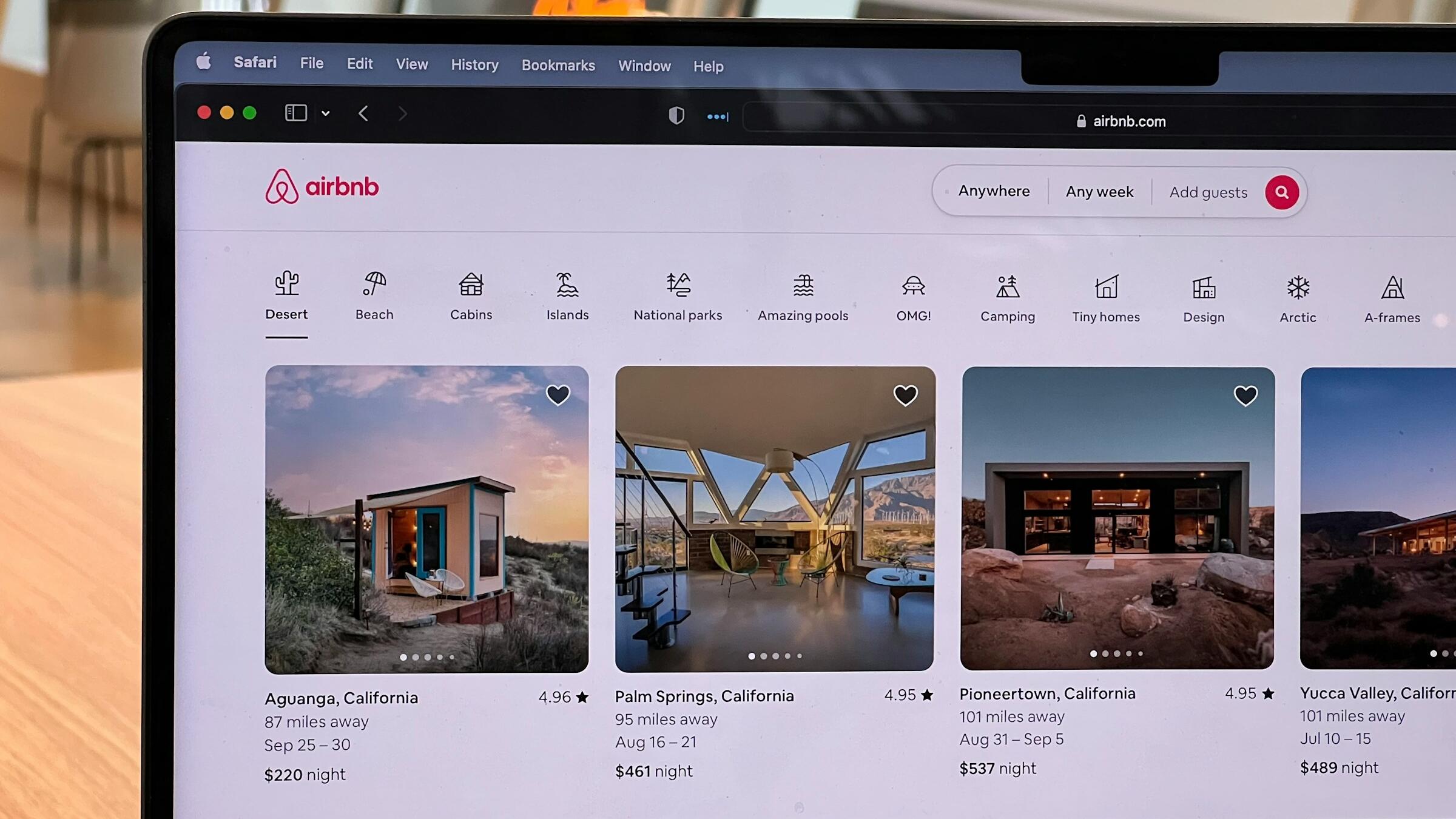

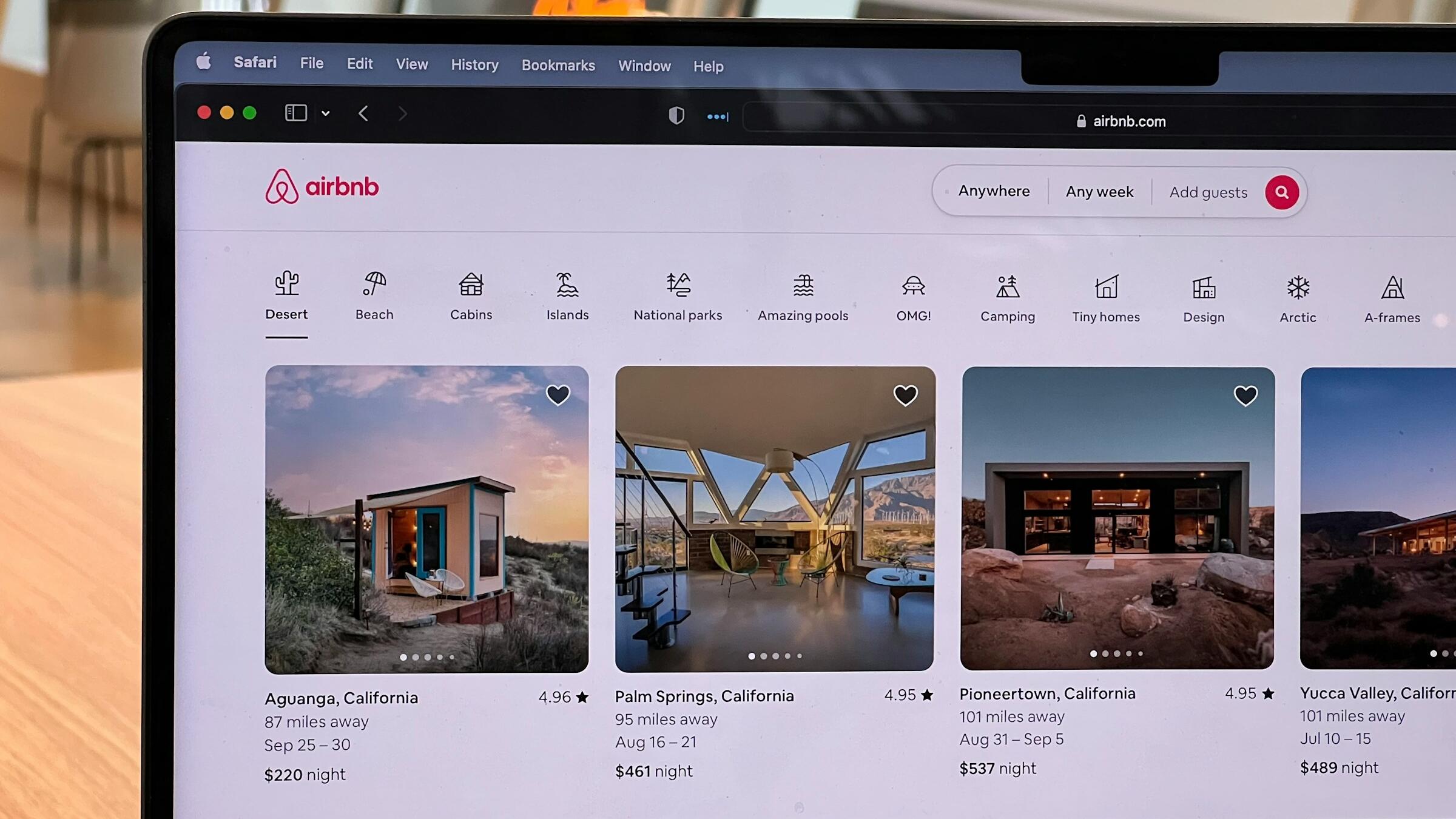

Airbnb expects momentum to accelerate in 2026

Airbnb’s reported fourth-quarter revenue beat analysts' expectations and offered strong guidance for 2026. The company’s revenue grew 12% year-over-year to US$2.8 billion, exceeding analysts' expectations of $2.72 billion. Airbnb has beaten Wall Street revenue expectations for 20 of the past 21 quarters, according to FactSet. However, the vacation rental company’s net revenue fell to $341 million, or 56 cents per share, from $461 million or 73 cents per share, a year earlier. This was also lower than the 66 cents per share expected by analysts. Airbnb has attributed the lower figure to $90 million of non-income tax matters and planned investments in new growth and policy initiatives. Gross booking value, which is used to report host earnings, service fees, cleaning fee and taxes, rose 16% year-over-year to $20.4 billion and beat expectations of $19.4 billion. It also reported 121.9 million nights and seats booked in the fourth quarter, up 10% from last year. Looking ahead to 2026, the company said its not just “maintaining momentum” its “accelerating”. For the first quarter, the company expects revenue of $2.59 billion to $2.63 billion, representing year-over-year growth of 14% to 16%. As for the full ye