The United States Federal Reserve left its benchmark interest rate unchanged on Wednesday (Thursday AEDT), pausing a recent easing cycle as policymakers signalled a firmer economic outlook and reduced concern over labour market weakness.

The Federal Open Market Committee (FOMC) voted to maintain the federal funds rate in a target range of 3.5%–3.75%, in line with market expectations.

The decision followed three consecutive quarter-point cuts that officials had characterised as precautionary adjustments aimed at cushioning potential softness in employment.

In its post-meeting statement, the central bank upgraded its assessment of economic activity while indicating that risks to its dual mandate of price stability and maximum employment are now more balanced.

“Available indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained low, and the unemployment rate has shown some signs of stabilisation,” the central bank said in its post-meeting statement, adding that “Inflation remains somewhat elevated”.

The statement also removed earlier language suggesting greater concern about labour market deterioration than inflation pressures.

That shift in tone points to a near-term pause in further rate cuts, as officials assess incoming data and the evolving economic outlook.

“In considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks,” the statement said, repeating language first introduced in December that markets interpreted as a move away from the easing cycle that began in September 2025.

U.S. Treasury yields rose following the announcement, while the S&P 500 traded near the 7,000 level as investors weighed the implications of a more patient policy stance.

The decision was not unanimous. Governors Stephen Miran and Christopher Waller dissented, both favouring an additional quarter-point reduction. It marked Miran’s fourth consecutive dissent, though he had previously pushed for a larger half-point cut.

Both policymakers were appointed by President Donald Trump. Miran filled an unexpired board seat in September 2025, with his term set to expire this week, while Waller, appointed during Trump’s first term, had previously been considered a candidate for the Fed chair role.

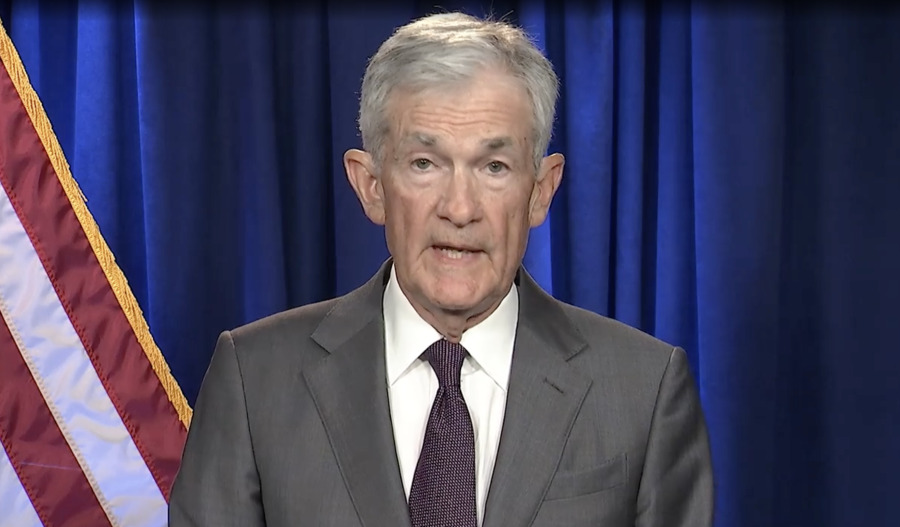

Powell’s final stretch

The meeting comes during a period of unusual strain for the central bank. Chair Jerome Powell has just two meetings remaining before his term as Fed chair concludes, capping eight years that have spanned a global pandemic, a sharp recession and repeated clashes with President Trump.

“If you look at the incoming data since the last meeting, [there is] clear improvement in the outlook for growth,” Powell said during a news conference. “Inflation performed about as expected, and ... some of the labour market data came in suggesting evidence of stabilisation. So it’s overall, a stronger forecast, really.”

Powell’s tenure has recently been overshadowed by political and legal pressures. The U.S. Justice Department has subpoenaed the chair in relation to renovations at the Fed’s Washington headquarters.

The president has also publicly criticised Powell and sought to remove other Fed officials, including Governor Lisa Cook, in a case now before the U.S. Supreme Court.

When asked about attending oral arguments at the court, Powell described the matter as “perhaps the most important” in the Fed’s 113-year history, underscoring the high stakes surrounding the institution’s independence.

Economic backdrop

The policy pause comes against a mixed but generally resilient economic backdrop. Gross domestic product growth has remained strong, with the third quarter expanding at a 4.4% annualised pace and the final quarter tracking at a 5.4% rate, according to estimates from the Atlanta Fed.

Labour market dynamics have shifted, with hiring slowing amid a crackdown on illegal immigration, but layoffs remaining subdued.

Initial jobless claims have trended at their lowest levels in two years, suggesting continued labour market stability.

Inflation, however, continues to pose challenges. Although well below the 40-year highs recorded in 2022, price growth remains closer to 3% than the Fed’s 2% target.

Some FOMC members have therefore argued for pausing or halting further rate cuts until there is clearer evidence that inflation is moving sustainably lower.

Tariffs introduced by the Trump administration are also a factor in the inflation outlook. Fed economists broadly view these measures as adding short-term price pressures that could fade later in the year.

Market expectations

Financial markets currently anticipate that the Fed will remain on hold for several months, with many traders expecting any further adjustment to the benchmark rate to come no earlier than June.

Futures pricing points to no more than two rate cuts in 2026 and none in 2027, regardless of who succeeds Powell.

Prediction markets have highlighted BlackRock bond chief Rick Rieder as a leading contender to become the next Fed chair, adding another layer of uncertainty to the policy outlook.

For now, however, the central bank appears focused on maintaining flexibility, balancing still-elevated inflation against signs of steady growth and a stabilising labour market as it navigates an increasingly complex political and economic environment.