Shares in Alphabet Inc raced to a new high after Berkshire Hathaway revealed a small stake in the technology giant.

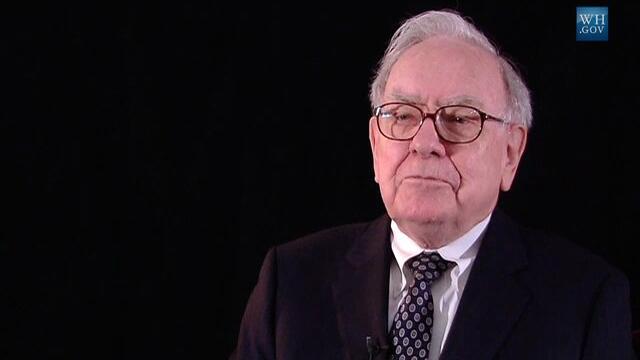

Warren Buffet’s holding company said it owned 17.85 million Alphabet shares on 30 September, representing 0.14% of Google’s parent company.

Alphabet Class C (NASDAQ: GOOG) shares rose $8.62 (3.11%) to close at $285.60 on Monday (Tuesday AEDT), capitalising the Magnificent Seven company at US$3.44 trillion (A$5.26 trillion), after earlier reaching a peak of $294.52.

Berkshire Hathaway’s Alphabet stake, worth $5.09 billion at the closing price, was the largest new investment by Berkshire Hathaway in the third quarter of the 2025 financial year.

It is one of the last major purchases and a rare investment in the technology sector by Warren Buffett, the 95-year-old billionaire known as the Oracle of Omaha for his outstanding track record, sage advice and long-time business base.

"The stake purchase of a tech company may represent a different type of mentality at Berkshire, though it's not a total departure from its value-investing model," Interactive Brokers Chief Strategist Steve Sosnick was quoted saying in a Reuters article.

Berkshire disclosed the holding in a filing with the U.S. Securities and Exchange Commission, which also showed it had cut its Apple stake to 238.2 million shares from 280 million in the third quarter, and down from a peak of more than 900 million.

Buffet has likened Apple to a consumer products company rather than a tech company.

The Alphabet buy should boost confidence in a sector amid concerns over stretched valuations, mostly in stocks leveraged to the artificial intelligence (AI) boom, and as the market keenly awaits quarterly results from AI giant NVIDIA, the world's most valuable company, on Wednesday (Thursday AEDT).

Alphabet has risen almost 14% in the December quarter and is the best-performing of the Magnificent Seven companies with a 46% gain.

Berkshire Hathaway Class B (NYSE: BRK.B) shares closed $5.68 (1.12%) lower at $503.26, implying a valuation of $1.09 trillion, on Monday.