Demand for advanced chips has surged as the artificial intelligence race heats up - and the United States’ restrictions on exporting semiconductors to China now stand to change both countries' chip markets.

Global semiconductor sales were at US$179.7 billion in 2025’s second quarter, up nearly 20% year-over-year. Both the Asia Pacific and the Americas saw strong sales increases.

While the U.S. has worked to stop some chipmakers from exporting or manufacturing in China, leading U.S. firms like Nvidia have tried to strike deals to sell previously banned chips for the Chinese market. However, China’s domestic chipmakers have stepped up their manufacturing, and the Chinese government has urged tech companies not to buy from the U.S.

The US’ restrictions

The U.S. government has aimed to restrict exports of advanced semiconductors to China since 2018, due to national security concerns around China gaining access to advanced chip and computing technology.

“U.S. actions have focused on sustaining the lead in advanced chips, and related computing and AI applications, and slowing China's development of competitive capabilities, including in defense and intelligence,” according to an August Congressional Research Service report.

Under these measures, China-based firms like Huawei were added to the Bureau of Industry and Security’s Entity List. This list required U.S. businesses to obtain a licence before exporting chips to these companies.

During the second Trump administration, some companies have faced increased restrictions. In August, it revoked the authorisations allowing South Korea-based chipmakers Samsung and SK Hynix to receive U.S. manufacturing equipment at its facilities in China.

The U.S. similarly ended Taiwan Semiconductor Manufacturing Co.’s (TSMC) authorisation to send equipment to its facility in Nanjing this month. While it said it had also revoked Intel’s authorisation, Intel completed the sale of its factory in Dalian to SK Hynix earlier this year.

These companies must now obtain licences to buy U.S. equipment from 2026.

Nvidia’s deals

Nvidia has managed to evade several restrictions on selling its chips in China this year, though China's regulators have now reportedly banned the country's largest technology companies from buying from Nvidia.

In August, Nvidia struck a deal to give 15% of its revenue from Chinese sales of its H20 chip to the U.S. government. The company’s H20 chips were designed with less computing power than its flagship Blackwell chips, with the goal of abiding by export restrictions so they could be sold in China. Regardless, Nvidia’s H20 chips were still banned from being sold in China in April.

This ban was reversed in July, after Nvidia CEO Jensen Huang met with Trump and committed to investing around US$500 billion in the U.S.

AMD agreed to a similar deal, offering the U.S. government 15% of its Chinese revenues. Its MI308 chips were also designed to meet export restrictions, but were banned from Chinese sales in April.

China’s government began urging domestic companies to avoid buying U.S. chips in recent months, however. It has aruged that H20 chips could potentially be operated remotely, and documents Nvidia submitted to the U.S. government could reveal sensitive data about Chinese clients.

Ultimately, China's Cyberspace Administration told companies like Alibaba and ByteDance to cancel all orders and halt testing of Nvidia's RTX Pro 6000D chip, the Financial Times reported this week. The RTX Pro 6000D is another semiconductor Nvidia designed for the Chinese market.

Nvidia will “continue to be supportive of the Chinese government and Chinese companies as they wish, and we’re of course going to continue to support the U.S. government as they all sort through these geopolitical policies,” said CEO Jensen Huang after the ban was reported.

Nvidia has not included any H20 sales in its forecast for the October quarter, though it predicted in August it could sell between US$2 and $5 billion in H20 chips. The company was reportedly also developing a more powerful chip for the Chinese market, known as the B30A, though its fate is unclear under the ban.

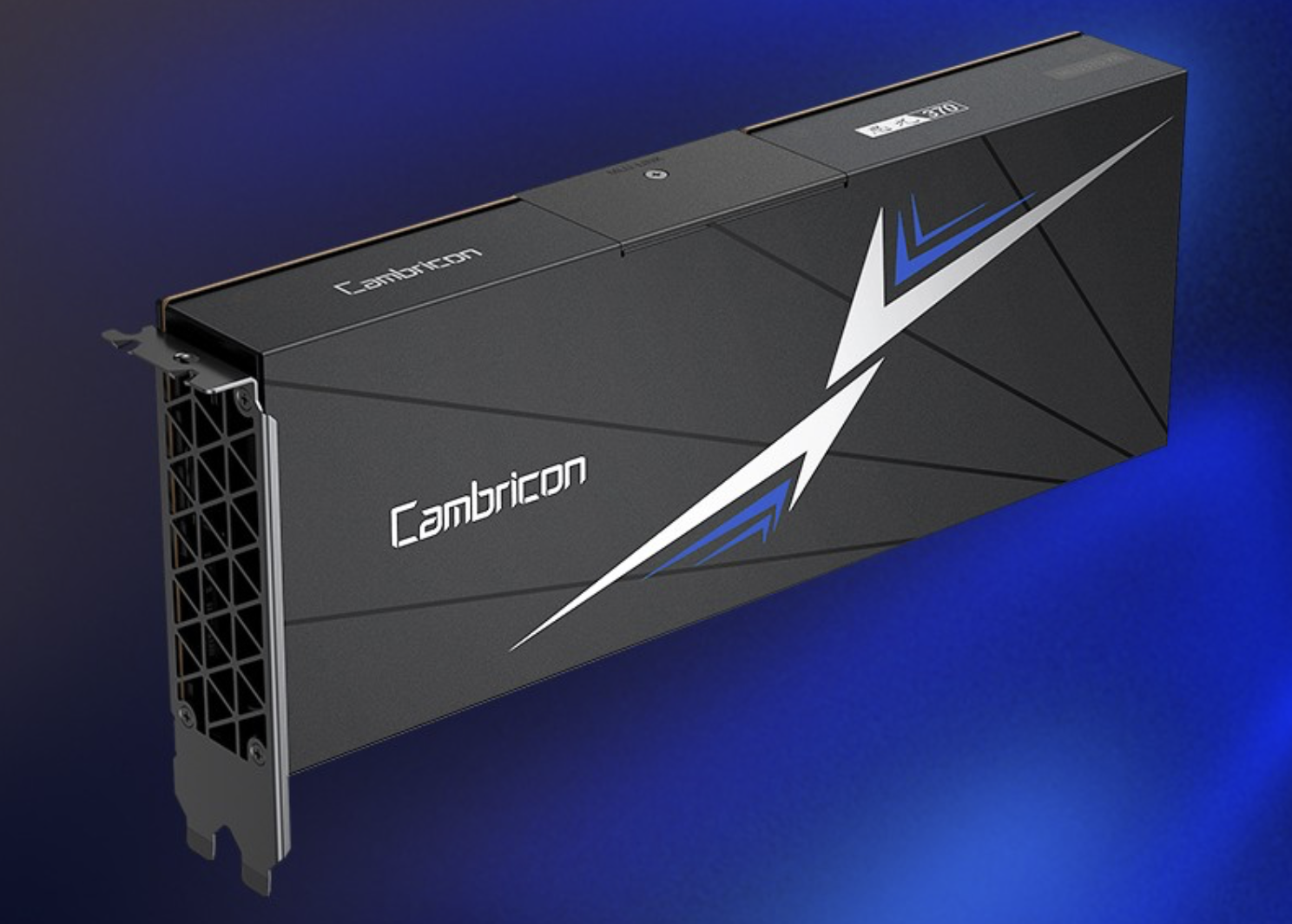

China’s chipmakers step up

Meanwhile, China’s domestic chip industry has seen a surge of activity as the country seeks to reduce its reliance on U.S. chips. Cambricon, a chip-designing startup that is partly state-owned, briefly became mainland China’s most expensive stock last month, and the country's Cyberspace Administration reportedly cited the high performance of new China-made chips in its decision to halt purchases from Nvidia.

Cambricon’s share price has surged by over 480% in the past 12 months, and it said in August that it planned to raise CN¥3.98 billion (A$845 million) to develop new chips for artificial intelligence.

Chinese chipmakers and AI companies formed the Model-Chip Ecosystem Innovation Alliance in July, a bid to link businesses from both the infrastructure and AI training sectors. The group includes Cambricon, Huawei, Moore Threads, Enflame, and Tencent-backed StepFun.

“This is an innovative ecosystem that connects the complete technology chain from chips to models to infrastructure,” said Enflame CEO Zhao Lidong.

Chinese AI company DeepSeek has also said its V3.1 model, released in August, is built to be compatible with next-generation domestic chips. Its previous V3 model was trained on Nvidia’s chips.

Companies including Alibaba and Huawei have been developing advanced chips for AI this year, but these chips are not on par with Nvidia’s in training AI models. Alibaba’s is reportedly designed for inference processes in already-trained models, while Huawei’s have struggled with issues like overheating during training.

Azzet has contacted the Global Semiconductor Alliance and the Semiconductor Industry Association for comment.