Headline metrics suggest the global economy is threading the needle on a miraculous soft landing as policymakers ruminate over whether interest rate levels will do their job in the current financial climate. But is that really the case?

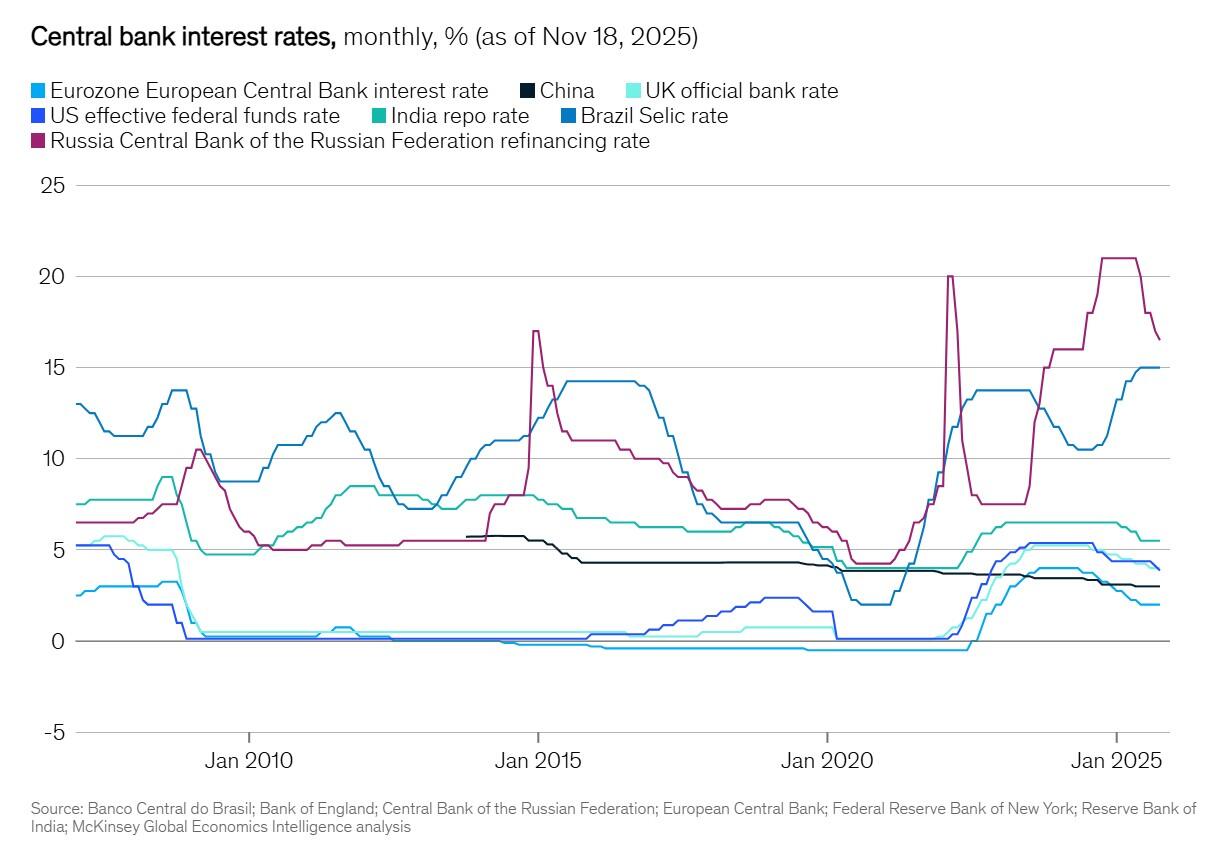

The International Monetary Fund (IMF) is tipping steady 3% growth through 2026 and that inflation is largely back in its cage, and central bankers from the Fed to the ECB are slashing rates accordingly.

But crack open the latest Global Economics Intelligence report from McKinsey, and that "soft landing" looks less like a policy win and more like a statistical fugazi.

Boil it down, and the report basically posits that our monolithic "global" economy is effectively cooked - replaced by a Balkanised, multi-speed thunderdome where the United States is lapping a stagnant Europe.

Meanwhile, C-suite heavyweights are increasingly concerned over the one variable they can’t hedge - a volatile new era of trade warfare between the West and the rest.

Another peek under the hood suggests the consulting class might be overstating the gloom; while the world is undoubtedly fragmenting, the "smart money" reckons the global machine isn't broken - it's simply rerouting.

The great divergence

The McKinsey data suggests a massive structural schism is reshaping the investment landscape across the world's three key market movers, signalling that the days of synchronised global growth are dead and buried.

Here's where they are at the moment:

- The U.S. juggernaut: America continues to levitate, growing at an annualised clip of 2.8% in Q3 2025.

Powered by a productivity boom that mimics the early returns of an AI capex cycle, the U.S. is leaving its advanced economy peers eating dust.

- Europe’s innovation void: Contrast that barnstorming performance with the Eurozone, where growth is scraping the bottom of the barrel.

The bloc has failed to close the widening innovation gap, leaving it stalling on the starting grid while Washington and Beijing race for tech supremacy.

And the sheer scale of the U.S. national laboratory system provides a structural advantage a fragmented Europe (the UK sort-of included) simply cannot match, creating a moat that capital is finding increasingly difficult to cross.

- An Asian split: Meanwhile, India has cemented its status as the new growth engine with projections exceeding 6%.

Its consumer price inflation continued to slow, reaching 1.55% in July - a decline of 55 basis points versus June 2025 and the sub-continent's lowest inflation rate since June 2017.

China, conversely, is wrestling with a slow-motion deflationary crisis, forcing it to export its way out of trouble - a move that is triggering alarm bells across the globe.

Is there a trade war, or trade transition?

For the last two years, "geopolitical instability" was the undisputed bogeyman keeping the C-suite awake at night, but that dynamic has pivoted hard.

In McKinsey’s latest sentiment survey, "changes in trade policy" has rocketed up the risk register to rival war as the primary threat to growth.

Suits are realising they must stop optimising for efficiency and start optimising for survival in a tariff-laden world.

"They are also concerned about the impact of changes in trade policy and relationships on global growth," the McKinsey authors noted.

But is it here that the narrative forks? While the consultants see fragmentation, the hard data show adaptation.

The "trade is dead" crowd loves to point at U.S. - China decoupling, but trade volumes aren't evaporating - they are just finding new rat runs.

UNCTAD says global trade expanded by about US$500 billion during the first half of this year, despite volatility, policy shifts and persistent geopolitical tensions.

Rise of the 'Connector' economies

This resilience is being driven by a new breed of economic winner: the "connector" economy.

Countries like Vietnam, Mexico, and Morocco are positioning themselves as the ultimate middlemen - absorbing Chinese capital and components, assembling them, and shipping the final product to Western markets with a different country of origin sticker.

Oxford Economics notes that emerging Asian economies are capturing mid-tech assembly niches left behind by Chinese manufacturers.

Vietnam’s trade surplus with the United States has ballooned, while Mexico has overtaken China as America’s top trading partner.

This isn't "deglobalisation" - it is "reglobalisation" with more layovers, and it explains why the global machine keeps humming despite the tariff noise.

Innovation myth?

The prevailing view in the McKinsey report is that Europe has failed to close the innovation gap - an easy story to flog where the U.S. innovates, China replicates, and Europe regulates.

But this misses a crucial nuance regarding where the capital is actually flowing.

The 2025 European Innovation Scoreboard paints a different picture, showing that since 2018, the EU’s innovation performance has grown significantly.

"Europe's innovation engine is resilient, but the global race for technological leadership is intensifying," Cohesion and Reforms Executive VP Raffaele Fitto said.

While the U.S. chases the trillion-dollar consumer AI hype cycle, Europe is quietly building capacity in industrial biotech, green energy technology, and advanced manufacturing.

The IMF notes that with the right single-market reforms, AI could boost European productivity significantly, suggesting the "Old Continent" still has plenty of fight left in it.

Gold as a signal

If you want to know what the market really thinks about this fragmentation, you could ignore the S&P 500 for a hot minute and look at the yellow metal.

Bullion prices have surged almost 40% this year to currently trade around the US$4,150 mark, smashing through record highs along the way.

The bearish take is that this is a "fear hedge" - a sign that investors believe the fiat system is buckling under the weight of debt, sanctions and tired economic policies.

However, banks like JP Morgan suggest this is simply “a crowded trade driven by structural diversification” - rather than impending doom.

"Add in economic, trade and U.S. policy uncertainty and shifting, more unpredictable geopolitical alliances and we think further diversification into gold will amount to around 900 tonnes of [central bank] buying in 2025," JP Morgan Head of Base and Precious Metals Strategy Gregory Shearer said.

It's a focus on a number of central banks - particularly from the Global South - wanting a reserve asset that can’t be frozen by a sanctions order from Washington.

We are transitioning from a world of synchronised growth to one of fragmented competition, where the U.S. and India are decoupling from the losers, and the era of frictionless trade is officially over.

The "fractured world" narrative sells subscriptions and gold bars, but the data suggests our global machine is far more resilient than the doom-mongers want you to believe.