While it is rare for the Reserve Bank of Australia (RBA) to enter the political arena, Governor Michele Bullock had no reservations about wading in with her size 10s in support of her Federal Reserve (The Fed) peer following serious accusations by United States President Donald Trump.

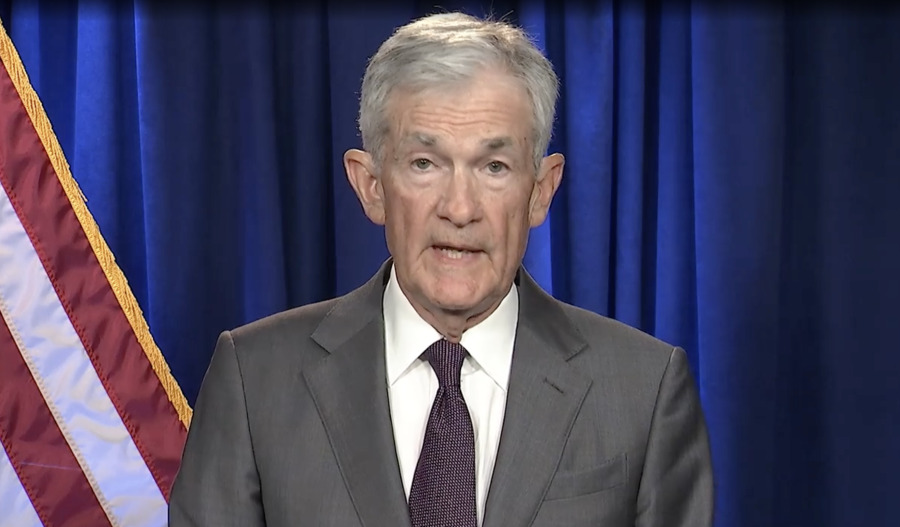

Bullock has publicly rejected the decision by the U.S. Department of Justice (DOJ) on 11 January 2026 to serve the Fed Chair Jerome Powell with grand jury subpoenas as part of a criminal investigation into allegations he misled Congress.

The DOJ’s criminal investigation has nothing to do with his running of the U.S. central bank and more to do with construction.

The DOJ claims Powell knowingly made fraudulent or misleading statements to the Senate Banking Committee in relation to a multi-billion dollar renovation of the Fed's Washington, D.C. headquarters.

Playing out as a confounding backdrop to these allegations are revelations that the projected cost of the new White House ballroom has doubled since it was first announced by the U.S. president in July 2025.

Powell hits back

What appears to have ruffled the feathers of the Trump Administration were revelations by the Office of Management and Budget that Powell was leading an "ostentatious" office renovation project that may be “violating the law”.

It is understood the project’s cost have increased from original estimates.

What appears to have also fanned Republican disdain for Powell were his comments at a Senate Banking Committee in June 2025 that [Republican] descriptions of the renovation project were "misleading and inaccurate."

However, Powell remains adamant that the Fed through testimony and other public disclosures made every effort to keep Congress informed about the renovation project.

Direct dig

Criticisms also took a more personal note when Republicans claimed Powell’s comments also nuanced a direct dig at Trump for his handling of a new White ballroom.

Powell told lawmakers there was not any new marble aside from what was necessary to replace broken old marble and said there were no "special elevators," new water features or rooftop gardens.

"I have deep respect for the rule of law and for accountability in our democracy. No one — certainly not the chair of the Federal Reserve — is above the law," Powell said last Sunday.

“The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President.”

Unsurprisingly, Powell and a growing chorus of other central bank leaders globally were quick to call out the DOJ’s action against Powell as an act of political pressure and intimidation from the Trump administration.

Powell believes DOJ action threaten the Fed's independence to be able to set interest rates based on evidence and economic conditions.

Central bankers unite

Meantime, RBA governor Michele Bullock joined 11 other central bank leaders around the world displaying public support for Powell.

"We stand in full solidarity with the Federal Reserve System and its chair Jerome Powell. The independence of central banks is a cornerstone of price, financial and economic stability in the interest of the citizens that we serve," the combined statement from central bankers read.

“Chair Powell has served with integrity, focused on his mandate and an unwavering commitment to the public interest. To us, he is a respected colleague who is held in the highest regard by all who have worked with him."

Ex-RBA board member condemns decision

While the RBA chair has not made public comments about the DOJ’s criminal investigation of Powell, former RBA board member Warwick McKibbon has described it as a very dangerous game that threatens the essential independence of central banks.

McKibbon reiterated the importance of central banks being independent and noted that Australia had done a review of the RBA recently that “led to restructuring and an improvement in the capacity of the bank to implement policy”.

"So we’ve been through the review, we’ve seen what’s important, and I think that adds a bit of weight,” he said.

“All central banks understand this, as do all of the economic and finance officials in the US. So it’s a very dangerous game to play, and it’s surprising that it’s gone as far as it has.”

Last ditch effort

Meanwhile, Betashares chief economist David Bassanese described moves from Trump as a "last-ditch effort" to pressure Powell to not only end his term as chair in May, but also to step down concurrently from the Federal Open Market Committee (FOMC) despite the term not expiring until January 2028.

While it makes for political theatre and once again highlights the president's desire to wield wide ranging powers, Bassanese said it risked backfiring if it undermined market confidence in the independence of the Fed and pushed long-term bond yields higher.

"After all, in the U.S. it is long term rates — not the Fed's control over short-term rates — that determine mortgage rates and most corporate borrowing costs,” he said.

“Rumours that President Trump may nominate his economic adviser, Kevin Hassett, as the next Fed Chair will do little to reassure markets about the Fed's independence.”

Global consequences

Meanwhile, deVere Group CEO Nigel Green was quick to remind the market that pressure on the central bank of the world's largest economy carried global consequences.

He also reminded investors that confidence in monetary governance in the U.S. anchored financial stability far beyond its borders.

When that confidence weakened, capital moved quickly toward assets designed to exist beyond political reach.

In other words, the Fed's role reaches far beyond U.S. borders, with its decisions shaping global interest-rate cycles, capital flows, currency stability and risk pricing across continents, influencing trading desks, treasury teams, and policymakers across emerging markets.

"Monetary credibility in the U.S. sets the tone for financial credibility everywhere," Green said.

"Financial systems operate on trust in institutions. The Fed anchors that trust for the dollar, for global bond markets, for equity valuations and for cross-border investment flows.

"When legal pressure appears alongside political frustration over interest rates, investors reassess the durability of that anchor."

Meantime, those who signed the letter with the RBA chair include:

Christine Lagarde, president of the European Central Bank on behalf of the ECB Governing Council.

Andrew Bailey, Governor of the Bank of England.

Erik Thedéen, gGovernor of Sveriges Riksbank.

Christian Kettel Thomsen, Chair of the Board of Governors of the Danmarks Nationalbank.

Martin Schlegel, Chair of the Governing Board of the Swiss National Bank.

Ida Wolden Bache, Governor of Norges Bank.

Tiff Macklem, Governor of the Bank of Canada.

Chang Yong Rhee, Governor of the Bank of Korea.

Gabriel Galípolo, Governor of the Banco Central do Brasil.

François Villeroy de Galhau, Chair of the Board of Directors of the Bank for International Settlements

Pablo Hernández de Cos, General Manager of the Bank for International Settlements.

The timing of Powell’s grand jury subpoenas coincideed with U.S. inflation data, which showed headline inflation rose by 0.3% in December, with the all-items annual rate holding at 2.7% - in line with forecasts – and strongly suggested keeping interest rates at restrictive levels had been helping to fight against sticky inflation.