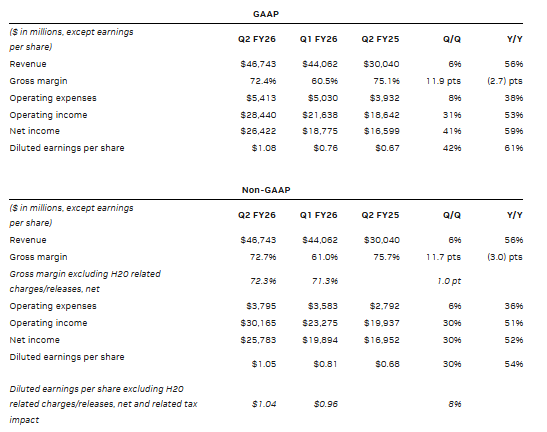

NVIDIA has reported a 41% increase in net income for the second quarter of the 2026 financial year (Q2 FY26) as its Blackwell artificial intelligence (AI) platform helped propel revenue to record levels.

However, the share price of the world’s most valuable company fell due to concerns about restrictions on sales of its AI computer chips to China and other factors.

The company at the centre of the AI revolution said net income surged to US$26.422 billion (A$40.734 billion) in the quarter ended 27 July 2025 from $16.599 billion in Q2 FY25 as revenue soared 56% to a quarterly record of $46.7 billion.

NVIDIA said group revenue was 6% higher than in Q1 FY26, with Data Centre revenue rising 5% from Q1, boosted by a 17% jump in Blackwell Data Centre revenue.

Founder and CEO Jensen Huang said demand for its Blackwell Ultra flagship graphic processing units (GPUs) was extraordinary and production was ramping up at full speed.

“The AI race is on and Blackwell is the platform at its centre,” he said in a press release.

The company made no H20 chip sales to China in Q2 due to American government restrictions, but benefited from a $180 million release of H20 inventory from about $650 million in unrestricted sales to a customer outside China.

Diluted earnings per share (EPS) jumped 42% to $1.08 in Q2 FY26 compared with a year earlier.

“The opportunity ahead is immense, a new industrial revolution has started, the AI race is on,” Huang said on a conference call.

For Q3 FY26, NVIDIA forecast revenue within 2% of $54.0 billion, and did not assume H20 shipments to China.

Although the Q3 revenue forecast was higher than expected, the share price eased due to worries about the outlook for China sales and as Q2 results from data centres were below expectations er segment.

Nvidia has agreed with President Donald Trump to pay the United States Government 15% of its revenue in China in exchange for a reversal of restrictions that curbed sales of its H20 chips to China.

Nvidia shares (NASDAQ: NVDA) closed 17 cents (0.094%) lower at $181.60, capitalising the company at $4.43 trillion, before falling $4.70 (2.59%) further to $176.90 in after-hours trading.

Founded in 1993, the company, which develops the GPUs driving the AI revolution, became the first company valued at more than $4 billion earlier this year.