Airbnb shares rose in after-market trading after the online accommodation marketplace reported flat profits for the third quarter of the 2025 financial year (Q3 FY25).

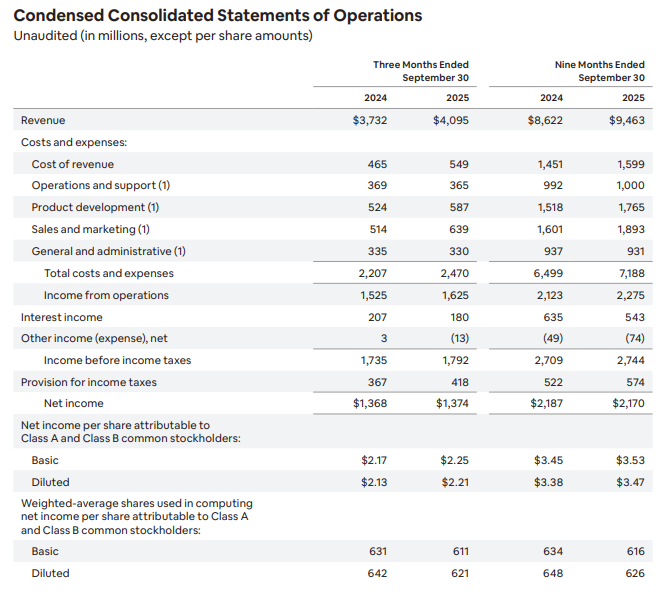

The company said net income was US$1.374 billion ($2.11 billion) in the three months ended 30 September 2025, compared with $1.368 billion in the previous corresponding period (pcp).

Revenue increased 10% to $4.095 billion due mainly to solid growth in nights stayed and a modest increase in the average daily rate (ADR).

Net income was stable as higher revenue was offset by investments in growth and policy initiatives, and a $213 million valuation allowance against deferred tax assets related to Corporate Alternative Minimum Tax credits.

Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) soared more than 50% to a quarterly record of $2.0 billion.

Gross booking value increased 14% while nights and seats booked rose by 9%.

“Our Q3 2025 results demonstrate our continued focus on driving faster growth, as year-over-year growth of nights booked accelerated relative to Q2 2025,” the company said in a letter to shareholders.

Demand remained strong in October despite more difficult year-over-year comparisons.

Airbnb said it expected to generate revenue of $2.66 billion to $2.72 billion in Q4, representing year-over-year growth of 7% to 10%, which compared with analysts’ forecasts of $2.67 billion.

The company expected adjusted EBITDA in Q4 to be flat to slightly down year on year.

Airbnb (NASDAQ: ABNB) shares closed $1.97 (1.61%) lower at $120.53 on Thursday (Friday AEDT) before the result was released, capitalising it at $74.9 billion, before rebounding in aftermarket trading by 4.31% to $125.71.