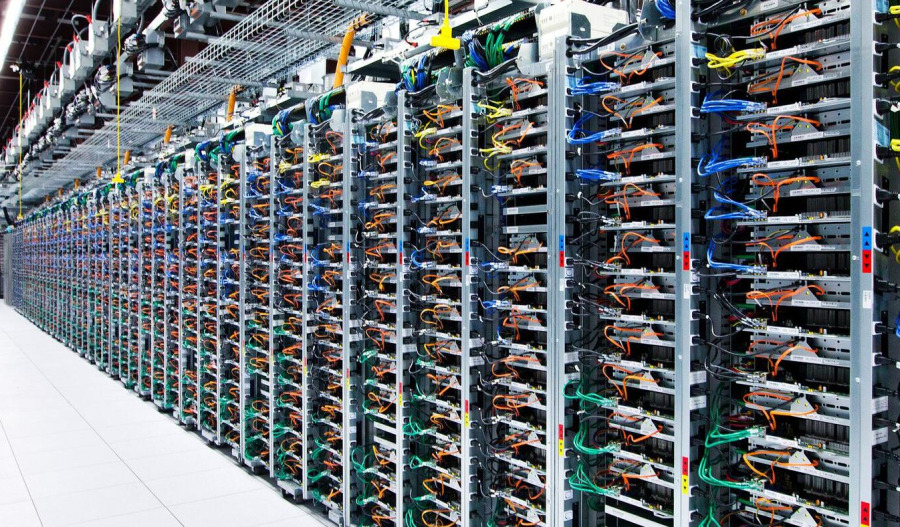

AI investments and infrastructure were driving revenue and growth across the board.

Revenue in Q4 exceeded the average analyst’s estimate of $111.43 billion, while adjusted EPS beat forecasts of $2.63, but the shares were weighed down by concerns over increased capital expenditure (capex).

Alphabet said capex could almost double this year as it ramped up investments related to artificial intelligence (AI).

Alphabet (NASDAQ: GOOG) shares closed $7.36 (2.16%) lower at $333.34, capitalising the company at $4.02 trillion, before the results were released, before easing a further 1.4% to $328.78 in after-hours trading followed the announcement.