AI enhancements to global fintech platform Intuit have led to strong Q3 results, beating analyst estimates and even stronger than expected guidance for the upcoming quarter.

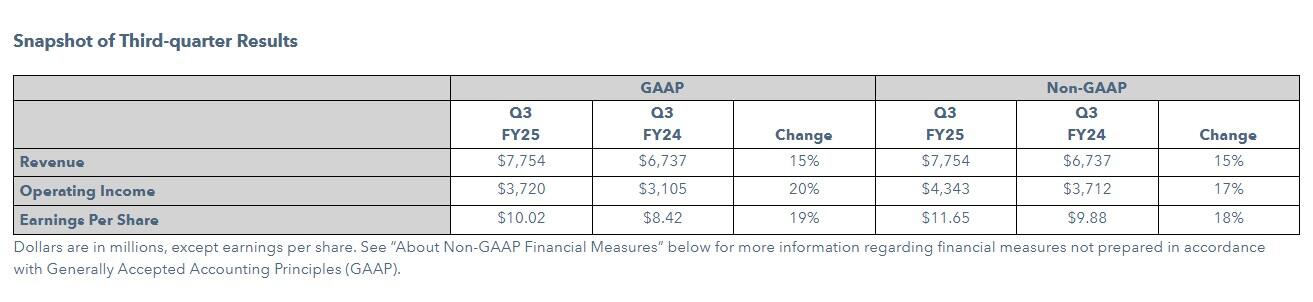

The brains behind QuickBooks, Mailchimp, Turbotax and Credit Karma went up 4% on Wall Street in after-hours trading, with earnings per share (EPS) up 18% and revenue of US$7.8 billion up 15%.

EPS came in at $11.65, exceeding forecasts of $10.93, driven by an uptick in revenue from integrating generative AI into its product suite.

“We have exceptional momentum with outstanding performance across our platform,” Intuit CEO Sasan Goodarzi said.

“We're redefining what's possible with AI by becoming a one-stop shop of AI agents and AI-enabled human experts to fuel the success of consumers and small and mid-market businesses.

“We had an outstanding year in tax, including a significant acceleration in TurboTax Live revenue growth as we disrupt the assisted tax category.”

Intuit is confident the run will continue, upping its Q4 guidance to between $18.72 and $18.76 billion, up from the range of $18.16-$18.35 billion it shared last quarter.

That’s a beat on analysts' predictions, who were expecting $18.35 billion, according to an LSEG poll.